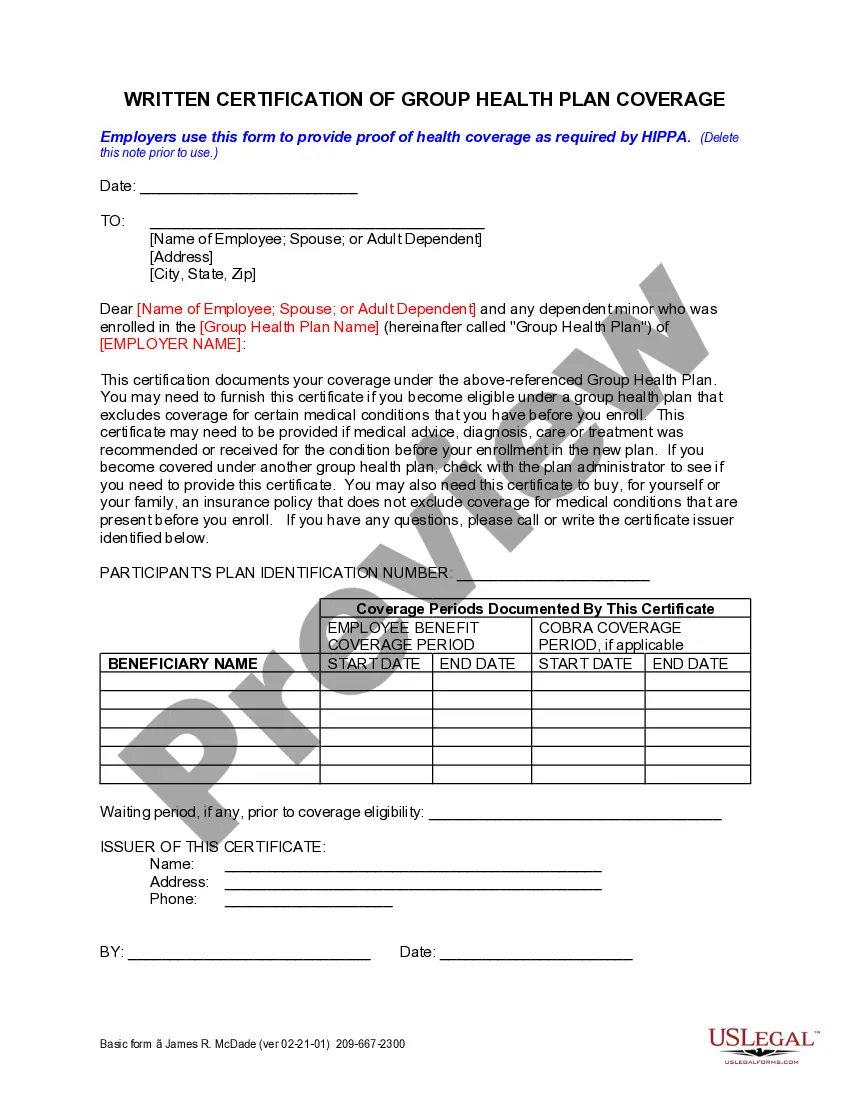

Employers use this form to provide proof to the employee of health coverage as required by HIPPA.

Costa Mesa California Certification of Group Health Plan Coverage is a mandate that requires employers to provide a comprehensive group health insurance plan for their employees in Costa Mesa, California. This certification ensures that employees have access to adequate healthcare coverage and are protected from exorbitant medical expenses. The Costa Mesa California Certification of Group Health Plan Coverage is a legal requirement that employers must comply with to safeguard the health and well-being of their employees. It is aimed at ensuring that employees have access to essential healthcare services, including preventive care, doctor visits, hospital stays, prescription drugs, and more. There are different types of Costa Mesa California Certification of Group Health Plan Coverage, each catering to the diverse needs of employers and employees. These types may include: 1. Traditional Group Health Insurance: This type of coverage involves the employer providing a traditional health insurance policy to its employees. The premiums for this plan are usually shared between the employer and the employee, ensuring affordable coverage for all. 2. Preferred Provider Organization (PPO) Plans: PPO plans offer employees the flexibility to choose healthcare providers from a network of preferred providers. They provide both in-network and out-of-network coverage options. 3. Health Maintenance Organization (HMO) Plans: HMO plans focus on a network of healthcare providers, providing comprehensive coverage within that network. Employees must select a primary care physician who will coordinate all their healthcare needs within the network. 4. High Deductible Health Plans (HDPS): HDPS typically have lower premium costs but higher deductibles. They are often paired with Health Savings Accounts (Has) or Flexible Spending Accounts (FSA's), allowing employees to save funds tax-free for qualified medical expenses. 5. Self-Funded Group Health Plans: In self-funded plans, the employer assumes the financial risk for healthcare claims rather than purchasing insurance from an external provider. These plans offer employers greater flexibility in managing their healthcare costs. Compliance with Costa Mesa California Certification of Group Health Plan Coverage is essential for employers to not only meet legal obligations but also provide a strong benefits package to attract and retain talented employees. By offering comprehensive group health plan coverage, employers can prioritize the well-being of their workforce and ensure access to quality healthcare services.

Costa Mesa California Certification of Group Health Plan Coverage is a mandate that requires employers to provide a comprehensive group health insurance plan for their employees in Costa Mesa, California. This certification ensures that employees have access to adequate healthcare coverage and are protected from exorbitant medical expenses. The Costa Mesa California Certification of Group Health Plan Coverage is a legal requirement that employers must comply with to safeguard the health and well-being of their employees. It is aimed at ensuring that employees have access to essential healthcare services, including preventive care, doctor visits, hospital stays, prescription drugs, and more. There are different types of Costa Mesa California Certification of Group Health Plan Coverage, each catering to the diverse needs of employers and employees. These types may include: 1. Traditional Group Health Insurance: This type of coverage involves the employer providing a traditional health insurance policy to its employees. The premiums for this plan are usually shared between the employer and the employee, ensuring affordable coverage for all. 2. Preferred Provider Organization (PPO) Plans: PPO plans offer employees the flexibility to choose healthcare providers from a network of preferred providers. They provide both in-network and out-of-network coverage options. 3. Health Maintenance Organization (HMO) Plans: HMO plans focus on a network of healthcare providers, providing comprehensive coverage within that network. Employees must select a primary care physician who will coordinate all their healthcare needs within the network. 4. High Deductible Health Plans (HDPS): HDPS typically have lower premium costs but higher deductibles. They are often paired with Health Savings Accounts (Has) or Flexible Spending Accounts (FSA's), allowing employees to save funds tax-free for qualified medical expenses. 5. Self-Funded Group Health Plans: In self-funded plans, the employer assumes the financial risk for healthcare claims rather than purchasing insurance from an external provider. These plans offer employers greater flexibility in managing their healthcare costs. Compliance with Costa Mesa California Certification of Group Health Plan Coverage is essential for employers to not only meet legal obligations but also provide a strong benefits package to attract and retain talented employees. By offering comprehensive group health plan coverage, employers can prioritize the well-being of their workforce and ensure access to quality healthcare services.