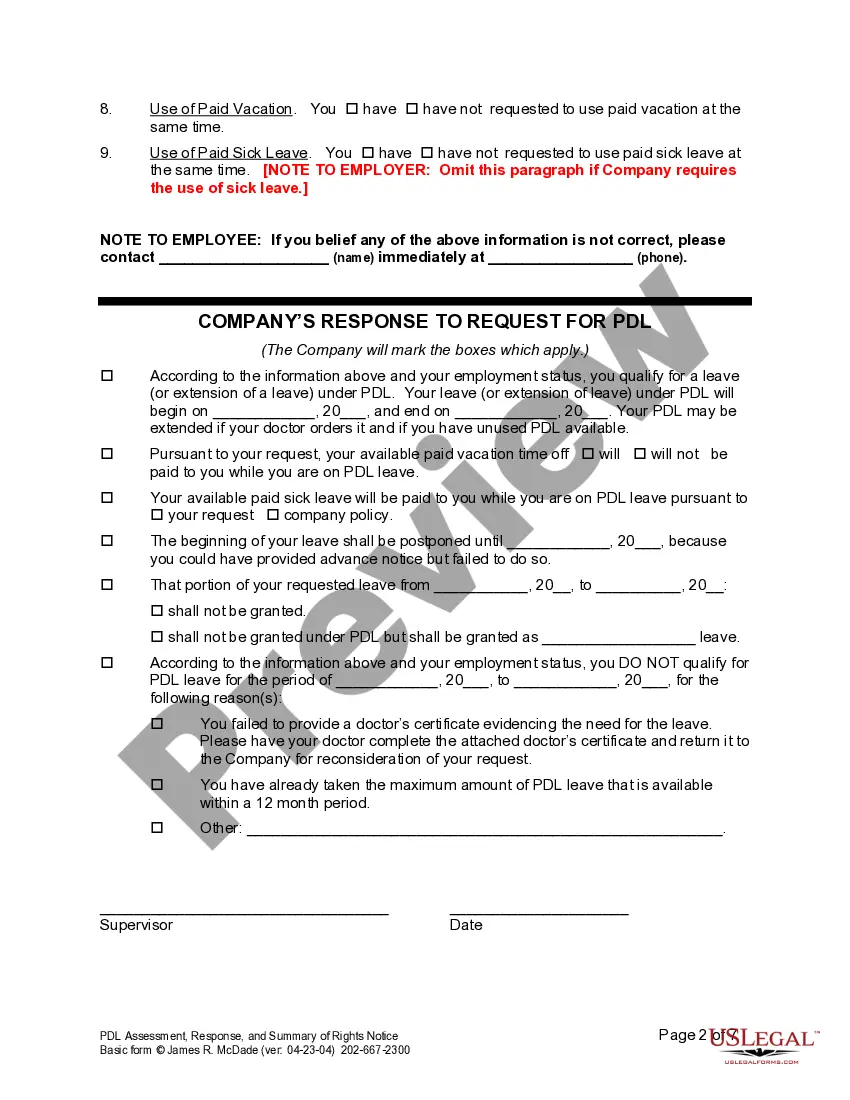

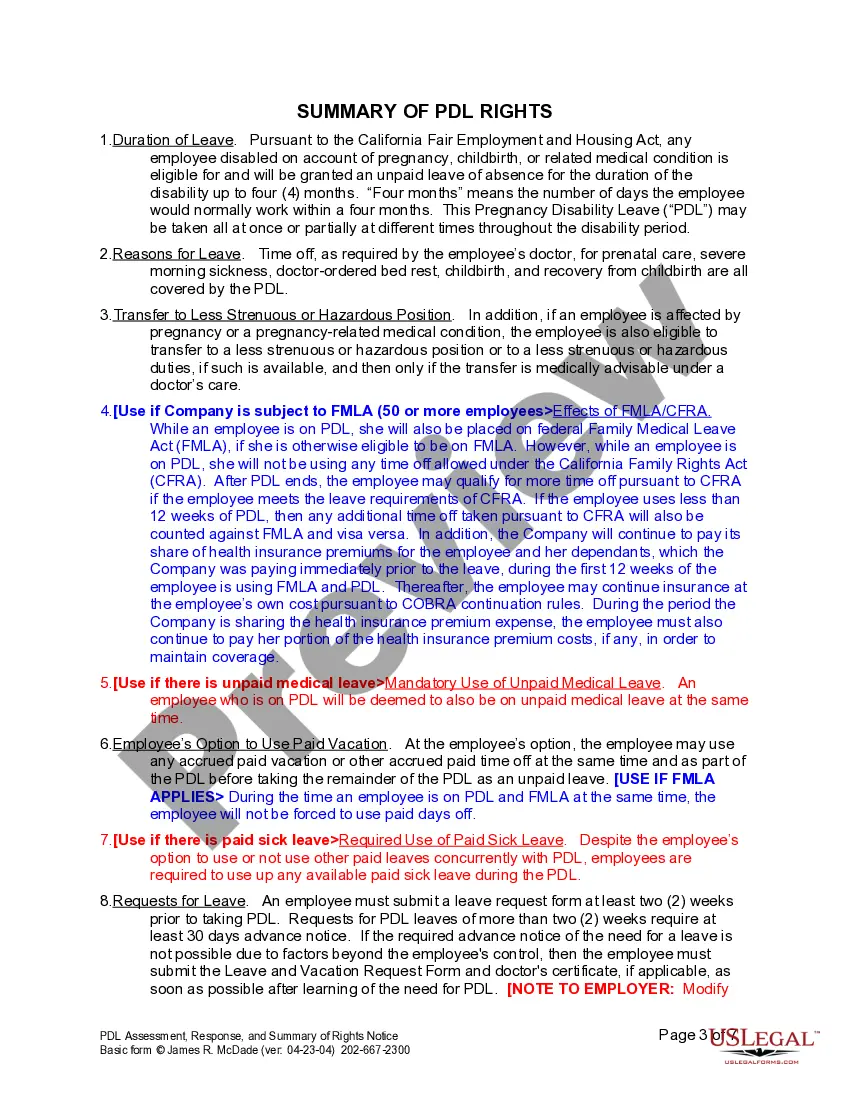

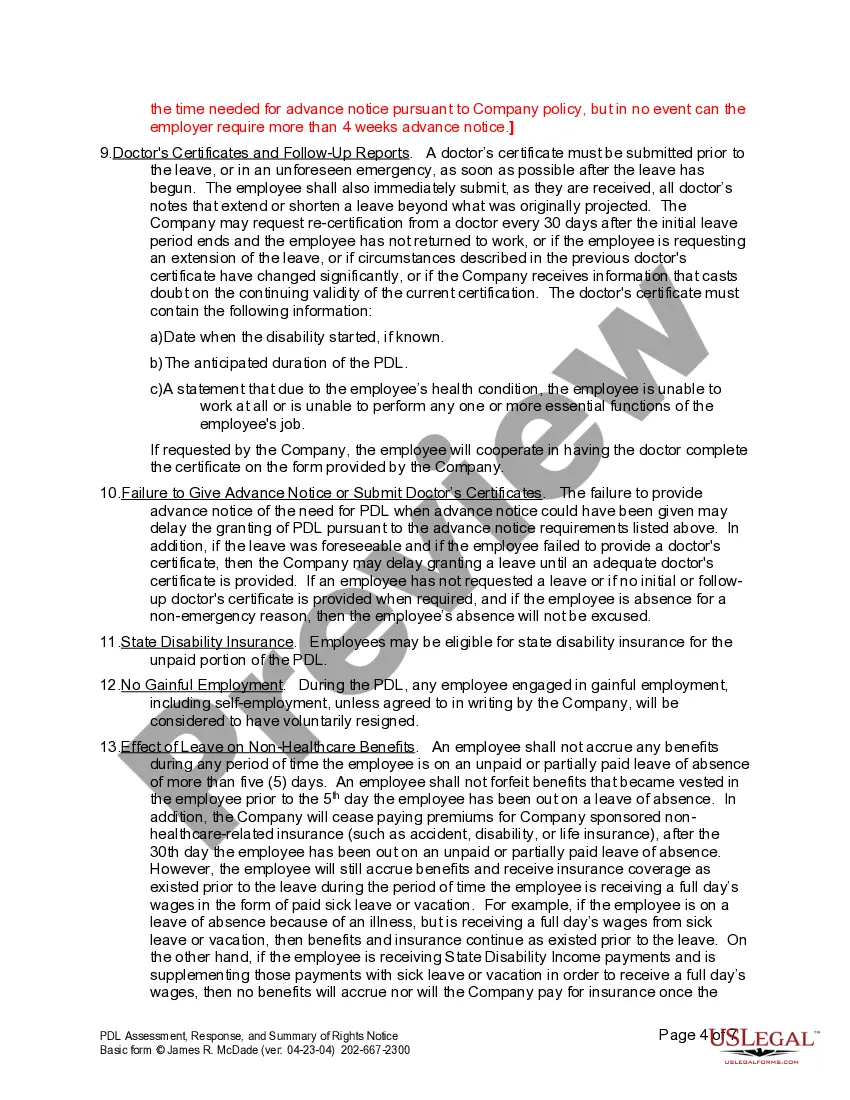

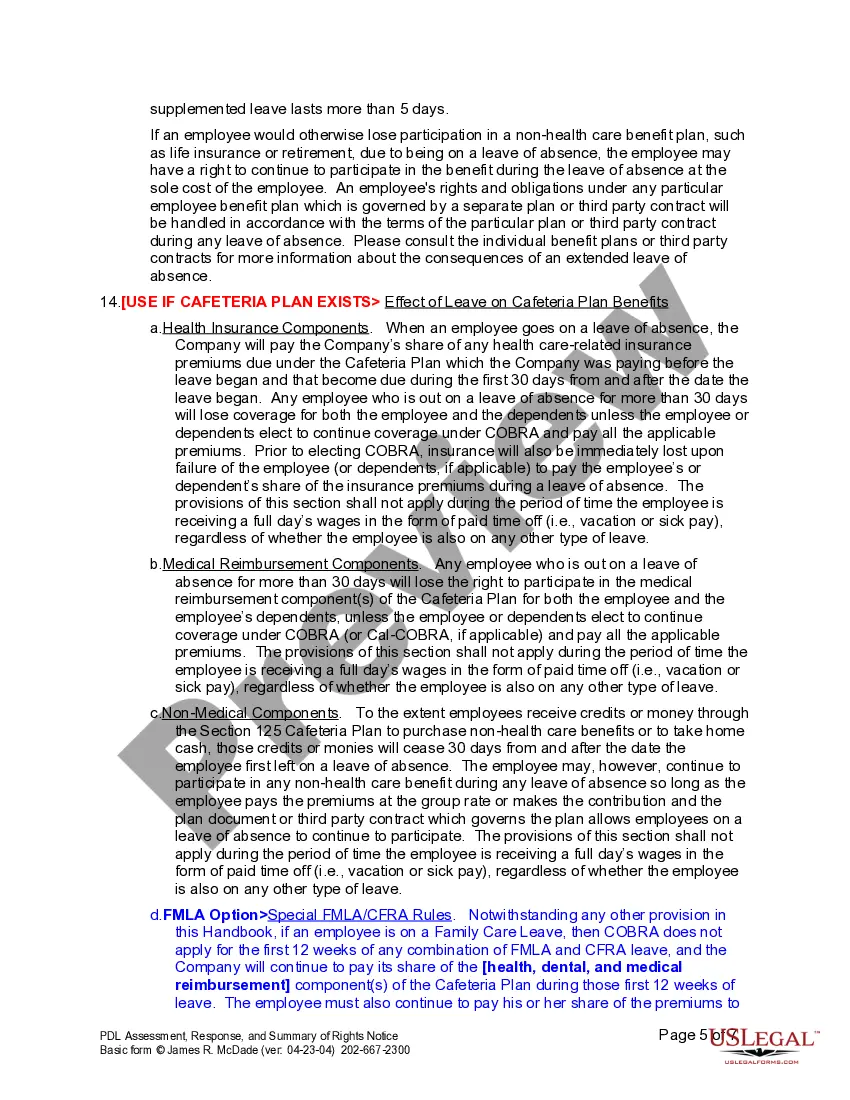

Employers use this form when an employee requests or should be placed on pregnancy disability leave. It provides general information about an employee’s and employer’s rights and obligations in relation to pregnancy disability leave.

Inglewood California PDL (Payday Lending) Request, Response, and Notice are critical components within the payday lending process in the city of Inglewood, California. The PDL Request is the initial step taken by an individual seeking a payday loan, while the PDL Response refers to the response from the lender regarding the request. The PDL Notice is an official notification sent to the borrower, containing important information and terms related to the payday loan. As part of the payday loan application process, an individual looking to borrow funds in Inglewood, California must submit a PDL Request. This request typically includes personal information such as the borrower's name, address, contact details, employment information, and proof of income. Keywords relevant to this step include "Inglewood California PDL Request," "payday loan application," "borrower information," and "loan request submission." Once the lender receives the PDL Request, they assess the provided information and financial records to determine the borrower's eligibility for the payday loan. The lender then prepares a PDL Response, which may include the loan amount approved, repayment terms, interest rates, fees, and any additional conditions. Relevant keywords for this step include "Inglewood California PDL Response," "loan eligibility assessment," "approved loan amount," "repayment terms," and "interest rates." Apart from the PDL Request and Response, the borrower is also provided with a PDL Notice, commonly referred to as the loan agreement or contract. This document serves as an official notice outlining the terms and conditions of the payday loan, including the repayment schedule, interest rates, applicable fees, consequences of non-payment, and other important provisions. Key phrases associated with the PDL Notice are "Inglewood California PDL Notice," "loan agreement," "payday loan terms," "repayment schedule," and "borrower rights and responsibilities." It's worth mentioning that different lenders may have specific variations or names for their PDL Request, Response, and Notice. However, the fundamental purpose remains the same — to initiate, process, and formally notify borrowers about their payday loan application and associated terms.Inglewood California PDL (Payday Lending) Request, Response, and Notice are critical components within the payday lending process in the city of Inglewood, California. The PDL Request is the initial step taken by an individual seeking a payday loan, while the PDL Response refers to the response from the lender regarding the request. The PDL Notice is an official notification sent to the borrower, containing important information and terms related to the payday loan. As part of the payday loan application process, an individual looking to borrow funds in Inglewood, California must submit a PDL Request. This request typically includes personal information such as the borrower's name, address, contact details, employment information, and proof of income. Keywords relevant to this step include "Inglewood California PDL Request," "payday loan application," "borrower information," and "loan request submission." Once the lender receives the PDL Request, they assess the provided information and financial records to determine the borrower's eligibility for the payday loan. The lender then prepares a PDL Response, which may include the loan amount approved, repayment terms, interest rates, fees, and any additional conditions. Relevant keywords for this step include "Inglewood California PDL Response," "loan eligibility assessment," "approved loan amount," "repayment terms," and "interest rates." Apart from the PDL Request and Response, the borrower is also provided with a PDL Notice, commonly referred to as the loan agreement or contract. This document serves as an official notice outlining the terms and conditions of the payday loan, including the repayment schedule, interest rates, applicable fees, consequences of non-payment, and other important provisions. Key phrases associated with the PDL Notice are "Inglewood California PDL Notice," "loan agreement," "payday loan terms," "repayment schedule," and "borrower rights and responsibilities." It's worth mentioning that different lenders may have specific variations or names for their PDL Request, Response, and Notice. However, the fundamental purpose remains the same — to initiate, process, and formally notify borrowers about their payday loan application and associated terms.