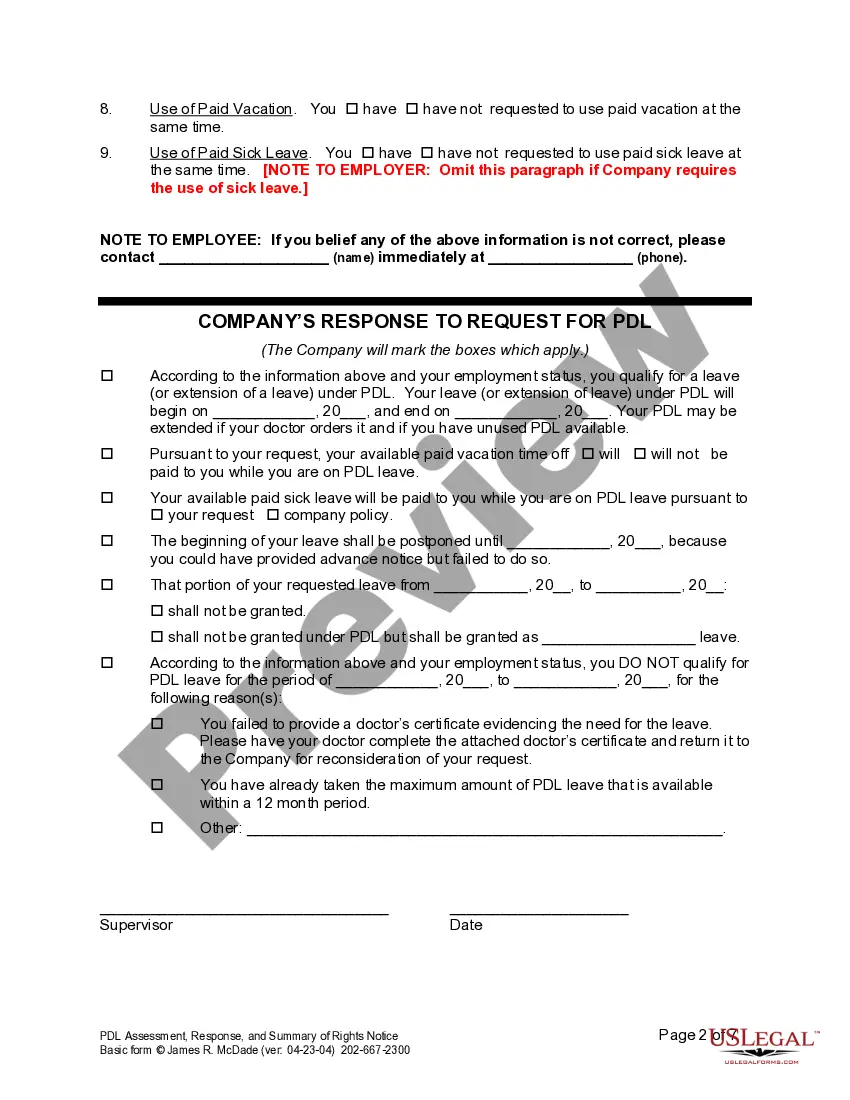

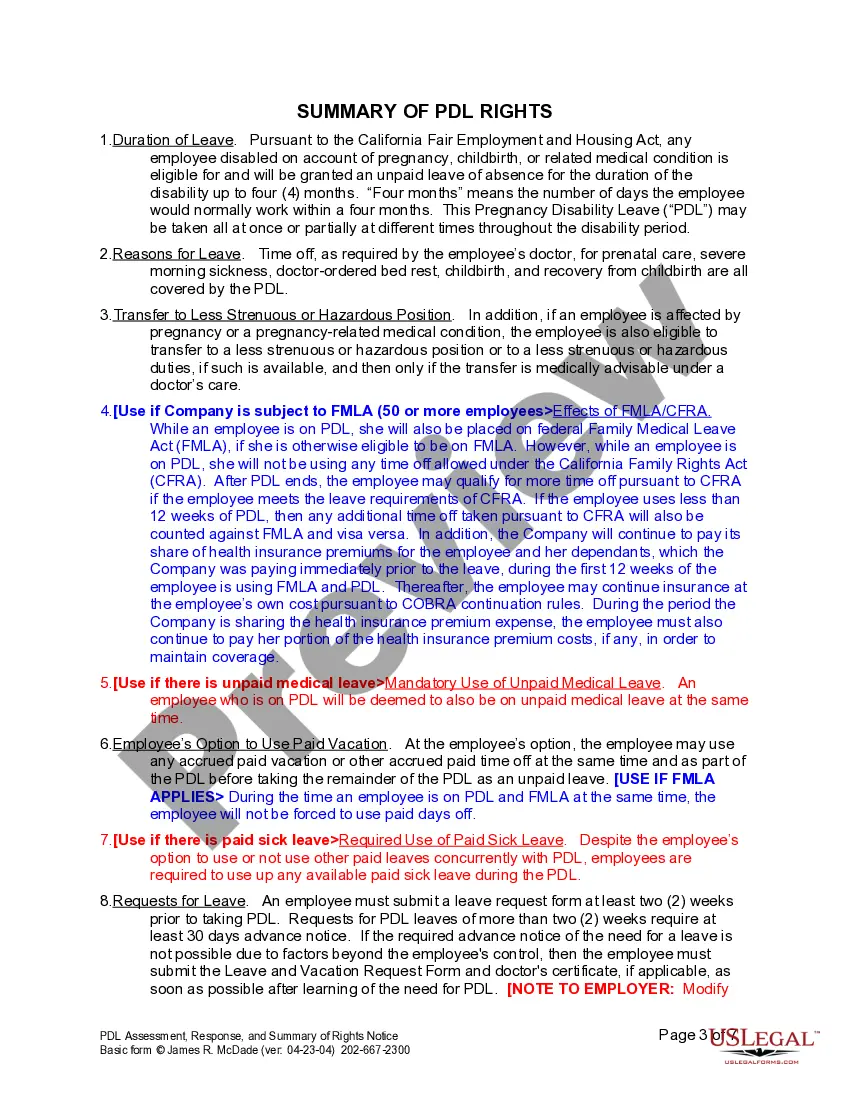

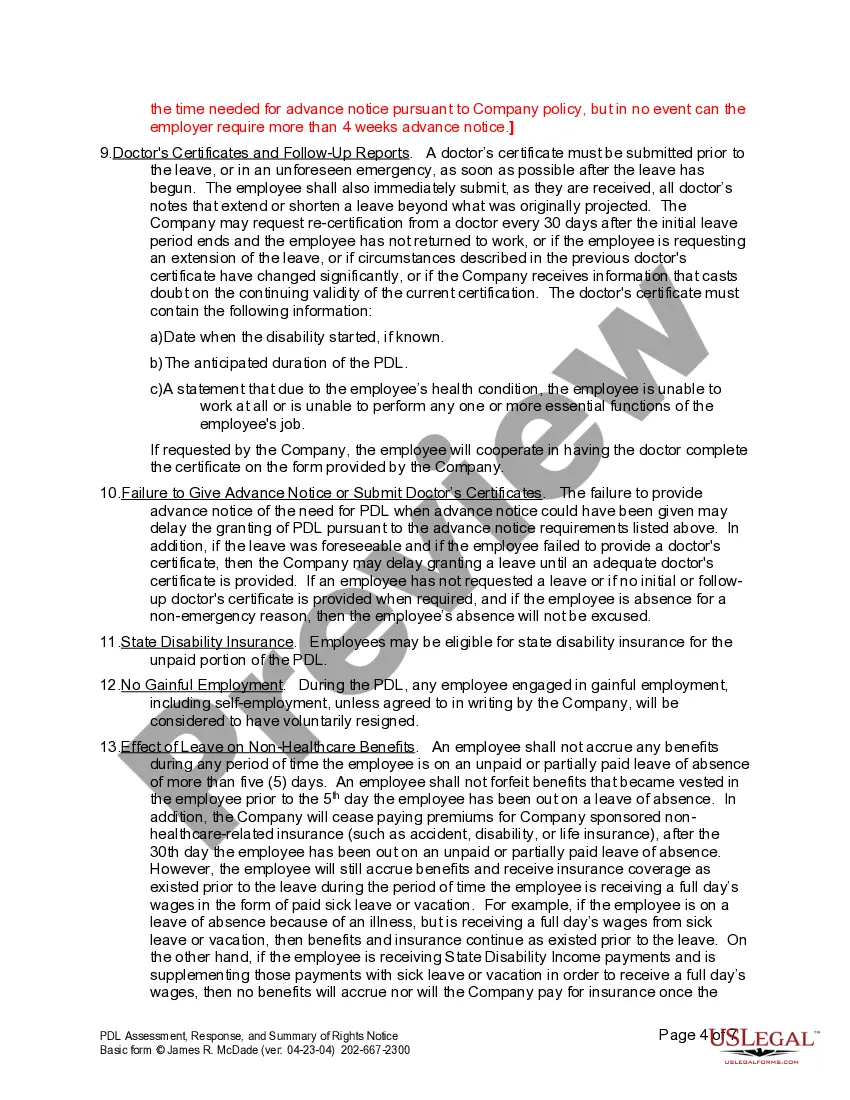

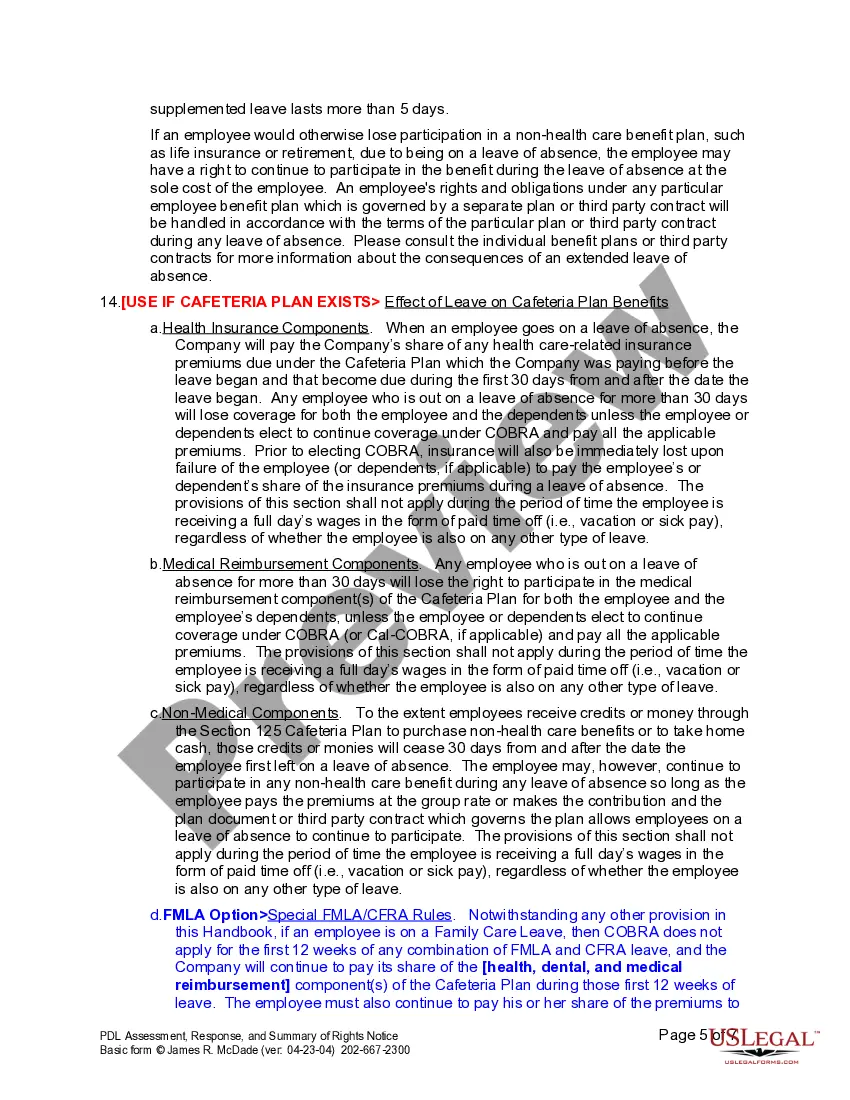

Employers use this form when an employee requests or should be placed on pregnancy disability leave. It provides general information about an employee’s and employer’s rights and obligations in relation to pregnancy disability leave.

Jurupa Valley California PDL Request Response and Notice refers to a specific process followed in Jurupa Valley, California, relating to Payday Loan (PDL) requests, responses, and notices. This description aims to provide a comprehensive understanding of these terms and their relevance in Jurupa Valley. Payday loans are short-term, high-interest loans typically availed by borrowers facing financial emergencies. Due to their predatory nature, various regulations are in place to protect consumers from unfair lending practices. In Jurupa Valley, California, the PDL Request Response and Notice is an integral part of this regulatory framework. When an individual applies for a payday loan in Jurupa Valley, they are required to submit a PDL request. This request outlines the borrower's personal and financial information, loan amount desired, and the proposed repayment plan. It is crucial to fill out this request accurately and honestly to ensure compliance with the law and increase the chances of loan approval. Once the PDL request is submitted, the lender reviews it and assesses the borrower's eligibility based on specific criteria. The lender's response to the PDL request includes information about loan approval, the loan amount sanctioned, interest rates, repayment terms, and any associated fees or penalties. The response may also highlight certain conditions or additional requirements that the borrower must meet to proceed with the loan agreement. In Jurupa Valley, California, it is essential for lenders to provide clear and transparent notices to borrowers regarding the loan terms, conditions, and legal rights. These notices ensure that borrowers have a complete understanding of their obligations and rights before entering into a payday loan agreement. These notices typically include information such as the annual percentage rate (APR), repayment schedule, consequences of default, and the borrower's rights relating to loan extension, prepayment, and dispute resolution. In addition to the standard PDL Request Response and Notice, there may be variations or specific types based on the borrower's circumstances or the loan agreement. These may include: 1. PDL Request Response for Online Applications: This type specifically caters to borrowers who apply for payday loans online. The response might involve additional electronic verification processes and online agreement signing. 2. PDL Request Response for In-Person Applications: This type pertains to borrowers who physically visit a payday loan store in Jurupa Valley to apply for a loan. The response might include immediate approval or denial, followed by a face-to-face discussion of loan terms. 3. PDL Request Response for Repeat Borrowers: This category relates to borrowers who have previously availed payday loans. The response may consider their past repayment history and might result in variable loan terms or borrowing limits. 4. PDL Request Response and Notice for Military Personnel: This particular response and notice type is applicable to members of the military and their families, who have specific rights and protections under the Military Lending Act (MLA). These notices would address the additional rules and restrictions that apply to them. It is crucial for both lenders and borrowers to follow the established procedures and provide accurate information throughout the PDL Request Response and Notice process in Jurupa Valley, California. This ensures compliance with local regulations, protects borrowers from predatory lending practices, and promotes transparency in the payday loan industry.Jurupa Valley California PDL Request Response and Notice refers to a specific process followed in Jurupa Valley, California, relating to Payday Loan (PDL) requests, responses, and notices. This description aims to provide a comprehensive understanding of these terms and their relevance in Jurupa Valley. Payday loans are short-term, high-interest loans typically availed by borrowers facing financial emergencies. Due to their predatory nature, various regulations are in place to protect consumers from unfair lending practices. In Jurupa Valley, California, the PDL Request Response and Notice is an integral part of this regulatory framework. When an individual applies for a payday loan in Jurupa Valley, they are required to submit a PDL request. This request outlines the borrower's personal and financial information, loan amount desired, and the proposed repayment plan. It is crucial to fill out this request accurately and honestly to ensure compliance with the law and increase the chances of loan approval. Once the PDL request is submitted, the lender reviews it and assesses the borrower's eligibility based on specific criteria. The lender's response to the PDL request includes information about loan approval, the loan amount sanctioned, interest rates, repayment terms, and any associated fees or penalties. The response may also highlight certain conditions or additional requirements that the borrower must meet to proceed with the loan agreement. In Jurupa Valley, California, it is essential for lenders to provide clear and transparent notices to borrowers regarding the loan terms, conditions, and legal rights. These notices ensure that borrowers have a complete understanding of their obligations and rights before entering into a payday loan agreement. These notices typically include information such as the annual percentage rate (APR), repayment schedule, consequences of default, and the borrower's rights relating to loan extension, prepayment, and dispute resolution. In addition to the standard PDL Request Response and Notice, there may be variations or specific types based on the borrower's circumstances or the loan agreement. These may include: 1. PDL Request Response for Online Applications: This type specifically caters to borrowers who apply for payday loans online. The response might involve additional electronic verification processes and online agreement signing. 2. PDL Request Response for In-Person Applications: This type pertains to borrowers who physically visit a payday loan store in Jurupa Valley to apply for a loan. The response might include immediate approval or denial, followed by a face-to-face discussion of loan terms. 3. PDL Request Response for Repeat Borrowers: This category relates to borrowers who have previously availed payday loans. The response may consider their past repayment history and might result in variable loan terms or borrowing limits. 4. PDL Request Response and Notice for Military Personnel: This particular response and notice type is applicable to members of the military and their families, who have specific rights and protections under the Military Lending Act (MLA). These notices would address the additional rules and restrictions that apply to them. It is crucial for both lenders and borrowers to follow the established procedures and provide accurate information throughout the PDL Request Response and Notice process in Jurupa Valley, California. This ensures compliance with local regulations, protects borrowers from predatory lending practices, and promotes transparency in the payday loan industry.