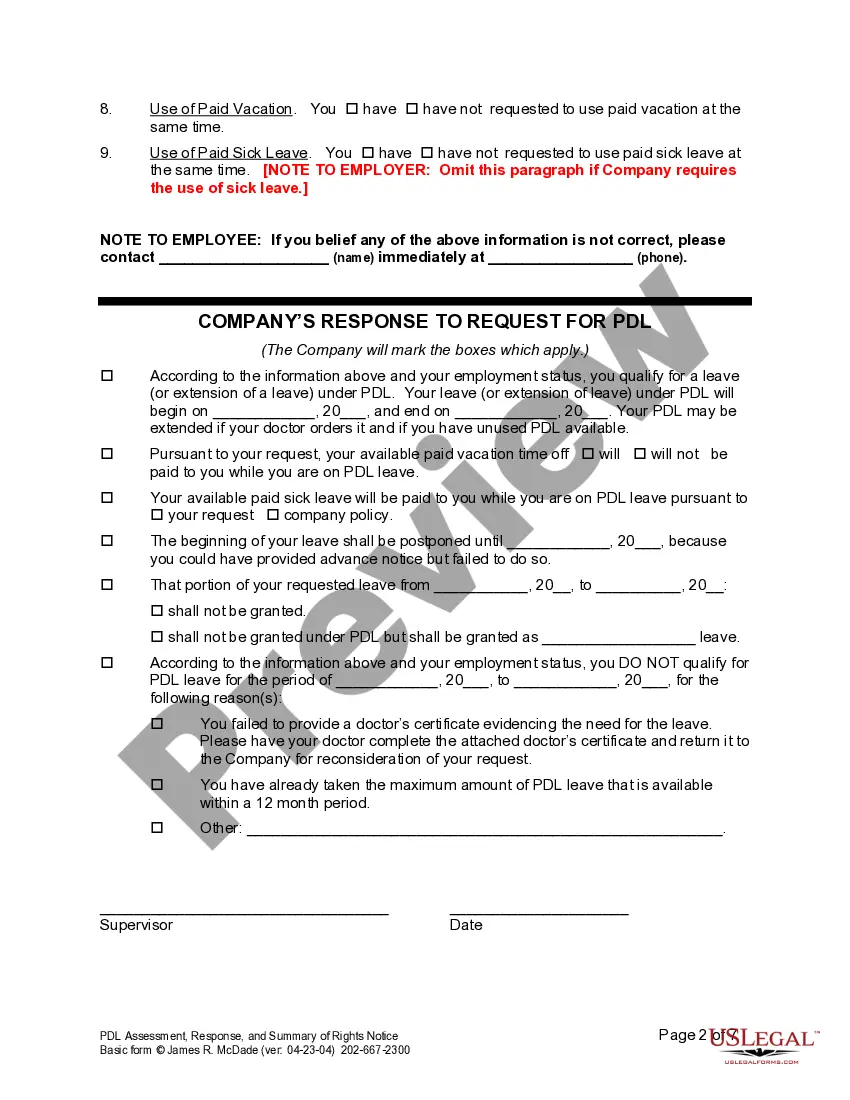

Employers use this form when an employee requests or should be placed on pregnancy disability leave. It provides general information about an employee’s and employer’s rights and obligations in relation to pregnancy disability leave.

Stockton California PDL Request Response and Notice

Description

How to fill out California PDL Request Response And Notice?

If you are looking for a legitimate form, it’s incredibly difficult to discover a more suitable location than the US Legal Forms website – one of the most extensive online repositories.

Here you can locate a vast array of form examples for corporate and personal needs categorized by type and jurisdiction, or keywords.

By utilizing our enhanced search function, obtaining the latest Stockton California PDL Request Response and Notice is as simple as 1-2-3.

Complete the transaction. Use your credit card or PayPal account to finalize the registration process.

Obtain the document. Specify the format and download it to your device. Edit. Complete, adjust, print, and sign the obtained Stockton California PDL Request Response and Notice.

- Additionally, the applicability of each document is validated by a team of experienced attorneys who routinely examine the templates on our platform and update them according to the most recent state and county laws.

- If you are already familiar with our site and possess an account, all you need to do to retrieve the Stockton California PDL Request Response and Notice is to sign in to your account and click the Download button.

- If you are using US Legal Forms for the first time, simply follow the instructions below.

- Ensure you have accessed the sample you need. Review its details and use the Preview option to investigate its content. If it doesn’t fulfill your criteria, leverage the Search bar at the top of the page to find the correct document.

- Verify your choice. Click the Buy now button. Then, choose the desired subscription option and enter your information to create an account.

Form popularity

FAQ

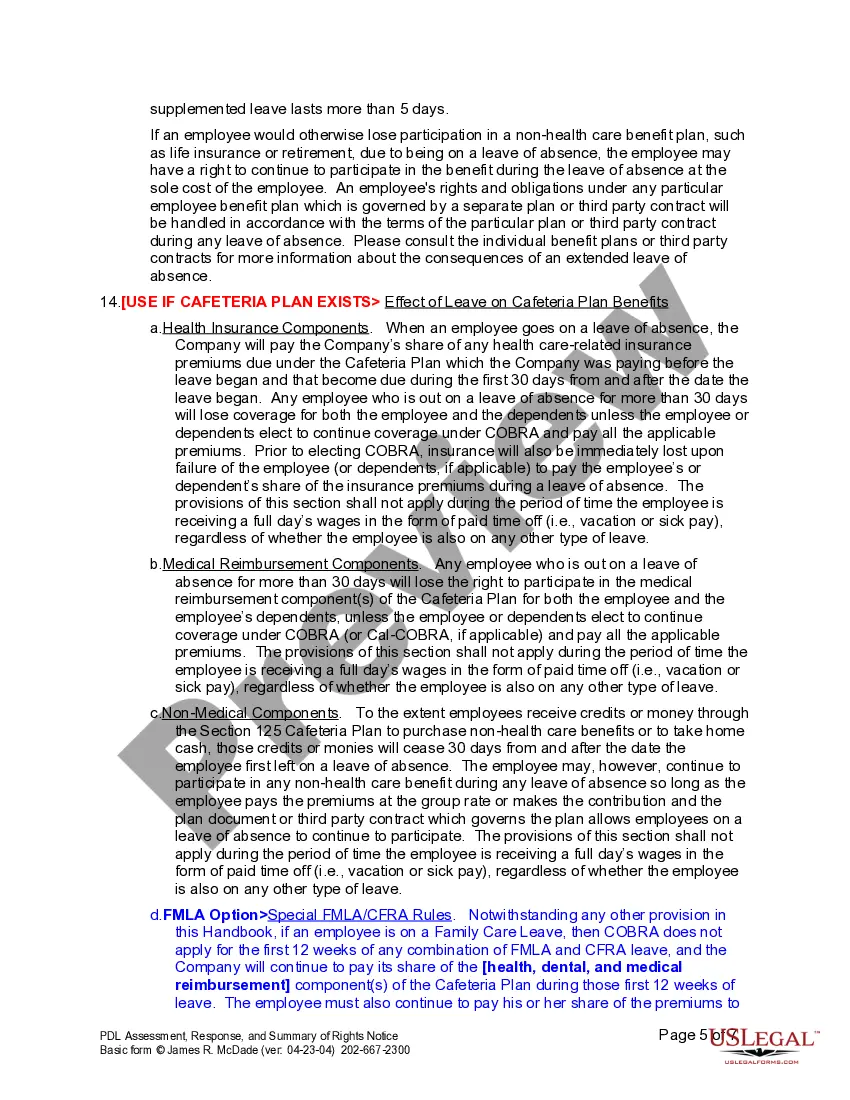

To secure your doctor’s approval for short-term disability due to pregnancy, provide detailed information about your medical condition and how it impacts daily activities. Building a case with documentation will support your request. Familiarizing yourself with the Stockton California PDL Request Response and Notice can also help clarify the necessary steps to take, ensuring your doctor has all relevant information.

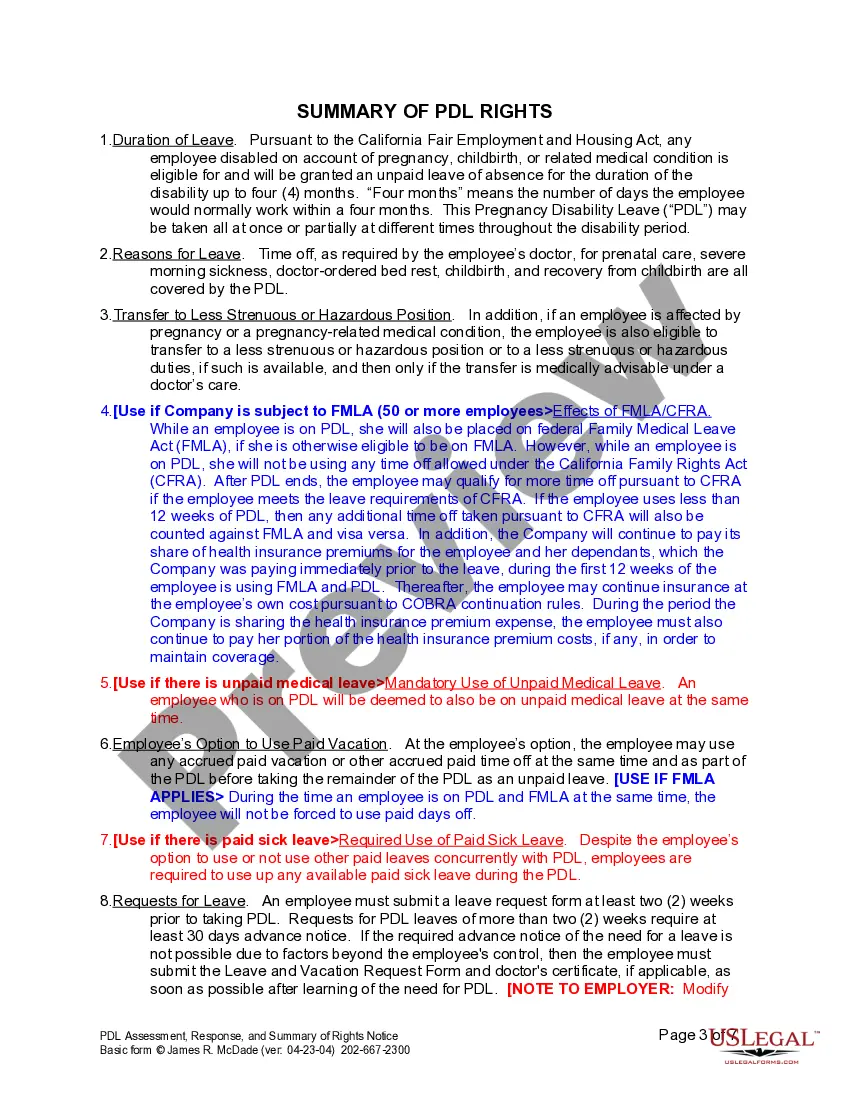

Disability during pregnancy may qualify if you face complications that prevent you from working, such as severe morning sickness, preterm labor, or other medical concerns. Each case is evaluated individually, taking into account your overall health. It is crucial to align your situation with the Stockton California PDL Request Response and Notice guidelines to determine qualification.

No, Pregnancy Disability Leave (PDL) and Family and Medical Leave Act (FMLA) are not the same, but they can overlap. PDL specifically addresses disability linked to pregnancy, while FMLA provides broader family leave benefits. Understanding the differences will help you navigate your rights. Remember to review the Stockton California PDL Request Response and Notice for specific guidance on your situation.

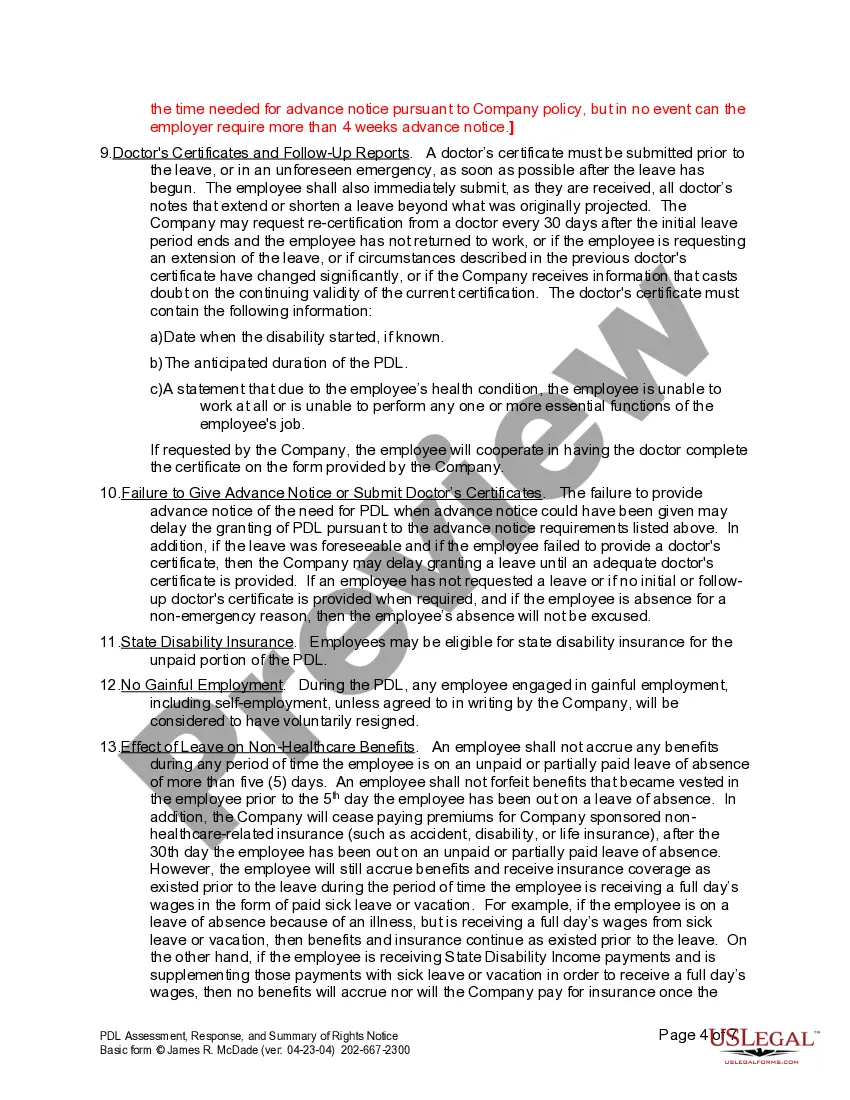

To obtain a disability recommendation from your doctor while pregnant, prepare to talk about how your condition affects your ability to perform your job. Be ready to discuss your medical history and any complications that arise. Familiarize yourself with the Stockton California PDL Request Response and Notice process, as this can provide a framework for your doctor’s recommendations.

Yes, you can request that your doctor takes you out of work while you are pregnant if you believe your health is at risk. It's vital to discuss any symptoms or stressors that contribute to your need for leave. Your doctor will assess your situation based on medical guidelines and the Stockton California PDL Request Response and Notice criteria to determine the best course of action.

To persuade your doctor to support your request for disability leave, clearly communicate your symptoms and how they affect your daily life. Documenting specific challenges can help your case significantly. Providing information about the Stockton California PDL Request Response and Notice may help guide your doctor’s decision. Be honest and open during your discussions about your situation.

In California, the Pregnancy Disability Leave (PDL) allows you to take up to four months off work for pregnancy-related disabilities. This time can be used before or after childbirth. To ensure you are following the correct procedures, refer to the Stockton California PDL Request Response and Notice guidelines. Consider using resources like US Legal Forms for assistance in filing your request.