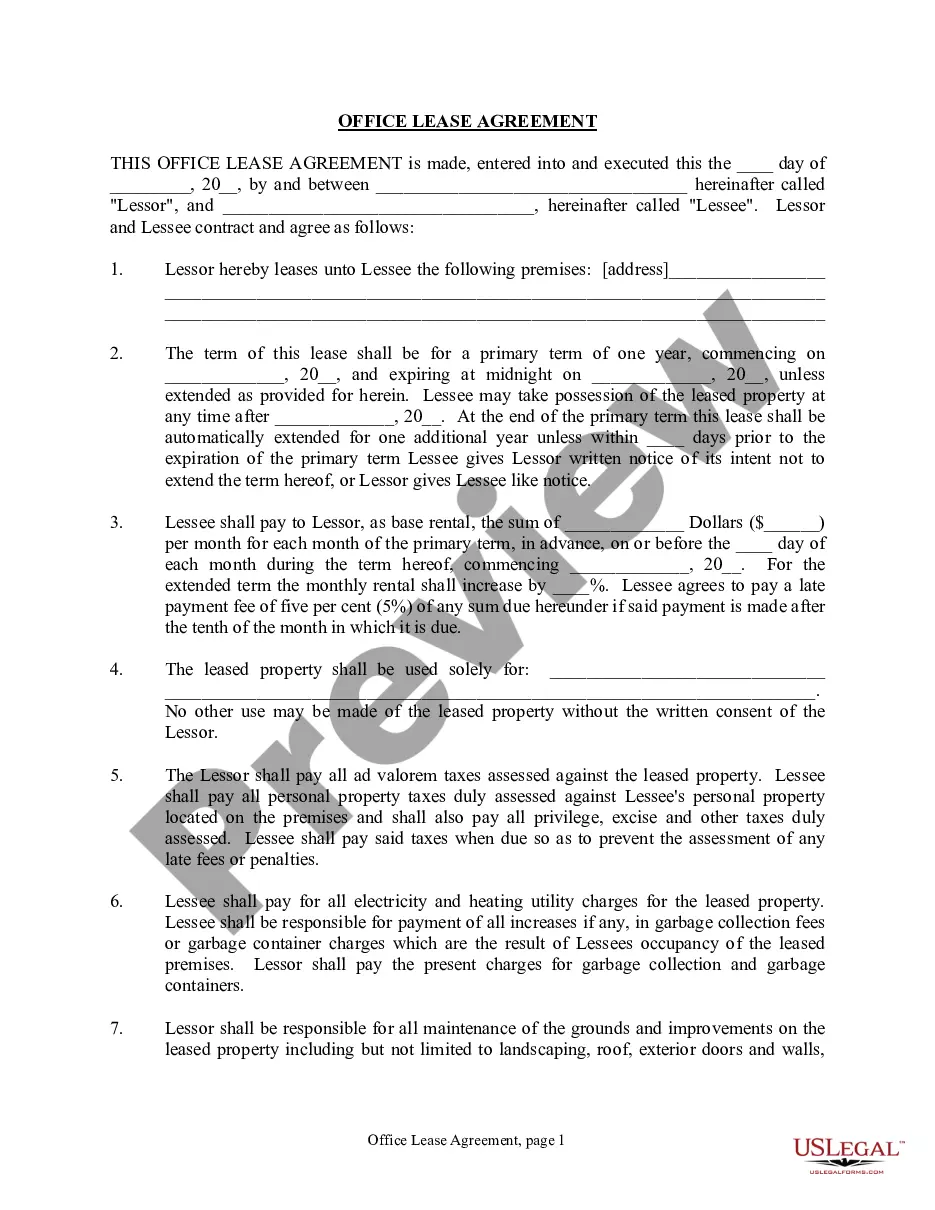

Employers use this form to notify an employee that his or her social security number does not match the name on file with the U.S. Social Security Administration and he or she needs to correct the mismatch.

Orange California Social Security Mismatch Notice

Description

How to fill out California Social Security Mismatch Notice?

If you are looking for an appropriate form template, it’s exceptionally difficult to find a superior platform compared to the US Legal Forms site – one of the most extensive collections online.

Here you can obtain a vast assortment of form examples for business and personal use categorized by type and state, or keywords.

With the enhanced search capability, locating the most recent Orange California Social Security Mismatch Notice is as simple as 1-2-3.

Complete the transaction. Use your credit card or PayPal account to finalize the registration process.

Obtain the form. Choose the format and download it to your device. Edit. Fill in, alter, print, and sign the obtained Orange California Social Security Mismatch Notice.

- Moreover, the applicability of each document is verified by a team of qualified lawyers who regularly evaluate the templates on our site and refresh them according to the latest state and county laws.

- If you are familiar with our site and possess an active account, all you need to do to access the Orange California Social Security Mismatch Notice is to sign in to your account and click the Download button.

- If you’re using US Legal Forms for the first time, simply follow the guidelines listed below.

- Ensure you have selected the template you need. Review its details and utilize the Preview feature (if available) to inspect its content. If it doesn’t satisfy your requirements, use the Search option at the top of the page to locate the desired record.

- Verify your selection. Click the Buy now button. Then, select your desired subscription plan and provide the necessary information to create an account.

Form popularity

FAQ

Visit a local SSA office You will need to bring your driver's license, state-issued identity document, or passport.

WHAT IS A SOCIAL SECURITY ADMINISTRATION ?NO-MATCH LETTER?? The Social Security Administration (?SSA?) sends ?no-match letters?1 to businesses when their employees' names and Social Security numbers (?SSNs?) don't exactly match those in the SSA's files, based on information the SSA gets each year from the employer.

Generally, if the information matches, the employee's case receives an Employment Authorized result in E-Verify. If the information does not match, the case will receive a Tentative Nonconfirmation (TNC) result and the employer must give the employee an opportunity to take action to resolve the mismatch.

Report any change to the Social Security Administration by visiting their website or calling them at 800-772-1213 (TTY 800-325-0778).

Go to the website for the social security administration, ssa.gov, and follow the links to the Social Security Number Verification System (SSNVS). From there, follow the instructions to register your business at the Business Services Online Welcome page.

Register online to find out which workers have discrepancies in their SSA files. Inform affected employees of the no-match notice and ask that they confirm the name and SSN reflected in your employment records. Advise the workers to contact the SSA to correct their SSA records.

SSA sends a no-match letter when the names or Social Security numbers (SSNs) listed on an employer's Form W?2 do not match SSA's records. The no-match letter may list one or more workers whose personal information does not match SSA's records.

A DHS or SSA Tentative Nonconfirmation (mismatch) results when the information entered in E-Verify does not match DHS records or data available to SSA. A mismatch does not necessarily mean that the employee is not authorized to work in the United States.