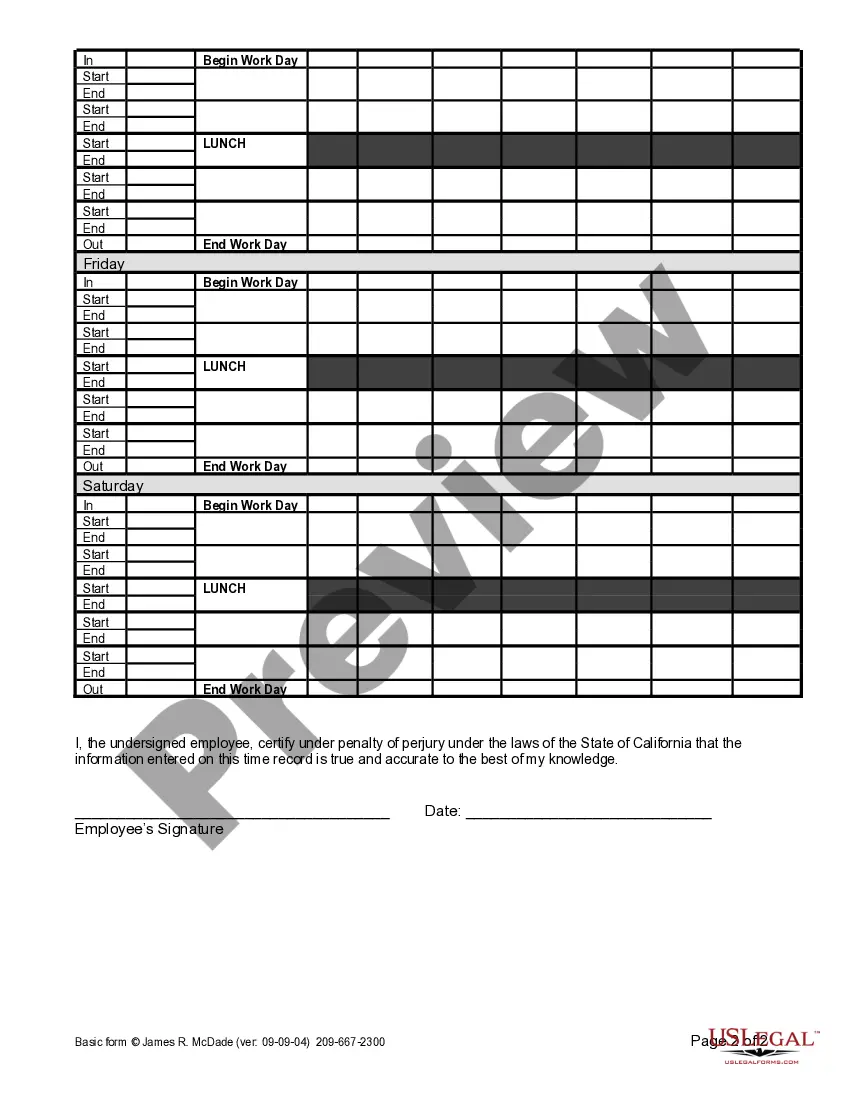

Employers use this form to keep track of an employee’s work time when the employee is paid different wage rates for different work.

Los Angeles California Weekly Time Sheet for Multiple Pay Rate

Description

How to fill out California Weekly Time Sheet For Multiple Pay Rate?

If you are searching for a pertinent template, it’s impossible to select a better site than the US Legal Forms portal – likely the most comprehensive online collections.

Here you can obtain thousands of document samples for organizational and personal use, categorized by type and location, or key terms.

Utilizing our enhanced search feature, finding the latest Los Angeles California Weekly Time Sheet for Multiple Pay Rate is as simple as 1-2-3.

Adjust the document. Complete, modify, print, and sign the acquired Los Angeles California Weekly Time Sheet for Multiple Pay Rate.

Every form you store in your user account has no expiration date and is yours indefinitely. You can access them via the My documents menu, so if you need to obtain another copy for editing or printing, feel free to return and export it again at any time.

- Ensure you have opened the document you need.

- Review its description and use the Preview function to assess its content. If it doesn’t satisfy your needs, use the Search tool at the top of the page to locate the correct file.

- Verify your choice. Click the Buy now button. Then, select your desired pricing plan and provide your details to create an account.

- Complete the transaction. Use your credit card or PayPal account to finalize the registration process.

- Obtain the document. Specify the format and save it on your device.

Form popularity

FAQ

In general, California overtime provisions require that all nonexempt employees (including domestic workers) receive overtime pay at a rate of 1.5 times their regular rate of pay for all hours worked in excess of 8 per day and 40 per week. These overtime rules apply to all nonexempt employees.

Double the employee's regular rate of pay for all hours worked in excess of 12 hours in any workday and for all hours worked in excess of eight on the seventh consecutive day of work in a workweek.

Effective January 1, 2022, SB 62 will prohibit employers from paying employees engaged in garment manufacturing by a piece rate. The bill imposes a $200 fine per employee against a garment manufacturer or contractor, payable to the employee, for each pay period where the employee is paid by the piece rate.

rate plan is a wage payment system where an employee is paid a fixed amount for each unit produced or action completed. Piece rate is used in many different industries, including automobile repair, trucking, manufacturing and call centers.

Under the weekly overtime law, overtime must be paid for any hours worked over 40 in the workweek at the rate of one and one half times the regular rate of pay. Simply count all hours worked for the entire workweek. If the employee worked 40 or fewer hours that week, he or she has zero weekly overtime hours that week.

Once an employee works past 12 hours in a day, the rate of overtime pay enters double time, where employees earn twice their normal rates. Employees are also entitled to double time in California if they work more than 8 hours on a Sunday, after a 7-day work week.

This can also be called ?output work,? because the employee is compensated by the measure of their output. Is it legal to pay piece rate? Yes, it is legal to pay piece rate. However, employers still need to comply with minimum wage laws, overtime, and state and federal record-keeping requirements.

All the non-exempt employees who are qualified for overtime are paid 1.5 times the regular rate for all hours worked in excess of 8 hours in a workday, in excess of 40 hours in a workweek, or for the first eight hours worked on the 7th consecutive day worked in any workweek.

In California, overtime is officially counted both after 8 hours of work per day, AND 40 hours per week - according to the California Labor Code Section 510, i.e. The Cunningham Law.

Example double-time calculation If you want to calculate a double-time rate for an employee who is a nonexempt hourly employee and makes $25 per hour ($950 per 38-hour week), you can simply double their hourly rate.