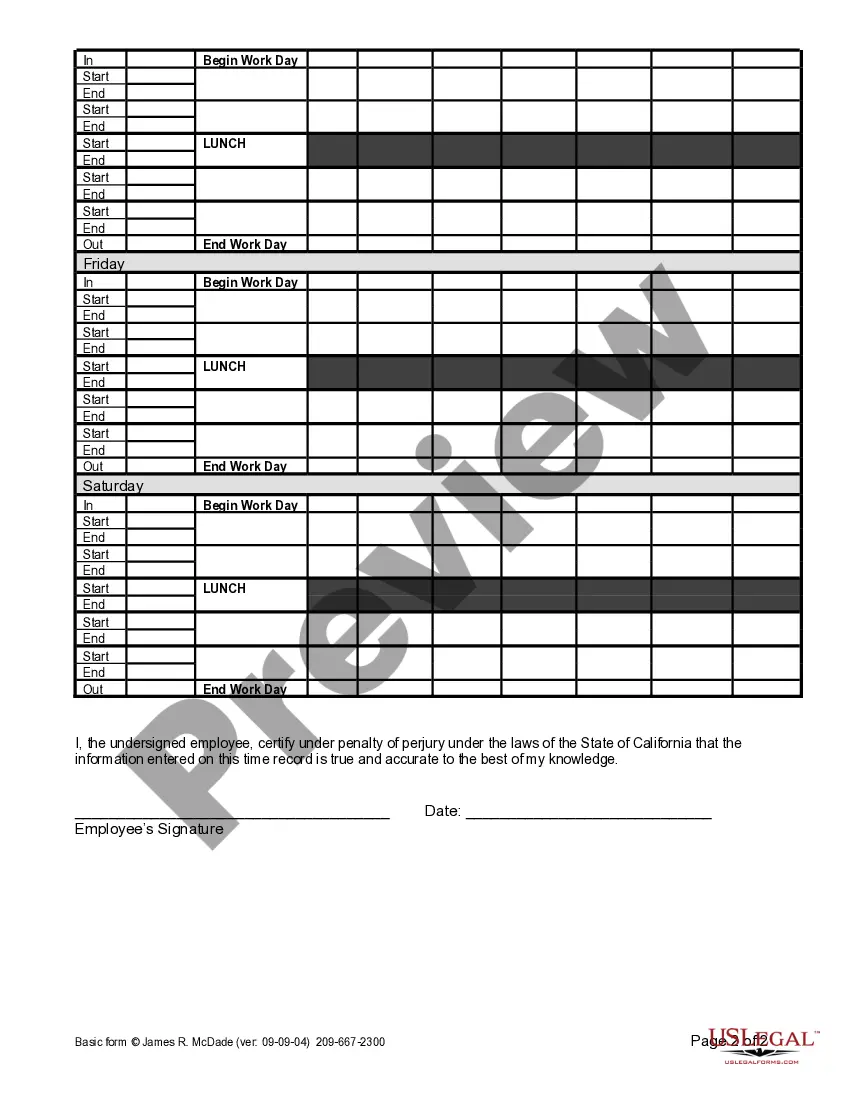

Employers use this form to keep track of an employee’s work time when the employee is paid different wage rates for different work.

Stockton California Weekly Time Sheet for Multiple Pay Rate is a vital tool used by employers in Stockton, California, to accurately track and manage employee working hours and wages. Designed for businesses with multiple pay rates, this time sheet ensures seamless payroll processing while adhering to legal requirements and maintaining transparent employee compensation. The Stockton California Weekly Time Sheet for Multiple Pay Rate allows employers to record the specific details of employee work hours based on various pay rates. It includes comprehensive sections for employee information, such as name, employee ID, department, and supervisor details. This sheet also incorporates columns for the week's start and end dates, allowing employers to conveniently track and store employee data on a weekly basis. This time sheet provides dedicated sections to record regular hours worked, overtime hours, and any other specific wage categories applicable to the employee's role or job duties. The multiple pay rates feature enables employers to assign different hourly rates for distinct tasks or shift differentials, ensuring accurate compensation calculations. To maintain compliance with labor laws, Stockton California Weekly Time Sheet for Multiple Pay Rate includes sections for employees to input their total break times, both paid and unpaid. By documenting break periods, employers can ensure that employees receive the appropriate compensation while adhering to applicable regulations. Moreover, this time sheet offers ample space for additional notes or comments, allowing employers or employees to provide specific information related to work hours or any other relevant details, ensuring better communication and fewer discrepancies in payroll processing. Stockton California may have various types of Weekly Time Sheets for Multiple Pay Rates based on specific industries or employer requirements. Some notable examples include: 1. Stockton California Weekly Time Sheet for Multiple Pay Rates in the Healthcare Industry: This time sheet variant caters to healthcare professionals working in hospitals, clinics, or other medical facilities. It includes specialized pay rate categories for different roles like doctors, nurses, technicians, and administrative staff. 2. Stockton California Weekly Time Sheet for Multiple Pay Rates in the Manufacturing Sector: This type of time sheet targets employers in the manufacturing industry. It allows employers to track different hourly rates based on specific shifts, skill levels, or specialized job duties within the manufacturing process. 3. Stockton California Weekly Time Sheet for Multiple Pay Rates in the Hospitality and Service Industry: This time sheet variant is tailored for businesses in the hospitality and service sectors, such as hotels, restaurants, or customer service centers. It incorporates pay rate categories considering different roles like waitstaff, bartenders, front desk staff, and customer service representatives. In conclusion, the Stockton California Weekly Time Sheet for Multiple Pay Rate is a flexible and customizable tool that assists employers in Stockton, California, in efficiently managing employee working hours and wages. By incorporating distinct pay rate categories, employers can accurately compensate employees based on their unique roles and responsibilities.