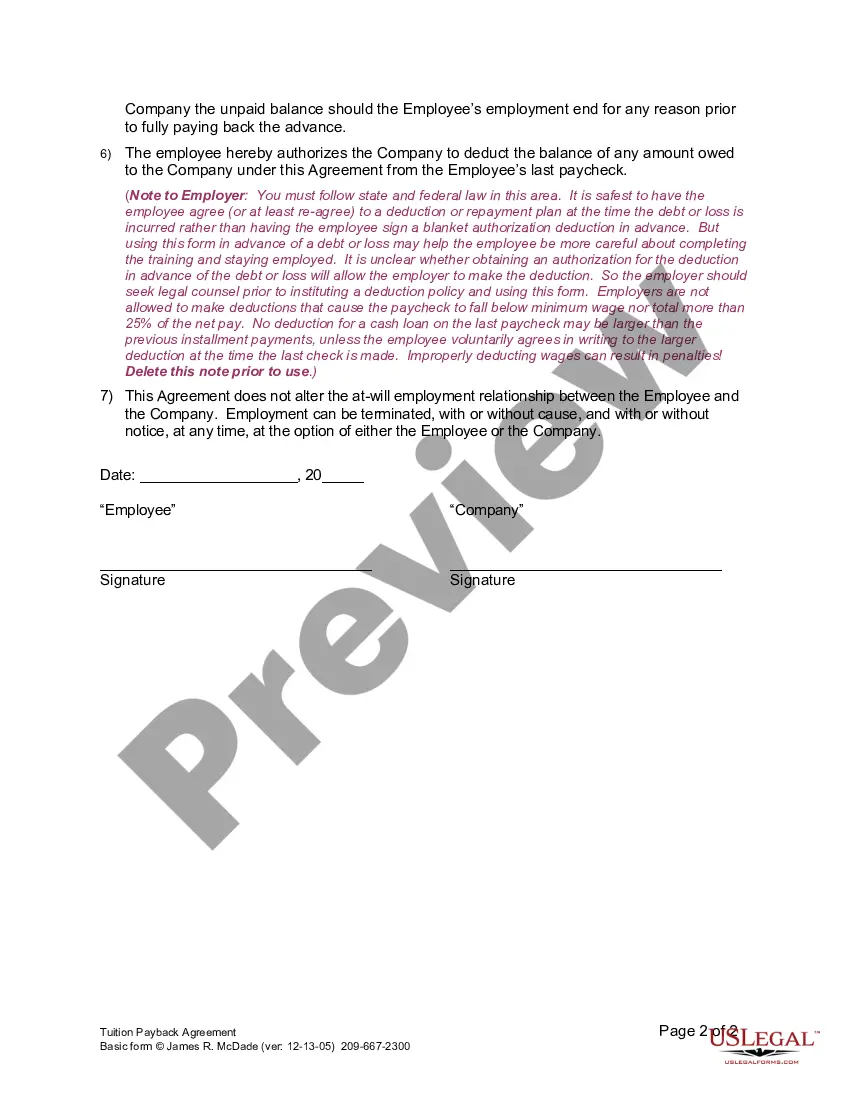

Employers use this form to recover the cost of voluntary training if the employee leaves prior to fulfilling an agreed-upon term of service.

The Murrieta California Tuition Payback Agreement is a contractual agreement between a student and an educational institution in Murrieta, California. This agreement outlines the terms and conditions under which the student will repay their tuition fees or loans, typically after completing their education or training. The primary purpose of the Murrieta California Tuition Payback Agreement is to provide students with the opportunity to pursue higher education without the immediate financial burden of paying tuition fees. Instead, the agreement allows the student to defer payment until after they have completed their studies or obtained gainful employment. One type of Murrieta California Tuition Payback Agreement is the Income-Share Agreement (ISA). Under an ISA, the student agrees to repay a percentage of their income for a specified period after graduation, typically a set number of years or until a predetermined amount has been repaid. This type of agreement allows students to repay their tuition fees based on their ability to pay, making education accessible for individuals who may not have the means to pay upfront. Another type of Murrieta California Tuition Payback Agreement is the Loan Repayment Agreement. This agreement functions more like a traditional loan, where the student borrows a specific amount of money to pay for tuition and other educational expenses. The student then agrees to repay the loan over a designated period with interest. The Murrieta California Tuition Payback Agreement may also include provisions for deferment or forbearance, allowing students to temporarily suspend or reduce their payment obligations in cases of financial hardship or other extenuating circumstances. Overall, the Murrieta California Tuition Payback Agreement serves as a mechanism to make higher education more accessible and affordable for students in the region. By providing options for deferred payment and income-based repayment, these agreements aim to alleviate the financial burden associated with pursuing education and ultimately help students achieve their academic and career goals.The Murrieta California Tuition Payback Agreement is a contractual agreement between a student and an educational institution in Murrieta, California. This agreement outlines the terms and conditions under which the student will repay their tuition fees or loans, typically after completing their education or training. The primary purpose of the Murrieta California Tuition Payback Agreement is to provide students with the opportunity to pursue higher education without the immediate financial burden of paying tuition fees. Instead, the agreement allows the student to defer payment until after they have completed their studies or obtained gainful employment. One type of Murrieta California Tuition Payback Agreement is the Income-Share Agreement (ISA). Under an ISA, the student agrees to repay a percentage of their income for a specified period after graduation, typically a set number of years or until a predetermined amount has been repaid. This type of agreement allows students to repay their tuition fees based on their ability to pay, making education accessible for individuals who may not have the means to pay upfront. Another type of Murrieta California Tuition Payback Agreement is the Loan Repayment Agreement. This agreement functions more like a traditional loan, where the student borrows a specific amount of money to pay for tuition and other educational expenses. The student then agrees to repay the loan over a designated period with interest. The Murrieta California Tuition Payback Agreement may also include provisions for deferment or forbearance, allowing students to temporarily suspend or reduce their payment obligations in cases of financial hardship or other extenuating circumstances. Overall, the Murrieta California Tuition Payback Agreement serves as a mechanism to make higher education more accessible and affordable for students in the region. By providing options for deferred payment and income-based repayment, these agreements aim to alleviate the financial burden associated with pursuing education and ultimately help students achieve their academic and career goals.