Fullerton California Notice of Delinquent Assessments And Claim of Lien serves as an official document that notifies property owners in Fullerton, California about their outstanding assessments and the subsequent claim of lien on their property. This notice is crucial for property owners to understand their obligations and to take necessary actions to address the delinquency. The Fullerton California Notice of Delinquent Assessments And Claim of Lien contains essential information such as the property owner's name, address, and the specific property for which the assessments are overdue. It informs the property owner about the outstanding balance, including any additional penalties or interest that may have accrued due to non-payment. By issuing this notice, the relevant authority, such as the homeowners' association (HOA) or the local government, aims to bring the delinquency to the property owner's attention and request immediate payment or resolution. There are various types of Fullerton California Notice of Delinquent Assessments And Claim of Lien that can be issued depending on the nature of the assessments. Some common types include: 1. HOA Lien Notice: This notice is issued by the homeowners' association to inform property owners within a specific community or development about their delinquent assessments. It outlines the consequences of non-payment, which usually lead to a claim of lien on the property. 2. Municipal Lien Notice: This notice is issued by the local government, such as the city tax collector's office, for overdue assessments related to municipal services like water, sewer, or trash collection. It serves as a warning that failure to pay may result in a claim of lien on the property. 3. Special Assessment Lien Notice: This notice is sent in cases where additional assessments are imposed on property owners for specific purposes, such as infrastructure repairs, improvements, or community projects. The notice informs property owners of the delinquency and the potential claim of lien that may follow. 4. County Tax Lien Notice: This notice is issued by the county tax collector's office when property owners fail to pay property taxes. It alerts the property owner about the delinquent taxes and the possibility of a tax lien being placed on the property for non-payment. 5. Mechanic's Lien Notice: This notice is applicable in cases where a contractor or supplier has provided services or materials for construction or improvement projects on the property, and the property owner fails to pay for these services. The mechanic's lien notice alerts the property owner about the delinquency and the potential claim of lien by the contractor or supplier. It is crucial for property owners in Fullerton, California, to carefully review and respond to any Notice of Delinquent Assessments And Claim of Lien they receive to avoid further consequences such as foreclosure or legal action. Prompt actions to resolve the outstanding assessments are essential to protect their property rights and financial interests.

Fullerton California Notice of Delinquent Assessments And Claim of Lien

Category:

State:

California

City:

Fullerton

Control #:

CA-LR007T

Format:

Word;

Rich Text

Instant download

Description

This model form, a Notice of Delinquent Assessment by Governing Authorities, provides notice of the stated matter.

Fullerton California Notice of Delinquent Assessments And Claim of Lien serves as an official document that notifies property owners in Fullerton, California about their outstanding assessments and the subsequent claim of lien on their property. This notice is crucial for property owners to understand their obligations and to take necessary actions to address the delinquency. The Fullerton California Notice of Delinquent Assessments And Claim of Lien contains essential information such as the property owner's name, address, and the specific property for which the assessments are overdue. It informs the property owner about the outstanding balance, including any additional penalties or interest that may have accrued due to non-payment. By issuing this notice, the relevant authority, such as the homeowners' association (HOA) or the local government, aims to bring the delinquency to the property owner's attention and request immediate payment or resolution. There are various types of Fullerton California Notice of Delinquent Assessments And Claim of Lien that can be issued depending on the nature of the assessments. Some common types include: 1. HOA Lien Notice: This notice is issued by the homeowners' association to inform property owners within a specific community or development about their delinquent assessments. It outlines the consequences of non-payment, which usually lead to a claim of lien on the property. 2. Municipal Lien Notice: This notice is issued by the local government, such as the city tax collector's office, for overdue assessments related to municipal services like water, sewer, or trash collection. It serves as a warning that failure to pay may result in a claim of lien on the property. 3. Special Assessment Lien Notice: This notice is sent in cases where additional assessments are imposed on property owners for specific purposes, such as infrastructure repairs, improvements, or community projects. The notice informs property owners of the delinquency and the potential claim of lien that may follow. 4. County Tax Lien Notice: This notice is issued by the county tax collector's office when property owners fail to pay property taxes. It alerts the property owner about the delinquent taxes and the possibility of a tax lien being placed on the property for non-payment. 5. Mechanic's Lien Notice: This notice is applicable in cases where a contractor or supplier has provided services or materials for construction or improvement projects on the property, and the property owner fails to pay for these services. The mechanic's lien notice alerts the property owner about the delinquency and the potential claim of lien by the contractor or supplier. It is crucial for property owners in Fullerton, California, to carefully review and respond to any Notice of Delinquent Assessments And Claim of Lien they receive to avoid further consequences such as foreclosure or legal action. Prompt actions to resolve the outstanding assessments are essential to protect their property rights and financial interests.

Free preview

How to fill out Fullerton California Notice Of Delinquent Assessments And Claim Of Lien?

If you’ve already utilized our service before, log in to your account and download the Fullerton California Notice of Delinquent Assessments And Claim of Lien on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple steps to get your document:

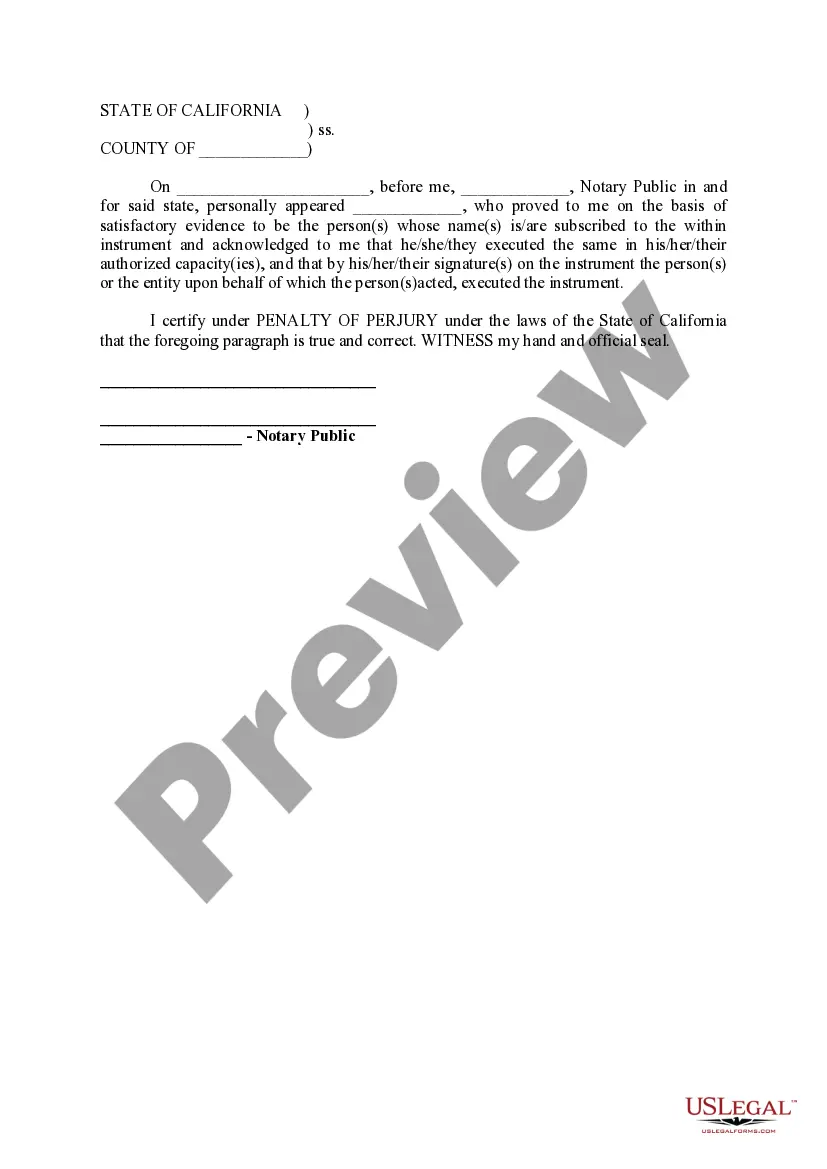

- Ensure you’ve found the right document. Read the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t fit you, utilize the Search tab above to get the proper one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Obtain your Fullerton California Notice of Delinquent Assessments And Claim of Lien. Select the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have bought: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly find and save any template for your individual or professional needs!