Title: Inglewood California Notice of Delinquent Assessments And Claim of Lien: Understanding the Process and Types Introduction: The Inglewood California Notice of Delinquent Assessments And Claim of Lien is an essential document in the property assessment and taxation system. This detailed description will clarify the purpose, process, and various types of this notice, ensuring homeowners, property owners, and interested individuals have a comprehensive understanding. 1. What is an Inglewood California Notice of Delinquent Assessments And Claim of Lien? The Inglewood California Notice of Delinquent Assessments And Claim of Lien is a legal instrument used to notify property owners about unpaid assessments, such as property taxes, special assessments, or homeowners association (HOA) fees. It aims to inform property owners of an imminent lien against their property due to the outstanding debt. 2. Purpose and Importance of the Notice: The primary purpose of the Inglewood California Notice of Delinquent Assessments And Claim of Lien is to legally notify property owners about their unpaid assessments, ensuring they are aware of the consequences and initiating the lien process. It establishes a timeline for the property owners to take necessary actions and settle their outstanding debts to avoid further complications. 3. Process of Issuing the Notice: When a property owner becomes delinquent on their assessments, the respective assessing agency, tax collector, or HOA begins the process of issuing the Inglewood California Notice of Delinquent Assessments And Claim of Lien. This involves preparing a comprehensive statement outlining the delinquent amounts, identifying the property, and serving the notice to the property owner by mail or personal delivery. 4. Different Types of Inglewood California Notice of Delinquent Assessments And Claim of Lien: a) Property Tax Lien: Used when a property owner fails to pay property taxes, the notice informs the owner about the outstanding amount, penalties, interest, and initiates the process of placing a lien on the property. b) Special Assessment Lien: This notice is issued when a property owner fails to pay special assessments, such as district assessments or improvement taxes, levied to fund infrastructure or public projects. It alerts the owner about the outstanding amount and the impending lien. c) Homeowners Association (HOA) Lien: In the case of a homeowner's association, this notice is sent when a property owner fails to pay their HOA dues. It informs about the delinquency, any penalties or late fees, and the initiation of the lien process. d) Repair and Maintenance Lien: When a government agency or municipality performs repairs or maintenance on a property, and the property owner fails to reimburse the costs, a notice is issued indicating the outstanding debt and the potential lien against the property. Conclusion: Understanding the Inglewood California Notice of Delinquent Assessments And Claim of Lien is crucial for property owners to protect their interests and avoid legal complications. By familiarizing themselves with the process and various types of liens, property owners can take timely action to resolve outstanding assessments and prevent the attachment of a lien on their property.

Inglewood California Notice of Delinquent Assessments And Claim of Lien

Description

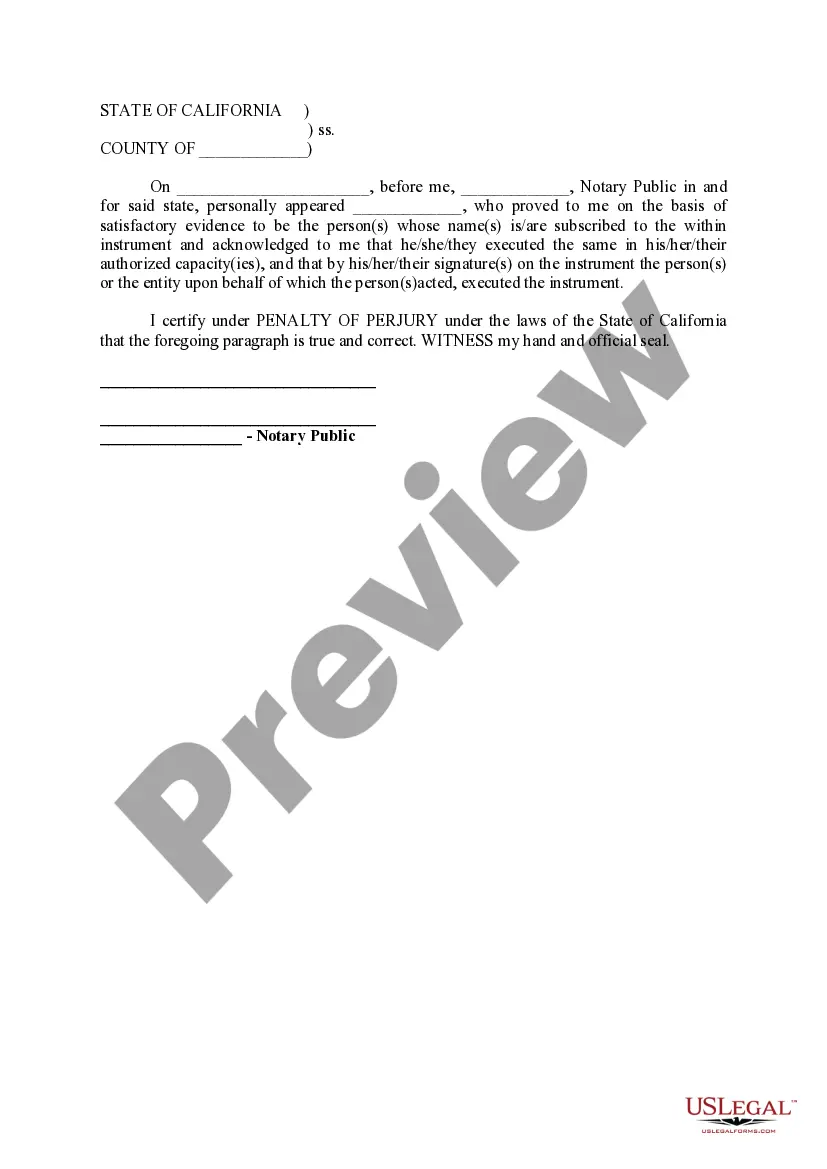

How to fill out Inglewood California Notice Of Delinquent Assessments And Claim Of Lien?

Do you need a reliable and affordable legal forms supplier to buy the Inglewood California Notice of Delinquent Assessments And Claim of Lien? US Legal Forms is your go-to solution.

Whether you require a basic arrangement to set regulations for cohabitating with your partner or a set of forms to move your separation or divorce through the court, we got you covered. Our website provides more than 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t generic and frameworked based on the requirements of specific state and county.

To download the form, you need to log in account, locate the required form, and hit the Download button next to it. Please keep in mind that you can download your previously purchased form templates anytime in the My Forms tab.

Is the first time you visit our website? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Find out if the Inglewood California Notice of Delinquent Assessments And Claim of Lien conforms to the laws of your state and local area.

- Read the form’s details (if provided) to learn who and what the form is good for.

- Start the search over if the form isn’t good for your specific situation.

Now you can register your account. Then select the subscription option and proceed to payment. As soon as the payment is done, download the Inglewood California Notice of Delinquent Assessments And Claim of Lien in any provided file format. You can get back to the website at any time and redownload the form free of charge.

Finding up-to-date legal forms has never been easier. Give US Legal Forms a try now, and forget about spending hours researching legal paperwork online for good.