Keyword: Palmdale California Notice of Delinquent Assessments And Claim of Lien The Palmdale California Notice of Delinquent Assessments And Claim of Lien is a legal document issued by the Palmdale County Tax Collector's Office to notify property owners of their outstanding assessments that have not been paid on time. This notice serves as a warning that failure to settle these delinquent assessments may result in a claim of lien placed against the property. The purpose of the Palmdale California Notice of Delinquent Assessments And Claim of Lien is to inform property owners of the consequences of not fulfilling their financial obligations related to assessments. It serves as a means to recoup the outstanding balance of assessments owed by the property owner. There are several types of Palmdale California Notice of Delinquent Assessments And Claim of Lien, including: 1. Annual Assessment Lien: This occurs when property owners fail to pay their annual assessments that are levied to cover the costs of community services and amenities provided by the homeowner's association or local municipality. These assessments may include fees for maintenance, landscaping, recreational facilities, and utilities. 2. Special Assessment Lien: This type of lien is imposed when property owners fail to pay special assessments that are levied for specific projects or improvements within a community. These may include road repairs, street lighting installations, or infrastructure enhancements. 3. Property Tax Lien: In Palmdale, property taxes are assessed based on the value of the property. Failure to pay property taxes can result in a tax lien being placed against the property. This lien is enforced by the county tax collector's office and can lead to eventual foreclosure if the taxes remain unpaid. It is important for property owners to take the Palmdale California Notice of Delinquent Assessments And Claim of Lien seriously and take immediate action to resolve the outstanding balance. Ignoring this notice can lead to further legal consequences, such as additional penalties, interest charges, or even the potential loss of the property. Property owners who receive a Palmdale California Notice of Delinquent Assessments And Claim of Lien should contact the appropriate department or agency mentioned in the notice to discuss payment options, request a payment plan, or seek clarification on the outstanding assessments. Resolving the delinquency promptly can help prevent the situation from escalating and protect the property owner's rights and interests.

Palmdale California Notice of Delinquent Assessments And Claim of Lien

Description

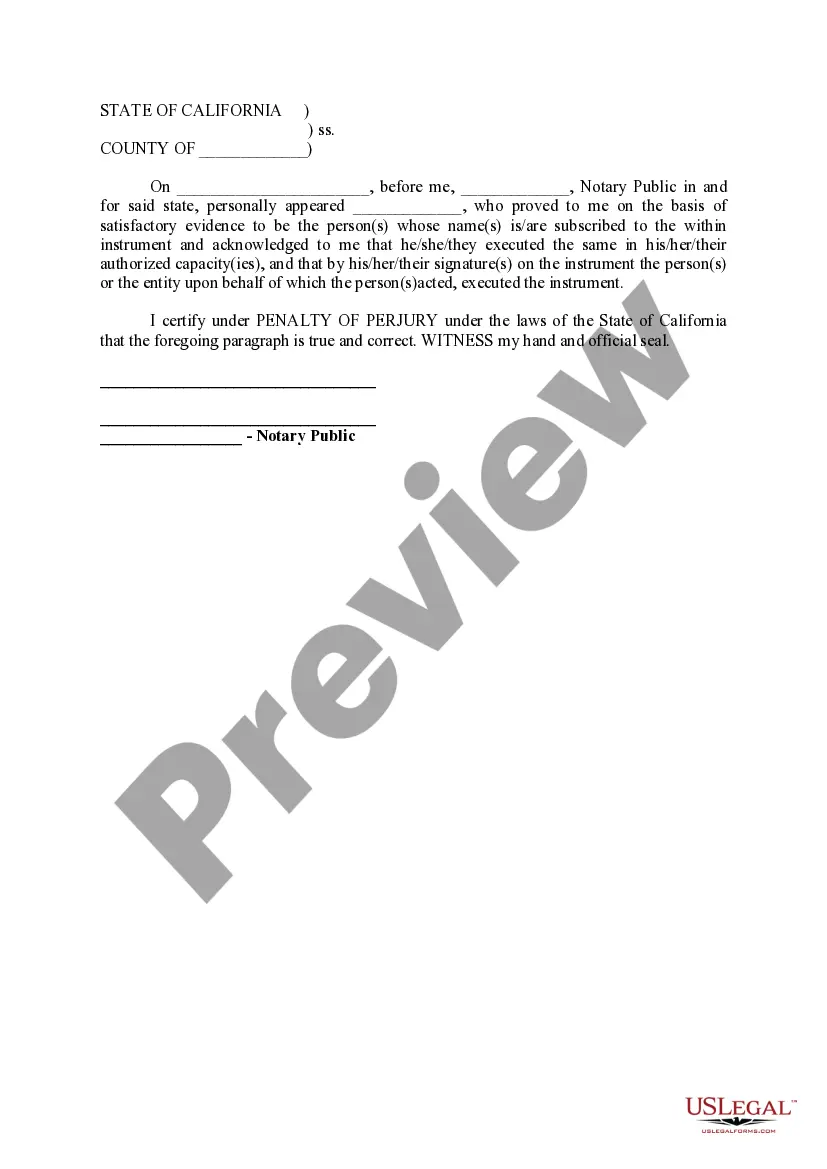

How to fill out Palmdale California Notice Of Delinquent Assessments And Claim Of Lien?

If you are in search of a legitimate document, it’s challenging to discover a superior service than the US Legal Forms site – one of the most comprehensive repositories available online.

With this repository, you are able to locate an extensive variety of document samples for both commercial and personal uses categorized by types and locations, or keywords.

With the enhanced search functionality, locating the latest Palmdale California Notice of Delinquent Assessments And Claim of Lien is as simple as 1-2-3.

Complete the acquisition. Use your credit card or PayPal account to finalize the registration process.

Receive the document. Select the file format and download it to your device. Edit the document. Complete, modify, print, and sign the obtained Palmdale California Notice of Delinquent Assessments And Claim of Lien.

- Moreover, each file's relevance is assured by a team of experienced attorneys who regularly review the templates on our site and update them in accordance with the latest state and county laws.

- If you are already acquainted with our platform and possess a registered account, all you need to obtain the Palmdale California Notice of Delinquent Assessments And Claim of Lien is to Log In to your user profile and click the Download button.

- If this is your initial experience with US Legal Forms, simply adhere to the instructions listed below.

- Ensure you have selected the document you desire. Review its description and utilize the Preview function (if accessible) to inspect its content. If it doesn’t meet your requirements, use the Search feature at the top of the page to find the suitable record.

- Validate your selection. Choose the Buy now option. After that, select your desired subscription plan and provide the necessary information to register for an account.

Form popularity

FAQ

A delinquent lien refers to a legal claim on a property due to unpaid debts, such as taxes or assessments. This lien becomes a formal notice, often documented in a Palmdale California Notice of Delinquent Assessments And Claim of Lien, indicating that payment is overdue. These liens can lead to severe consequences if not addressed, making it important to act swiftly. Utilizing resources like uslegalforms can help you understand and resolve these issues effectively.

A lien can negatively impact your credit score, signaling to lenders that you defaulted on a debt. It is essential to understand that a Palmdale California Notice of Delinquent Assessments And Claim of Lien can remain on your credit report for several years, which may affect your ability to secure loans. Proactively resolving your debts can mitigate this impact, and tools like uslegalforms can assist you in navigating the process.

A lien can present challenges, especially regarding your property rights. However, it is essential to understand that a lien may also symbolize an unpaid debt that needs resolution. In the context of a Palmdale California Notice of Delinquent Assessments And Claim of Lien, it serves a legal purpose, but it is crucial to address it promptly. Ignoring it can lead to further complications.

HOAs have considerable authority because they enforce community standards and manage shared resources. Their power stems from the governing documents that homeowners agree to when purchasing property within the association. This includes the ability to place liens for delinquent assessments, such as those described in the Palmdale California Notice of Delinquent Assessments And Claim of Lien. As a homeowner, it is essential to understand these dynamics to navigate your rights and responsibilities effectively.

A lien HOA refers to a legal claim placed by a homeowners association on a property due to unpaid dues or assessments. This claim allows the association to secure payments for any delinquent assessments. Essentially, it serves as a warning to potential buyers and lenders about the outstanding obligations. Understanding the implications of a lien, such as the Palmdale California Notice of Delinquent Assessments And Claim of Lien, is crucial for property owners.

Filing an HOA lien involves several steps to protect your interests. First, ensure that the claim aligns with the guidelines of your community. You typically need to provide documentation showing the delinquent assessments. For clarity and to preserve your rights, you may consider utilizing the Palmdale California Notice of Delinquent Assessments And Claim of Lien through platforms like uslegalforms.

Delinquent assessment means that a property owner is behind on their financial obligations to their homeowner's association. This situation can lead to the issuance of the Palmdale California Notice of Delinquent Assessments And Claim of Lien if the debt remains unpaid. It's essential for homeowners to address these assessments promptly to avoid further legal complications and potential loss of property rights.

A notice of late assessment serves to inform homeowners that their payments to the HOA are overdue. This document typically includes details about the amount owed, any late fees, and potential repercussions for not settling the debt. If you receive a notice related to the Palmdale California Notice of Delinquent Assessments And Claim of Lien, it is vital to address it promptly to avoid additional penalties.

A delinquent assessment statement is a document that outlines unpaid amounts owed by property owners within a community. This statement indicates that an owner has not made their required payments to the homeowner's association (HOA) in a timely manner. Understanding this statement is crucial, especially in relation to the Palmdale California Notice of Delinquent Assessments And Claim of Lien, as it can lead to further legal action.