The Rialto California Notice of Delinquent Assessments and Claim of Lien is an official document important for property owners in Rialto, California. This notice indicates that an individual or entity is behind on their mandatory assessments and owes delinquent payments to a homeowners' association (HOA) or similar entity. When the HOA attempts to collect these overdue assessments, they may file a Claim of Lien against the property, conveying a legal interest in it as collateral until the debt is settled. In Rialto, there are different types of Notice of Delinquent Assessments and Claim of Lien, including: 1. Residential Property Delinquent Assessments and Claim of Lien: This type of notice is issued when a homeowner fails to fulfill their financial obligations to the HOA or association responsible for maintaining the residential property and its shared amenities. Common reasons for delinquency include failure to pay monthly, quarterly, or annual assessments, fines, and fees. 2. Commercial Property Delinquent Assessments and Claim of Lien: This notice applies to owners of commercial properties, such as office buildings, retail spaces, or industrial units, who have failed to meet their financial obligations to the relevant HOA or property management company. The delinquent assessments can be tied to the maintenance and management of common areas, security services, or other shared expenses crucial for the functioning of the commercial property. 3. Condominium Delinquent Assessments and Claim of Lien: Condominium owners in Rialto may receive this type of notice if they fall behind on paying their association fees, special assessments, or other financial obligations. The Condominium Delinquent Assessments and Claim of Lien ensure that the condominium association can secure the outstanding debt against the respective unit. 4. Homeowners Association (HOA) Delinquent Assessments and Claim of Lien: This notice is issued to homeowners who have failed to pay their mandatory assessments and dues to the HOA responsible for managing the community in which their property is located. It is applicable to both residential and commercial properties falling under the jurisdiction of an HOA. Property owners in Rialto, California should take the Rialto California Notice of Delinquent Assessments and Claim of Lien seriously, as it signifies potential legal consequences. Failure to resolve the delinquency within a specific timeframe can lead to the foreclosure of the property, additional fines, penalties, and even damage to one's credit score. It is of utmost importance for property owners to address these notices promptly, either by paying the outstanding assessments or by negotiating a payment plan with the respective HOA or association.

Rialto California Notice of Delinquent Assessments And Claim of Lien

Description

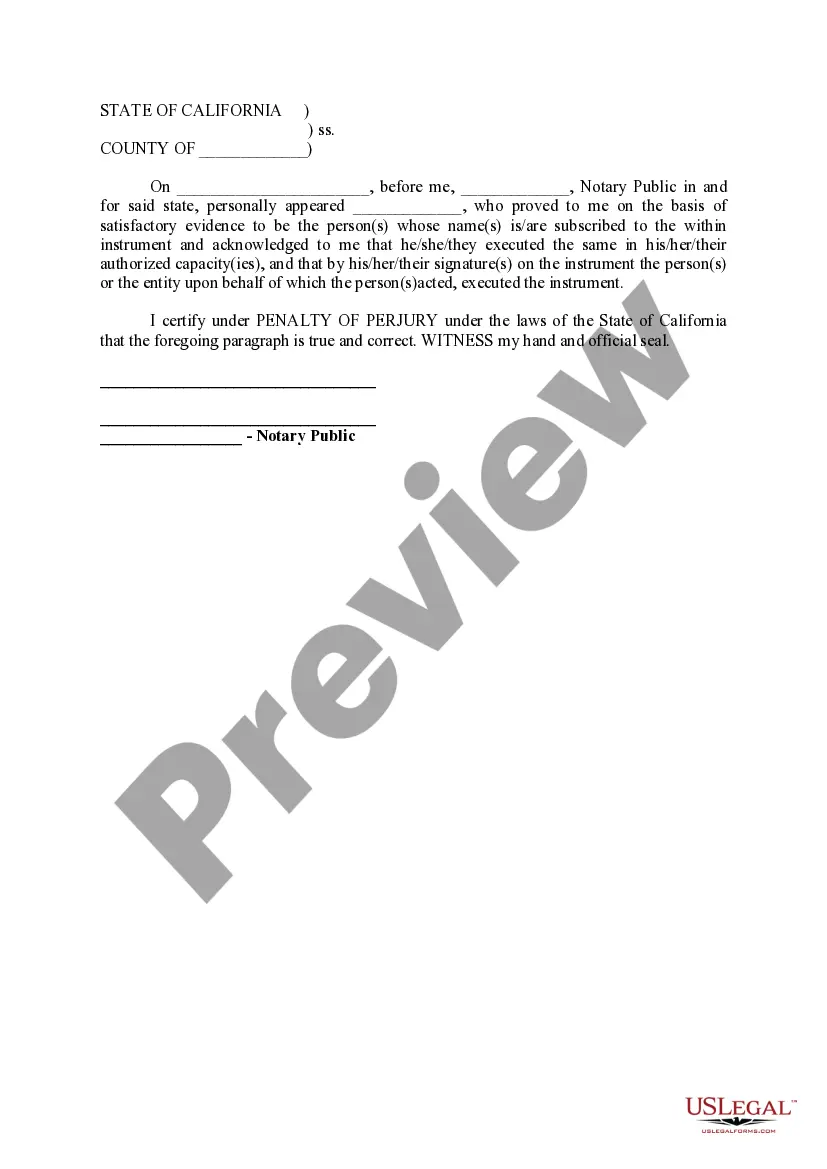

How to fill out Rialto California Notice Of Delinquent Assessments And Claim Of Lien?

Do you need a reliable and affordable legal forms supplier to get the Rialto California Notice of Delinquent Assessments And Claim of Lien? US Legal Forms is your go-to solution.

Whether you need a simple arrangement to set rules for cohabitating with your partner or a package of documents to advance your separation or divorce through the court, we got you covered. Our platform offers more than 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t universal and framed in accordance with the requirements of particular state and county.

To download the document, you need to log in account, find the needed template, and hit the Download button next to it. Please remember that you can download your previously purchased form templates at any time in the My Forms tab.

Are you new to our website? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Find out if the Rialto California Notice of Delinquent Assessments And Claim of Lien conforms to the regulations of your state and local area.

- Go through the form’s description (if available) to find out who and what the document is good for.

- Restart the search if the template isn’t suitable for your legal situation.

Now you can create your account. Then choose the subscription option and proceed to payment. As soon as the payment is done, download the Rialto California Notice of Delinquent Assessments And Claim of Lien in any available format. You can get back to the website at any time and redownload the document free of charge.

Finding up-to-date legal documents has never been easier. Give US Legal Forms a go now, and forget about spending your valuable time researching legal papers online for good.

Form popularity

FAQ

HOA Foreclosure Limitations California law limits the HOA's ability to foreclose in some circumstances. The HOA can't foreclose unless: the delinquent amount is $1,800 or more, not including any accelerated assessments, late charges, fees and costs of collection, attorneys' fees, or interest, or.

Pay the Full Amount The simplest way to stop an HOA from foreclosing is to make a lump-sum payment of all overdue assessments, plus interest, late fees, attorneys' fees, and costs. In practice, though, paying the full amount isn't often a viable option for homeowners who are significantly behind in assessments.

An HOA lien is usually subordinate to a first mortgage because the lien is recorded after the mortgage, or the terms of the CC&Rs or state laws make the lien junior to the mortgage. As such, the lien will usually remain on the property following an HOA's foreclosure.

That usually means you won't be able to use community amenities, such as the clubhouse, the pool, and the gym. It doesn't just stop there. The HOA board can even take it one step further and revoke your right to vote on issues concerning the community until you're fully paid.

Assessment Liens and Foreclosure A property owners' association can foreclose on the lien and trigger the sale of the property. The ability to create assessment liens is a power that is not automatically granted by Texas law. It must be specifically stated in the Declaration of Covenants, Conditions, and Restrictions.

While regulations can vary from state to state, most agree the owner of the property handles any dues. That would mean if a bank puts the property in its name upon foreclosure, the bank would be responsible for dues from that point on. When the bank sells the property, it can recover those fees from the new owner.

The recording of a Notice of State Tax Lien must take place within 10 years of the date the lien arose. The recorded lien is valid for 10 years and may be extended in 10 year increments. The EDD's lien is enforceable for all obligations which exist against the owner of the property.

If you fail to pay your HOA fees in California, the association can get a lien on your property and might foreclose on your home.

If you fail to pay your HOA fees in California, the association can get a lien on your property and might foreclose on your home.