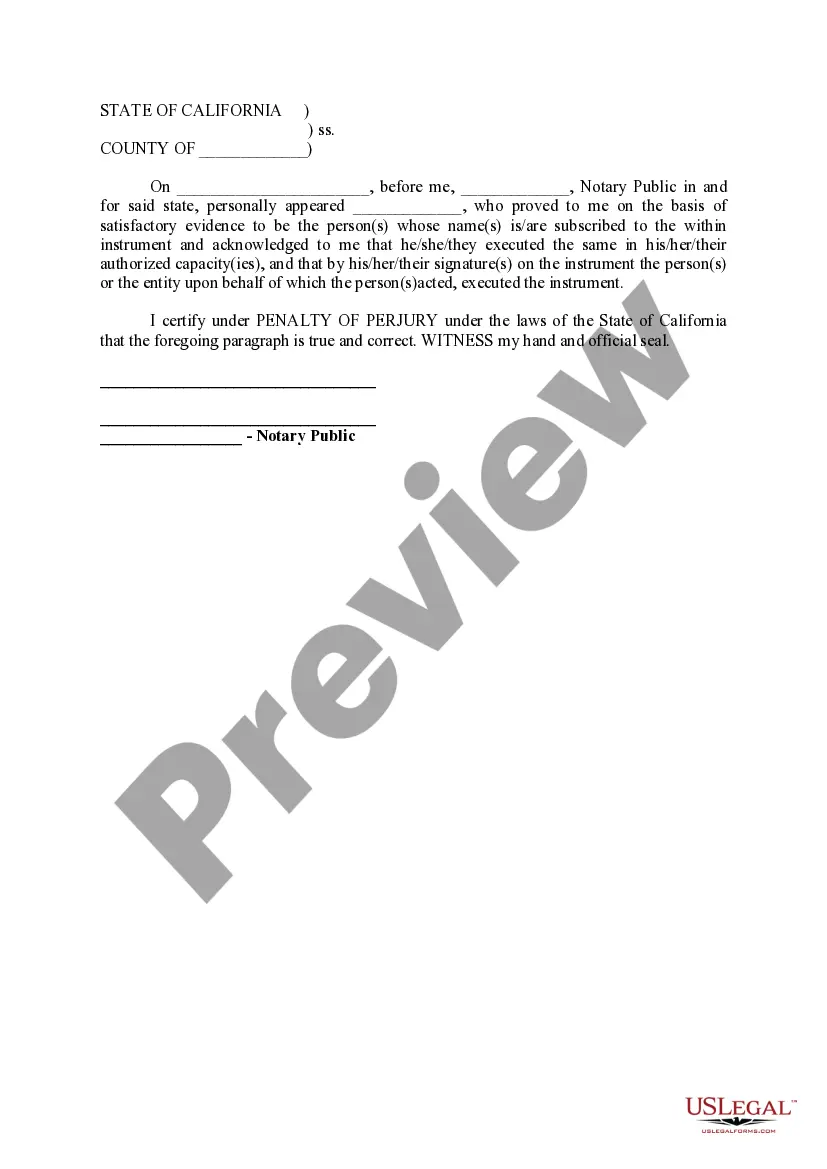

In San Diego, California, the Notice of Delinquent Assessments and Claim of Lien is an important legal document used by homeowners associations (Has) to address unpaid assessments by property owners. This notice serves as a formal communication to inform property owners about their outstanding dues and the potential consequences of non-payment. The San Diego County Notice of Delinquent Assessments and Claim of Lien is a specific type of notice that relates to a property's unpaid assessments. It is governed by California Civil Code Section 5675 and is commonly used by Has to ensure the collection of fees necessary for the maintenance and operation of shared community amenities, like recreational areas, parks, or common infrastructure. This notice includes relevant keywords such as "San Diego," "California," "Notice of Delinquent Assessments," "Claim of Lien," and "Property Owners Association" to provide a clear overview of its purpose and significance. It is crucial for property owners to understand the implications of receiving such a notice. There are different variations of the San Diego California Notice of Delinquent Assessments and Claim of Lien, which may vary based on specific California HOA laws and regulations, as well as the individual HOA's governing documents. These variations may include specific formatting requirements, mandatory contact or payment information, and deadlines to rectify the unpaid assessments. This notice is typically sent to property owners who have failed to pay their regular assessments or special assessments within a specified period. Upon receipt of the notice, the property owner is notified of the delinquent status of their account, the amount owed, any additional late fees or penalties, and the impending consequences if the dues remain unpaid. The Notice of Delinquent Assessments and Claim of Lien aims to inform property owners that if they fail to settle their outstanding assessments, the HOA has the legal right to file a lien against the property. This means that the HOA can claim a legal interest in the property, which can adversely impact the property owner's ability to sell or refinance the property until the outstanding fees and expenses are paid. It is crucial for property owners to take prompt action upon receipt of this notice to avoid further complications and potential legal actions. They should review the notice thoroughly, contact the HOA to gather accurate information and discuss possible resolutions, and aim to settle the outstanding dues as soon as possible to prevent the HOA from pursuing stronger collection methods such as foreclosure. In conclusion, the San Diego California Notice of Delinquent Assessments and Claim of Lien serves as a crucial instrument for Has in San Diego County to address overdue assessments from property owners. By providing relevant information and outlining the consequences of non-payment, this notice plays a key role in maintaining the financial stability and well-being of the community.

San Diego California Notice of Delinquent Assessments And Claim of Lien

Description

How to fill out San Diego California Notice Of Delinquent Assessments And Claim Of Lien?

We always want to minimize or prevent legal issues when dealing with nuanced law-related or financial matters. To do so, we apply for legal solutions that, usually, are extremely costly. However, not all legal issues are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is a web-based collection of up-to-date DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your matters into your own hands without the need of using services of legal counsel. We offer access to legal document templates that aren’t always openly accessible. Our templates are state- and area-specific, which significantly facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the San Diego California Notice of Delinquent Assessments And Claim of Lien or any other document quickly and safely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always re-download it from within the My Forms tab.

The process is equally straightforward if you’re new to the platform! You can create your account within minutes.

- Make sure to check if the San Diego California Notice of Delinquent Assessments And Claim of Lien complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s description (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve made sure that the San Diego California Notice of Delinquent Assessments And Claim of Lien is suitable for you, you can select the subscription option and make a payment.

- Then you can download the document in any suitable file format.

For more than 24 years of our existence, we’ve helped millions of people by providing ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save time and resources!