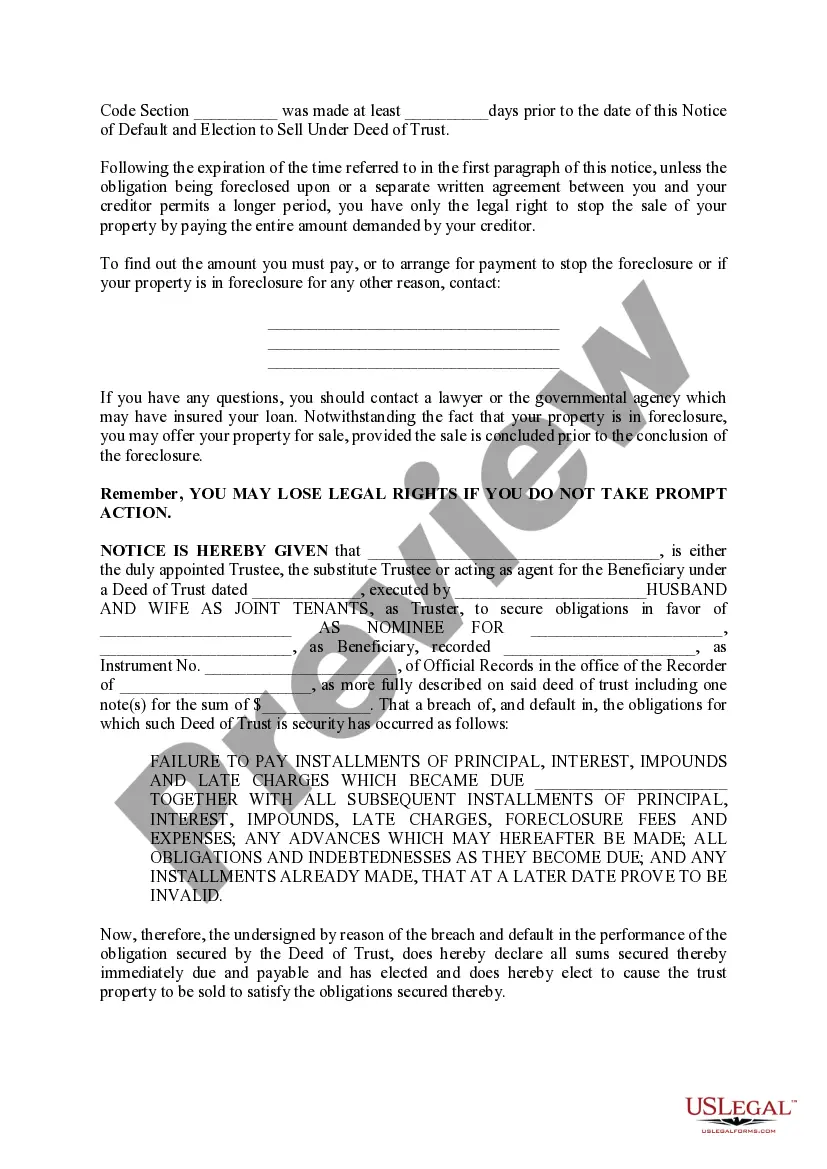

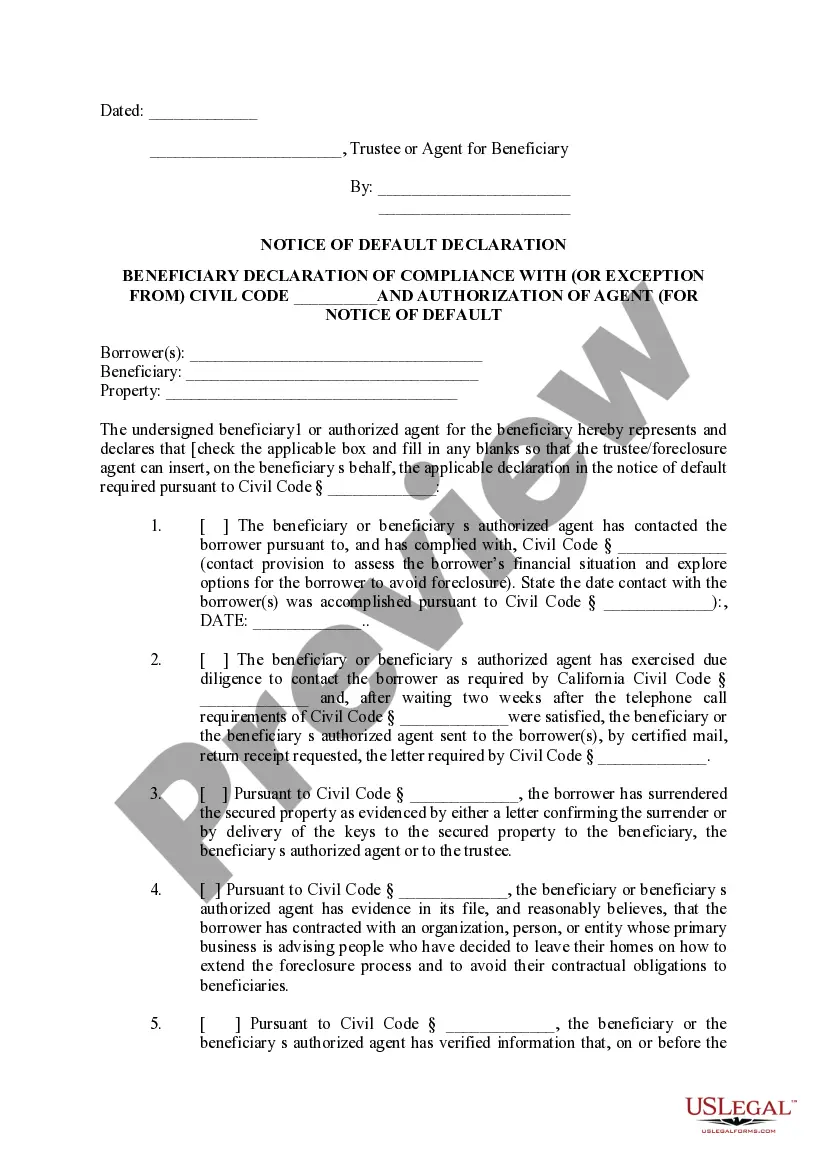

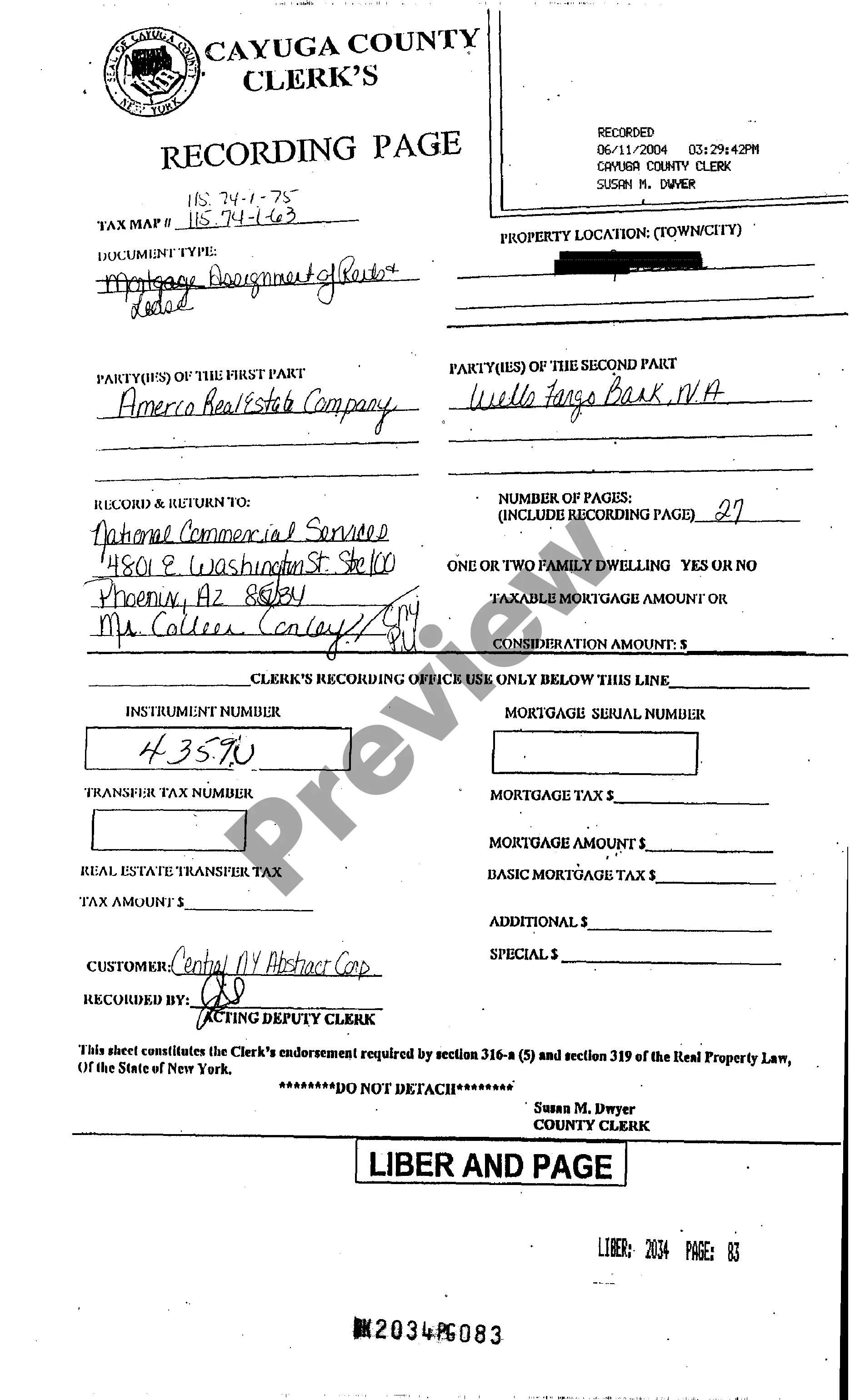

Irvine California Notice of Default and Election to Sell Under Deed of Trust is a legal document that signifies a borrower's failure to make timely mortgage payments or fulfill their obligations under a deed of trust in Irvine, California. This notice is a crucial step in the foreclosure process initiated by the lender or trustee, indicating their intent to sell the property. In Irvine, California, there are two primary types of Notice of Default and Election to Sell Under Deed of Trust: 1. Judicial Foreclosure: This type of foreclosure requires the lender or trustee to file a lawsuit against the borrower, resulting in a court-supervised sale of the property. Through a judicial foreclosure, the lender seeks to obtain a court order permitting the sale, which ultimately determines the property's fair market value. 2. Non-Judicial Foreclosure: Most foreclosures in California, including Irvine, follow a non-judicial process. Lenders or trustees can proceed with a non-judicial foreclosure when the deed of trust includes a power of sale clause. This clause grants them the authority to sell the property without court involvement, as long as specific legal requirements are met. As per the California Civil Code, the Notice of Default and Election to Sell Under Deed of Trust contains essential information, including: — Borrower's name and contact information — Lender's name and contacinformationio— - Trustee's name and contact information — The loan default amount (including missed payments, fees, and penalties) — Property description (address and legal description) — Recording information of the deed of trust — A statement declaring the borrower's right to cure the default by paying the outstanding amount within a specific timeframe — Details about the borrower's right to request a copy of the note and deed of trust — Contact information for the California Department of Business Oversight and the Bureau of Real Estate It is crucial for borrowers facing a Notice of Default and Election to Sell Under Deed of Trust to promptly seek legal advice to understand their rights, options, and potential consequences. They may have the opportunity to cure the default, renegotiate the terms, or explore alternatives to foreclosure, such as loan modifications or short sales. Handling a Notice of Default and Election to Sell Under Deed of Trust requires careful consideration and expert guidance to ensure the best possible outcome for all parties involved. Seek assistance from experienced real estate and foreclosure professionals to navigate this complex process successfully.

Irvine California Notice of Default and Election to Sell Under Deed of Trust is a legal document that signifies a borrower's failure to make timely mortgage payments or fulfill their obligations under a deed of trust in Irvine, California. This notice is a crucial step in the foreclosure process initiated by the lender or trustee, indicating their intent to sell the property. In Irvine, California, there are two primary types of Notice of Default and Election to Sell Under Deed of Trust: 1. Judicial Foreclosure: This type of foreclosure requires the lender or trustee to file a lawsuit against the borrower, resulting in a court-supervised sale of the property. Through a judicial foreclosure, the lender seeks to obtain a court order permitting the sale, which ultimately determines the property's fair market value. 2. Non-Judicial Foreclosure: Most foreclosures in California, including Irvine, follow a non-judicial process. Lenders or trustees can proceed with a non-judicial foreclosure when the deed of trust includes a power of sale clause. This clause grants them the authority to sell the property without court involvement, as long as specific legal requirements are met. As per the California Civil Code, the Notice of Default and Election to Sell Under Deed of Trust contains essential information, including: — Borrower's name and contact information — Lender's name and contacinformationio— - Trustee's name and contact information — The loan default amount (including missed payments, fees, and penalties) — Property description (address and legal description) — Recording information of the deed of trust — A statement declaring the borrower's right to cure the default by paying the outstanding amount within a specific timeframe — Details about the borrower's right to request a copy of the note and deed of trust — Contact information for the California Department of Business Oversight and the Bureau of Real Estate It is crucial for borrowers facing a Notice of Default and Election to Sell Under Deed of Trust to promptly seek legal advice to understand their rights, options, and potential consequences. They may have the opportunity to cure the default, renegotiate the terms, or explore alternatives to foreclosure, such as loan modifications or short sales. Handling a Notice of Default and Election to Sell Under Deed of Trust requires careful consideration and expert guidance to ensure the best possible outcome for all parties involved. Seek assistance from experienced real estate and foreclosure professionals to navigate this complex process successfully.