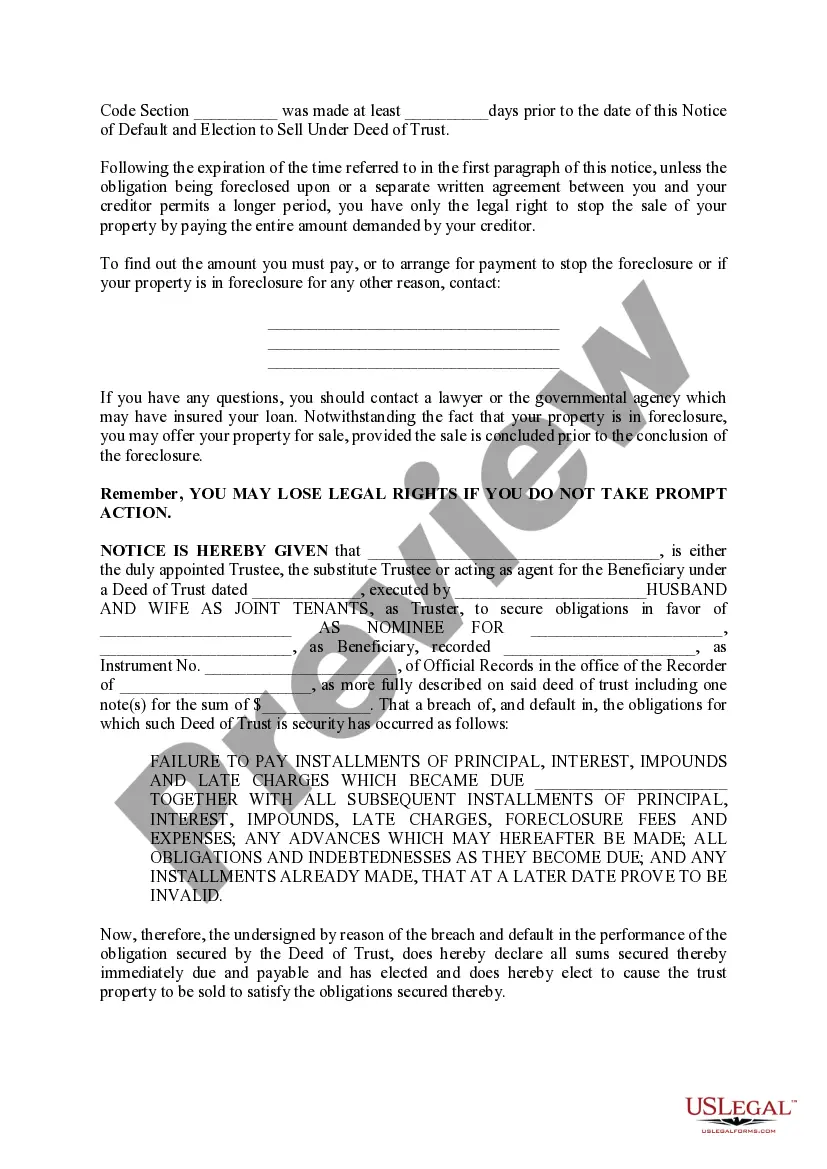

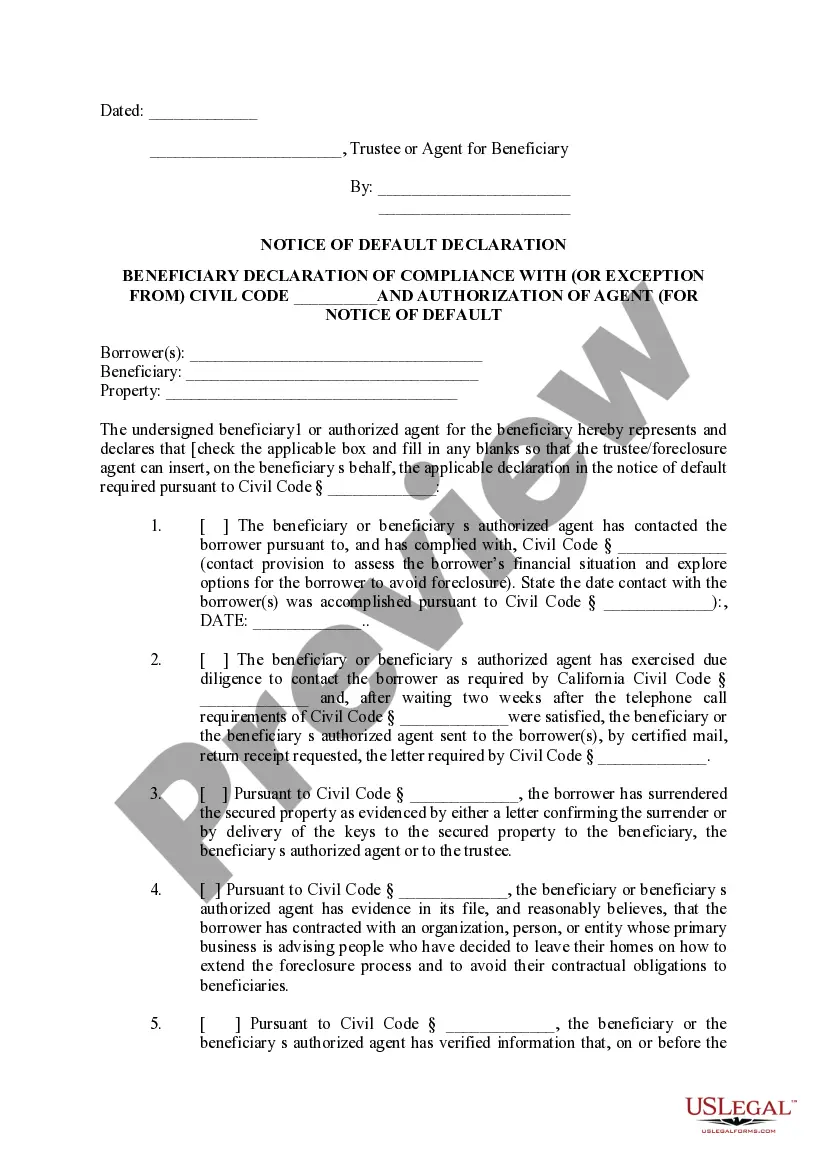

The Sunnyvale California Notice of Default and Election to Sell Under Deed of Trust is a legal document that indicates the initiation of foreclosure proceedings on a property in Sunnyvale, California. This notice is typically issued by the lender or mortgage holder when the borrower has failed to make timely mortgage payments or has violated other terms of their loan agreement. The Notice of Default serves as an official notice to the borrower that they are in default on their mortgage and that the lender intends to take necessary legal actions to recoup their investment. This document outlines the specific details of the default, including the overdue payments and any other applicable fees or charges. In accordance with California law, the Notice of Default must be properly recorded and served to all parties involved, including the borrower, co-borrowers, and any junior lien holders. This is a crucial step in the foreclosure process, as it provides the borrower with an opportunity to rectify the default and avoid foreclosure. Once the Notice of Default has been issued, a minimum statutory waiting period of 90 days is required before the lender can proceed with the next step, known as the Election to Sell Under Deed of Trust. This particular step signals the lender's decision to sell the property through a public auction or trustee sale. The auction allows potential buyers to bid on the property, with the highest bidder securing ownership. It's important to note that there may be different types of Sunnyvale California Notices of Default and Elections to Sell Under Deed of Trust, depending on the specific circumstances of the foreclosure. For example, there could be separate notices for residential and commercial properties, as well as distinctions for different stages of delinquency. In summary, the Sunnyvale California Notice of Default and Election to Sell Under Deed of Trust is a legal notification informing borrowers that they are in default on their mortgage and that the lender intends to proceed with foreclosure proceedings. This document initiates a minimum waiting period before the lender can proceed with the sale of the property. Understanding the implications of this notice is crucial for borrowers seeking to rectify their default and potentially prevent the loss of their property.

The Sunnyvale California Notice of Default and Election to Sell Under Deed of Trust is a legal document that indicates the initiation of foreclosure proceedings on a property in Sunnyvale, California. This notice is typically issued by the lender or mortgage holder when the borrower has failed to make timely mortgage payments or has violated other terms of their loan agreement. The Notice of Default serves as an official notice to the borrower that they are in default on their mortgage and that the lender intends to take necessary legal actions to recoup their investment. This document outlines the specific details of the default, including the overdue payments and any other applicable fees or charges. In accordance with California law, the Notice of Default must be properly recorded and served to all parties involved, including the borrower, co-borrowers, and any junior lien holders. This is a crucial step in the foreclosure process, as it provides the borrower with an opportunity to rectify the default and avoid foreclosure. Once the Notice of Default has been issued, a minimum statutory waiting period of 90 days is required before the lender can proceed with the next step, known as the Election to Sell Under Deed of Trust. This particular step signals the lender's decision to sell the property through a public auction or trustee sale. The auction allows potential buyers to bid on the property, with the highest bidder securing ownership. It's important to note that there may be different types of Sunnyvale California Notices of Default and Elections to Sell Under Deed of Trust, depending on the specific circumstances of the foreclosure. For example, there could be separate notices for residential and commercial properties, as well as distinctions for different stages of delinquency. In summary, the Sunnyvale California Notice of Default and Election to Sell Under Deed of Trust is a legal notification informing borrowers that they are in default on their mortgage and that the lender intends to proceed with foreclosure proceedings. This document initiates a minimum waiting period before the lender can proceed with the sale of the property. Understanding the implications of this notice is crucial for borrowers seeking to rectify their default and potentially prevent the loss of their property.