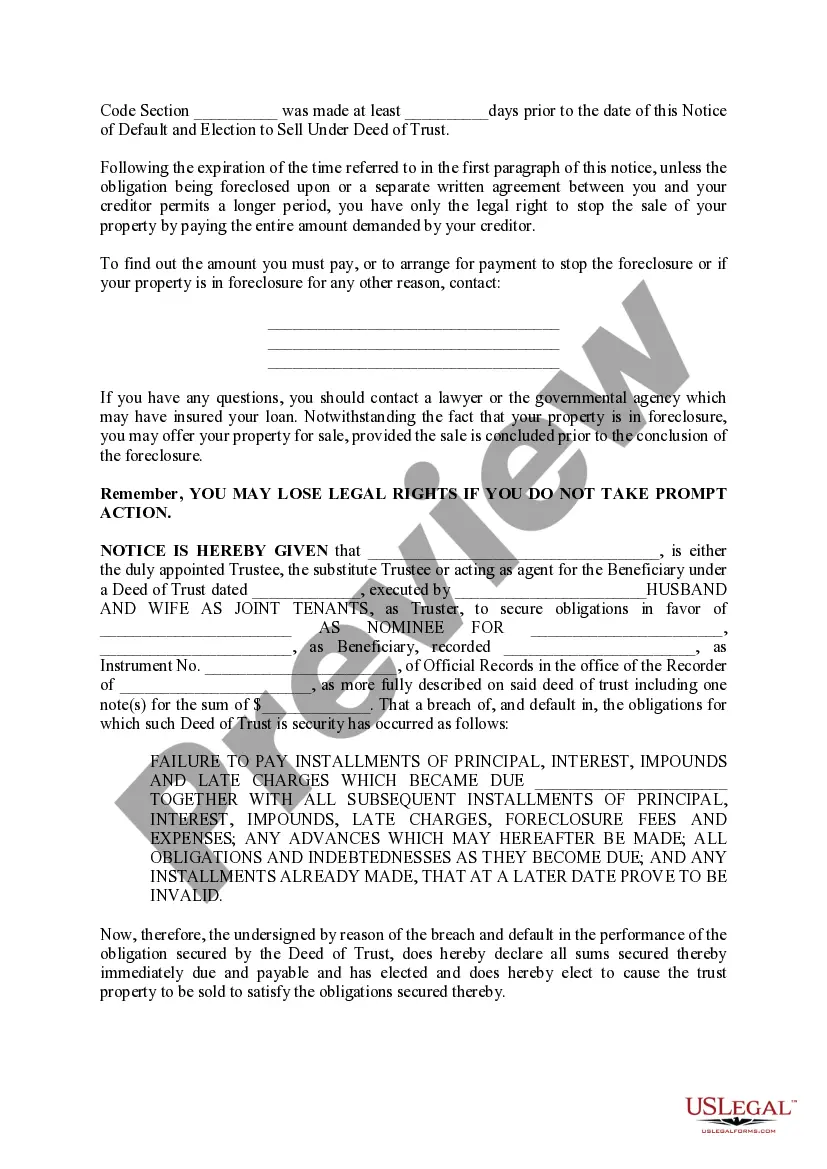

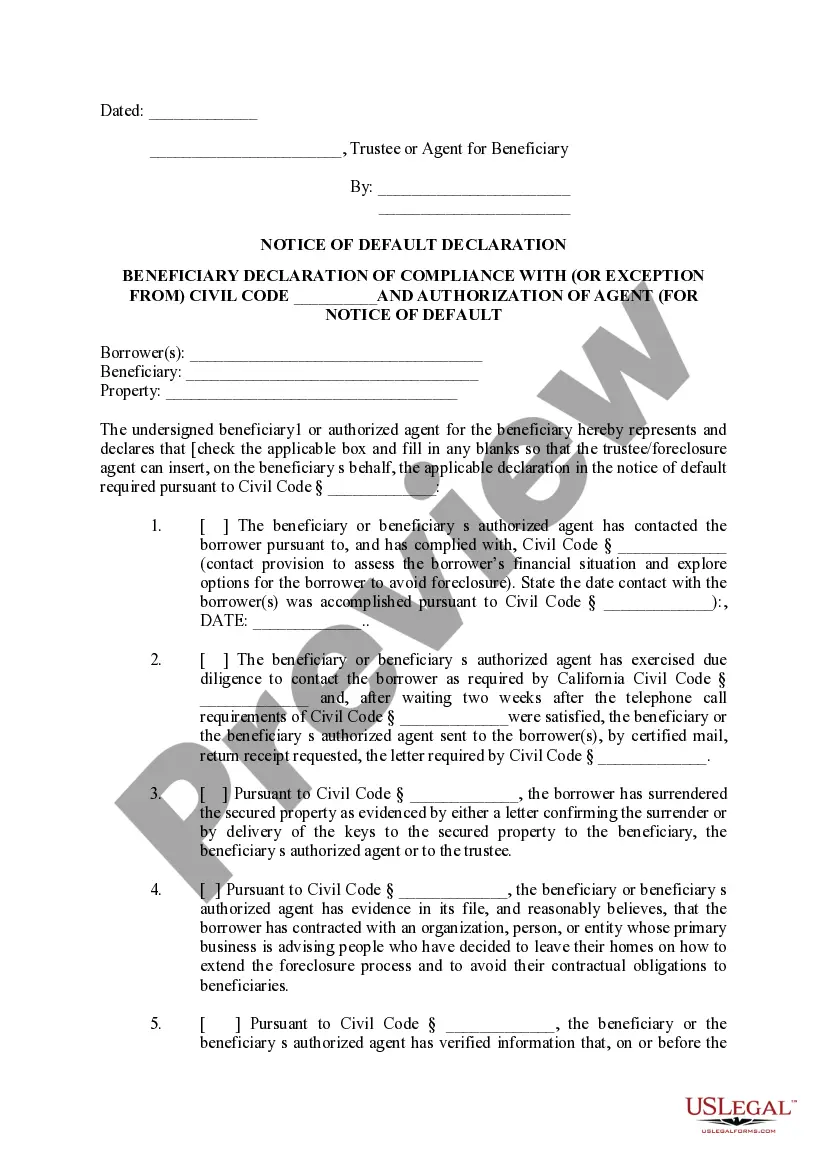

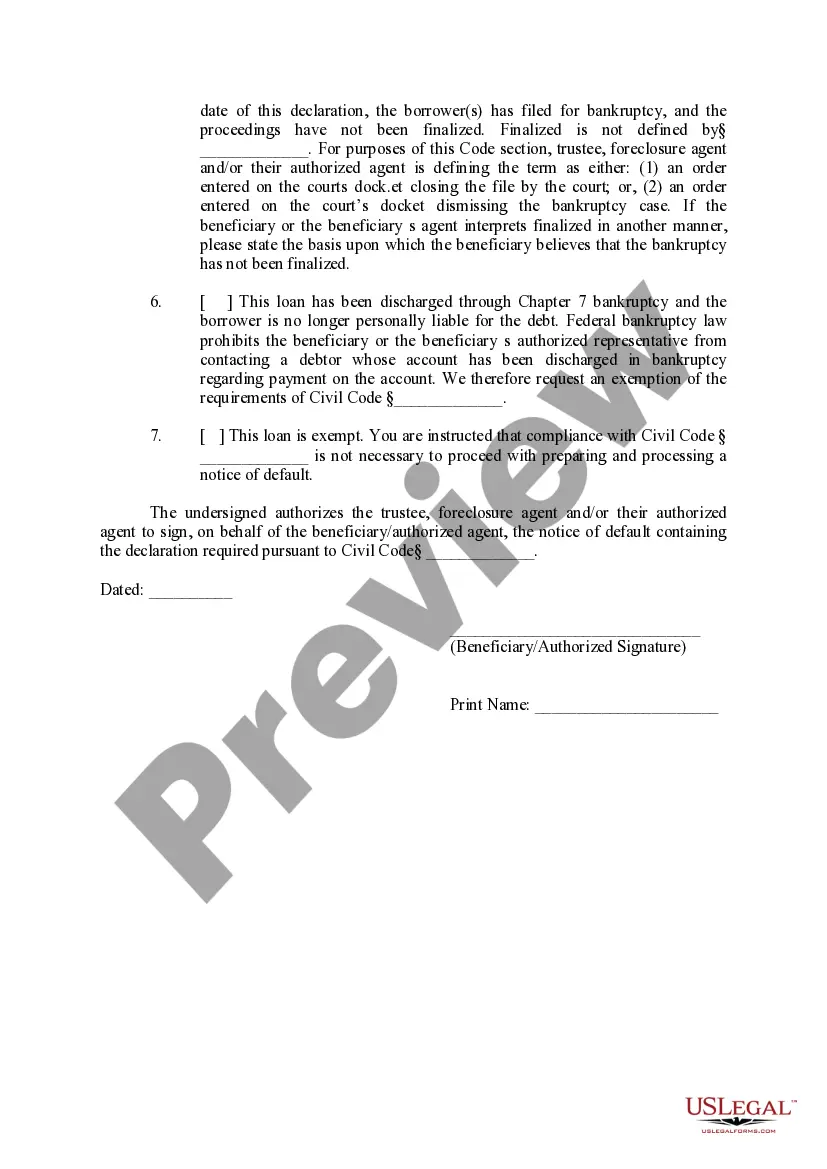

Vista California Notice of Default and Election to Sell Under Deed of Trust is a legal document that serves as a formal notice to a borrower when they have failed to meet their mortgage obligations. This notice is typically issued by the lender or trustee, and it initiates the foreclosure process on a property. Keywords: Vista California, Notice of Default, Election to Sell Under Deed of Trust, legal document, borrower, mortgage obligations, lender, trustee, foreclosure process, property. There are different types of Vista California Notice of Default and Election to Sell Under Deed of Trust, including: 1. Judicial foreclosure: In this type, the lender files a lawsuit against the borrower in order to obtain a court order to sell the property and recoup their investment. 2. Non-judicial foreclosure: This type is also known as a "power of sale" foreclosure. It allows the lender to sell the property without involving the court system, following the procedures specified in the deed of trust or mortgage. 3. Acceleration clause: This provision is included in some notices of default, stating that if the borrower does not cure the default within a specific timeframe, the entire loan balance becomes due immediately. 4. Reinstatement period: It is the timeframe given to the borrower to cure the default by paying all outstanding amounts, including missed payments, late fees, and any other relevant charges, in order to prevent foreclosure. 5. Trustee's sale: Once the notice of default has been filed and the reinstatement period has expired, the lender or trustee can proceed with the trustee's sale. This is an auction where the property is sold to the highest bidder. 6. Redemption period: In some cases, the borrower has a certain period of time after the trustee's sale to repurchase the property by paying off the outstanding debt, interest, and any additional costs incurred during the foreclosure process. 7. Deficiency judgment: If the proceeds from the trustee's sale do not cover the full amount owed, the lender may pursue a deficiency judgment against the borrower to collect the remaining debt. It is crucial for borrowers who have received a Vista California Notice of Default and Election to Sell Under Deed of Trust to seek legal advice promptly to understand their options and rights in order to potentially avoid foreclosure. Legal professionals can provide guidance on negotiating loan modifications, repayment plans, or exploring alternatives such as a short sale or deed in lieu of foreclosure.

Vista California Notice of Default and Election to Sell Under Deed of Trust

Description

How to fill out Vista California Notice Of Default And Election To Sell Under Deed Of Trust?

Finding verified templates specific to your local regulations can be challenging unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both personal and professional needs and any real-life scenarios. All the documents are properly grouped by area of usage and jurisdiction areas, so searching for the Vista California Notice of Default and Election to Sell Under Deed of Trust gets as quick and easy as ABC.

For everyone already familiar with our library and has used it before, obtaining the Vista California Notice of Default and Election to Sell Under Deed of Trust takes just a few clicks. All you need to do is log in to your account, select the document, and click Download to save it on your device. The process will take just a couple of more actions to complete for new users.

Adhere to the guidelines below to get started with the most extensive online form collection:

- Look at the Preview mode and form description. Make sure you’ve chosen the right one that meets your needs and totally corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you find any inconsistency, utilize the Search tab above to get the right one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the service.

- Download the Vista California Notice of Default and Election to Sell Under Deed of Trust. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Take advantage of the US Legal Forms library to always have essential document templates for any needs just at your hand!

Form popularity

FAQ

The Notice of Sale states that the trustee will sell your home at auction in 21 days. The Notice of Sale must: Be sent to you by certified mail. Be published weekly in a newspaper of general circulation in the county where your home is located for 3 consecutive weeks before the sale date.

You can stop the foreclosure process any time by bringing your payments current all the way up until 5 days before the sale. After that, it's up to the lender to decide if they want to accept payment or continue with foreclosure. You can however, payoff the entire amount all the way up until the point of the sale.

When a deed of trust is foreclosed by court sale, the action: Would allow the trustor a redemption period; A trustee has legally begun the process to sell property secured by a trust deed.

Once a lender files the notice of default, the next step is to hold a hearing to activate the lien recorded with the mortgage. The hearing allows the borrower to negotiate with the lender by suggesting a settlement plan for the defaulted payments and legal fees.

NOTICE OF DEFAULT/SALE If the borrower defaults, the lender can foreclose (force a sale) of the property to get paid. The lender's first step towards a foreclosure is to record and mail the borrower by certified mail a Notice of Default, sometimes titled Notice of Default and Election to Sell.

In states that allow the use of a deed of trust as opposed to a mortgage agreement, most homes are foreclosed through a process called non-judicial foreclosure. Non-judicial foreclosure, as the name implies, occurs outside of the court system, and is usually much faster and cheaper than judicial foreclosure.

judicial foreclosure usually takes a minimum of 121 days in California (in the actual foreclosure process), or less than 4 months from start to finish, but the formal foreclosure process will not begin until you are in default for at least 3 months.

After you've received a Notice of Default, you have 3 months in which to attempt to get your loan current. As mentioned above, that means paying all back payments, interest, fees, property taxes, and insurance. After 3 months, the bank can officially set a date for the auction of your home.

1) A D.O.T. is much easier to foreclose upon then a mortgage because the process to foreclose on a D.O.T. bypasses the judicial process. Assuming the Trustee gives the right notices (Notice of Default and Notice of Sale) the process will go to sale without court involvement at all.

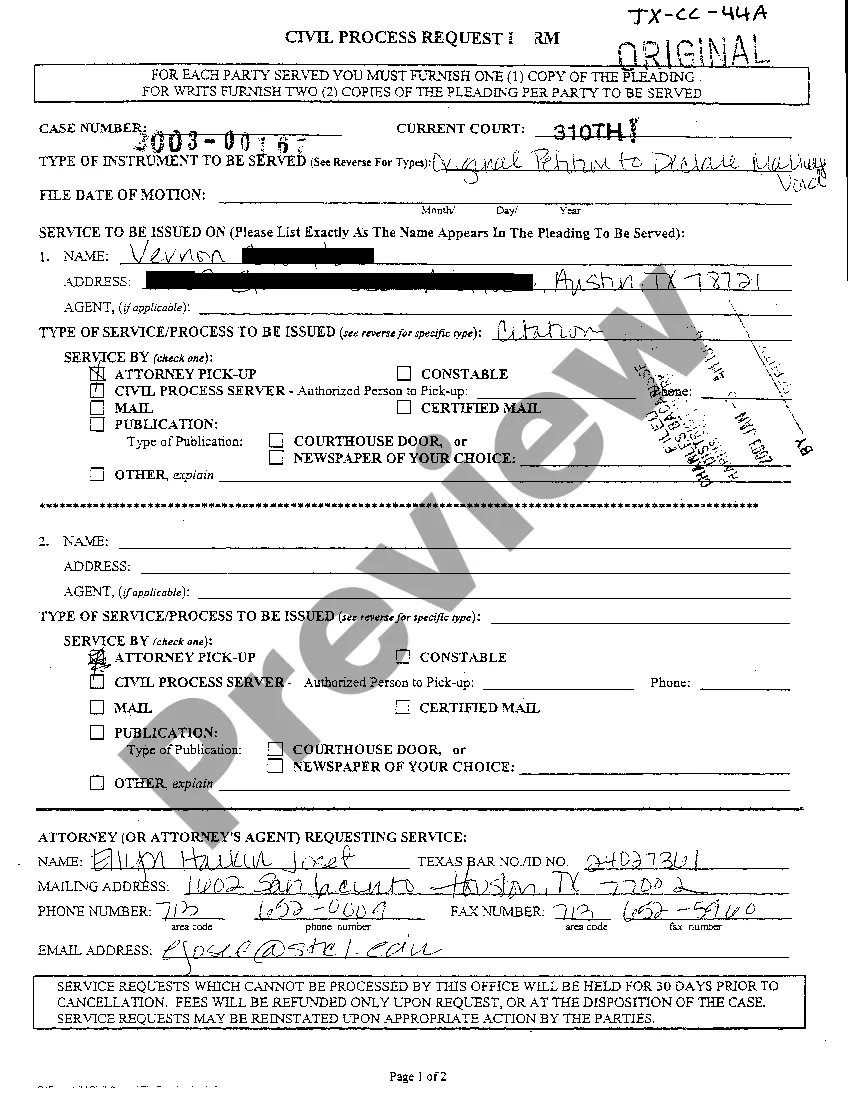

How to Foreclose on a Deed of Trust Step 1 ? Notice of Default. Record a Notice of Default with the county recorder.Step 2 ? Notice of Sale.Step 3 ? Auction.Step 4 ? Obtain Possession of Property.