Irvine California Application To Exceed Fee

Description

How to fill out Irvine California Application To Exceed Fee?

Regardless of social or occupational standing, completing legal documents is an unfortunate obligation in the contemporary world.

Frequently, it is nearly impossible for individuals lacking legal expertise to generate such documents independently, largely due to the intricate vocabulary and legal nuances involved.

This is where US Legal Forms proves to be beneficial.

Confirm that the chosen form is applicable to your locality, as the regulations of one state or region do not apply to another.

Review the document and check a brief description (if available) of the scenarios for which the document can be utilized.

- Our platform provides an extensive collection of over 85,000 ready-to-use state-specific documents suitable for virtually any legal matter.

- US Legal Forms is also a valuable tool for associates or legal advisors aiming to be more time-efficient with our DYI documents.

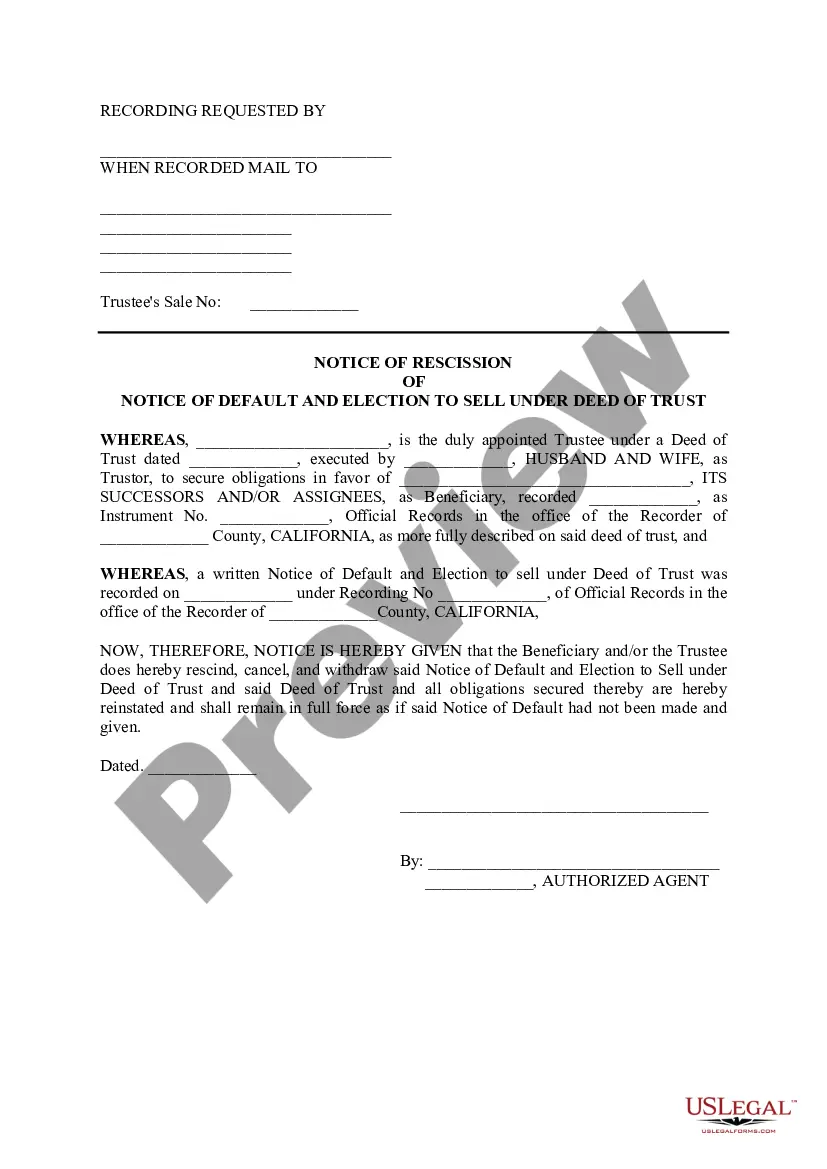

- Irrespective of whether you need the Irvine California Notice of Rescission of Notice of Default and Election to or any other forms relevant to your region, US Legal Forms places everything at your disposal.

- Here’s how to swiftly obtain the Irvine California Notice of Rescission of Notice of Default and Election to using our trustworthy platform.

- If you are already a registered customer, you can proceed to sign in to your account to retrieve the required document.

- However, if you are new to our library, be sure to adhere to these steps before obtaining the Irvine California Notice of Rescission of Notice of Default and Election to.

Form popularity

FAQ

In CA a Notice of Default does not expire. The Notice of Default would be active until a Notice of Rescission or a Reconveyance is recorded on the loan in question.

The right of rescission refers to the right of a consumer to cancel certain types of loans. If you are refinancing a mortgage, and you want to rescind (cancel) your mortgage contract; the three-day clock does not start until. You sign the credit contract (usually known as the Promissory Note)

?Foreclosure Sale Rescission? is the legal process of reversing a foreclosure sale and removing Fannie Mae as titleholder to the property. There are circumstances in which a foreclosure sale rescission may not involve elimination.

Technically speaking, a notice of default is not a foreclosure. Instead, it serves as notice that you are behind in your payments and that your property may be sold as a result of foreclosure if you don't act soon.

Write to the agency making the claim. Present evidence of why the NOD was improperly issued or why you legitimately cannot make payments. Ask the agency in the letter if they will take a lower monthly payment, total settlement or a payment plan. Send a copy of your letter by certified mail.

The lender sends you a copy of this notice by certified mail within 10 business days of recording it. You then have 90 days from the date that the Notice of Default is recorded to ?cure? (fix, usually by paying what is owed) the default.

Quite simply, rescission is the process of unwinding the loan and returning the borrower and the lender to where they were before the loan was issued.

When you receive a Notice of Default in California, the formal foreclosure process has begun. The document is official notice that you are in default on your mortgage and it will include options for getting your loan out of default.

A notice of rescission is a form given with the intention of terminating a contract, provided that the contract entered into is a voidable one. It releases the parties from obligations set forth in the contract, effectively restoring them to the positions they were in before the contract existed.

In the context of mortgage foreclosure, a notice of default is a formal notice that a lender filed with courts to notify the borrower who has failed to make payments that the lender intends to conduct a sale foreclosure.