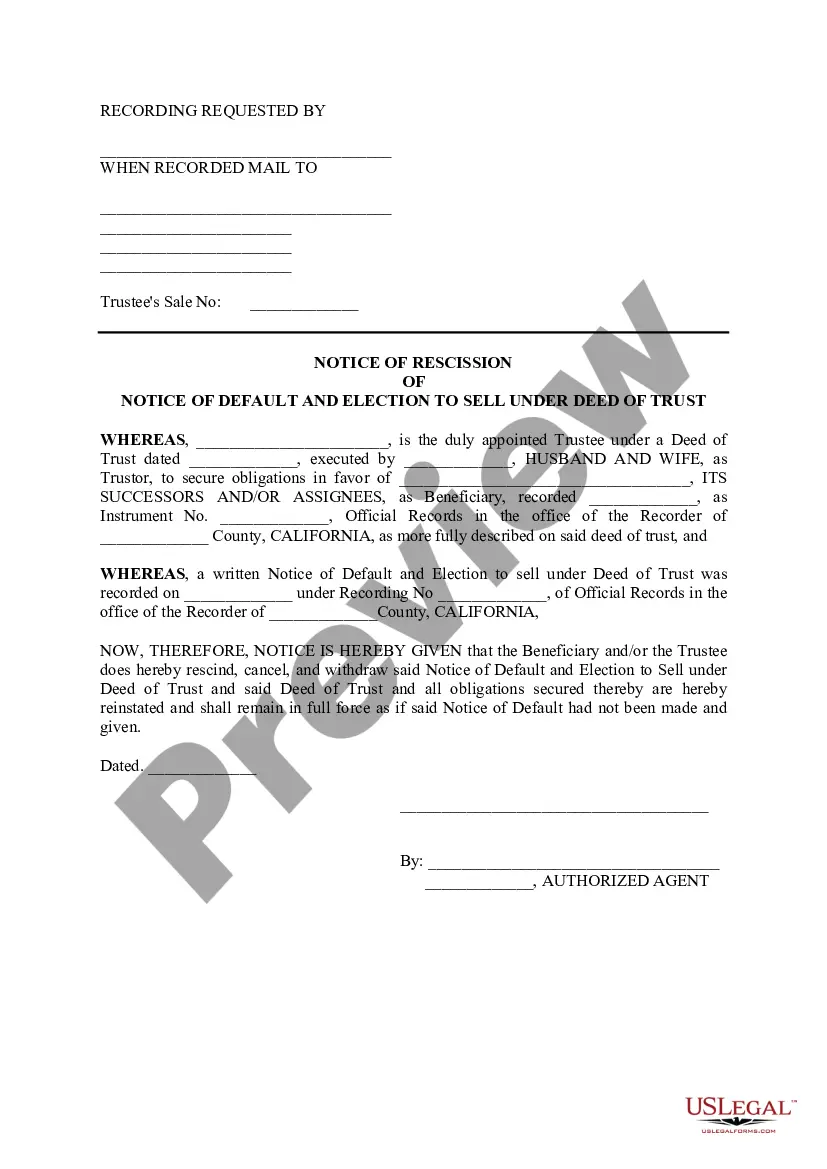

Rancho Cucamonga, California Notice of Rescission of Notice of Default and Election to is an essential legal document relating to foreclosure proceedings in Rancho Cucamonga, California. It provides homeowners with an opportunity to halt the foreclosure process and regain control over their property. When a homeowner falls behind on mortgage payments, the lender may initiate foreclosure proceedings by issuing a Notice of Default. This notice informs the homeowner that they are in default and gives them a certain period to bring their mortgage payments up to date. However, if the homeowner is able to resolve the default issue, they have the right to file a Notice of Rescission of Notice of Default and Election to in order to stop the foreclosure process. The Rancho Cucamonga, California Notice of Rescission of Notice of Default and Election to is a legal declaration made by the homeowner, notifying the lender that they have resolved the default issue and are now current on their mortgage payments. By filing this notice, the homeowner effectively rescinds the previous Notice of Default and requests the lender to stop all foreclosure proceedings. It is important to note that there are different types of Rancho Cucamonga, California Notice of Rescission of Notice of Default and Election to, depending on the specific circumstances of the foreclosure case. Some common types include: 1. Postponement Rescission: This notice is used when the homeowner has resolved the default issue and requests the lender to postpone the foreclosure sale date. It provides the homeowner with additional time to work out a repayment plan or explore other alternatives to foreclosure. 2. Reinstatement Rescission: This notice is employed when the homeowner has successfully brought their mortgage payments up to date and wants to reinstate their loan. By filing this notice, the homeowner requests the lender to remove the Notice of Default and continue the loan on its original terms. 3. Loan Modification Rescission: If the homeowner has received a loan modification offer from the lender and wants to accept it to avoid foreclosure, they can file a Loan Modification Rescission Notice. This notice notifies the lender of the homeowner's intention to accept the modified terms and rescind the Notice of Default. 4. Short Sale Rescission: In the case of a short sale, where the homeowner sells the property for less than the remaining mortgage balance to avoid foreclosure, they can file a Short Sale Rescission Notice. This notice informs the lender that the homeowner has entered into a sale agreement and requests the rescission of the Notice of Default. In conclusion, the Rancho Cucamonga, California Notice of Rescission of Notice of Default and Election to is a crucial legal document that allows homeowners to stop foreclosure proceedings by notifying the lender of the resolution of default issues. Various types of this notice exist, tailored to different circumstances, such as postponement, reinstatement, loan modification, or short sale.

Rancho Cucamonga California Application To Exceed Fee

Category:

State:

California

City:

Rancho Cucamonga

Control #:

CA-LR011T

Format:

Word;

Rich Text

Instant download

Description

This form removes the previously filed notice of default to the mortgagor for payments that are past due.

Rancho Cucamonga, California Notice of Rescission of Notice of Default and Election to is an essential legal document relating to foreclosure proceedings in Rancho Cucamonga, California. It provides homeowners with an opportunity to halt the foreclosure process and regain control over their property. When a homeowner falls behind on mortgage payments, the lender may initiate foreclosure proceedings by issuing a Notice of Default. This notice informs the homeowner that they are in default and gives them a certain period to bring their mortgage payments up to date. However, if the homeowner is able to resolve the default issue, they have the right to file a Notice of Rescission of Notice of Default and Election to in order to stop the foreclosure process. The Rancho Cucamonga, California Notice of Rescission of Notice of Default and Election to is a legal declaration made by the homeowner, notifying the lender that they have resolved the default issue and are now current on their mortgage payments. By filing this notice, the homeowner effectively rescinds the previous Notice of Default and requests the lender to stop all foreclosure proceedings. It is important to note that there are different types of Rancho Cucamonga, California Notice of Rescission of Notice of Default and Election to, depending on the specific circumstances of the foreclosure case. Some common types include: 1. Postponement Rescission: This notice is used when the homeowner has resolved the default issue and requests the lender to postpone the foreclosure sale date. It provides the homeowner with additional time to work out a repayment plan or explore other alternatives to foreclosure. 2. Reinstatement Rescission: This notice is employed when the homeowner has successfully brought their mortgage payments up to date and wants to reinstate their loan. By filing this notice, the homeowner requests the lender to remove the Notice of Default and continue the loan on its original terms. 3. Loan Modification Rescission: If the homeowner has received a loan modification offer from the lender and wants to accept it to avoid foreclosure, they can file a Loan Modification Rescission Notice. This notice notifies the lender of the homeowner's intention to accept the modified terms and rescind the Notice of Default. 4. Short Sale Rescission: In the case of a short sale, where the homeowner sells the property for less than the remaining mortgage balance to avoid foreclosure, they can file a Short Sale Rescission Notice. This notice informs the lender that the homeowner has entered into a sale agreement and requests the rescission of the Notice of Default. In conclusion, the Rancho Cucamonga, California Notice of Rescission of Notice of Default and Election to is a crucial legal document that allows homeowners to stop foreclosure proceedings by notifying the lender of the resolution of default issues. Various types of this notice exist, tailored to different circumstances, such as postponement, reinstatement, loan modification, or short sale.

How to fill out Rancho Cucamonga California Application To Exceed Fee?

If you’ve already used our service before, log in to your account and save the Rancho Cucamonga California Notice of Rescission of Notice of Default and Election to on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple actions to get your document:

- Make sure you’ve found the right document. Read the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t suit you, use the Search tab above to find the proper one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Obtain your Rancho Cucamonga California Notice of Rescission of Notice of Default and Election to. Choose the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly find and save any template for your individual or professional needs!