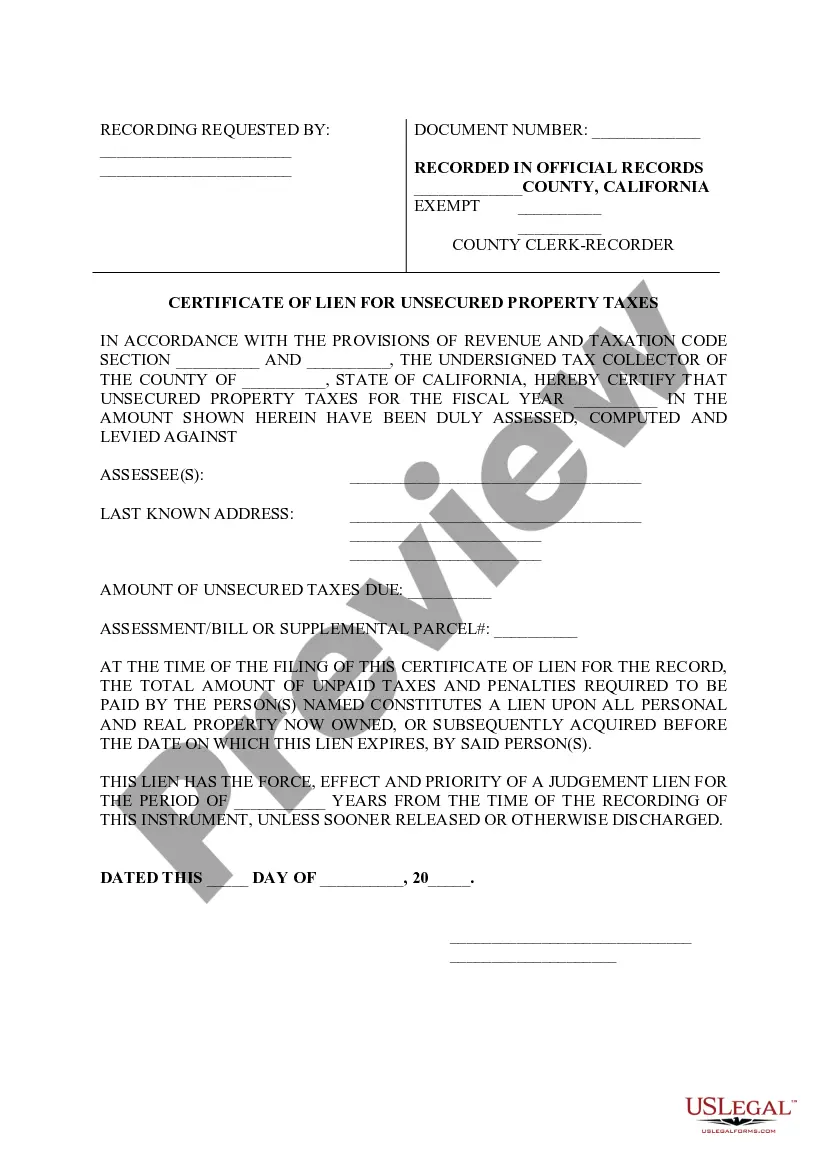

The Alameda California Certificate of Lien for Unsecured Property Taxes is a legal document that serves as a formal notice of a lien placed on a property due to unpaid unsecured property taxes. Unsecured property taxes refer to taxes on personal property, such as boats, aircraft, business equipment, and fixtures, rather than real estate. The certificate of lien is issued by the Alameda County Tax Collector's Office when the property owner fails to pay the unsecured property taxes within the specified due date. It is a legal claim that attaches to the property, indicating that the taxes must be paid to release the lien. Keywords: Alameda California, Certificate of Lien, Unsecured Property Taxes, Alameda County Tax Collector's Office, personal property, boats, aircraft, business equipment, fixtures, unpaid taxes, due date, legal claim. There are two types of Alameda California Certificate of Lien for Unsecured Property Taxes: 1. Regular Certificate of Lien: This type of certificate is issued when the property owner fails to pay the unsecured property taxes by the due date. It notifies the property owner and any interested parties that a lien has been placed on the property. The lien remains in effect until the taxes are paid. 2. Certificate of Redemption: This certificate is issued when the property owner pays off the outstanding unsecured property taxes along with any penalties and fees accrued. It serves as proof of redemption, indicating that the lien on the property has been released and that the property is no longer encumbered by the unpaid taxes. Keywords: Regular Certificate of Lien, Certificate of Redemption, outstanding taxes, penalties, fees, proof of redemption, encumbered property. It is important for property owners in Alameda, California, to address any unpaid unsecured property taxes promptly to avoid the issuance of a Certificate of Lien. Failure to do so may result in additional legal actions, such as a tax lien foreclosure, which could lead to the loss of the property. Overall, the Alameda California Certificate of Lien for Unsecured Property Taxes is a crucial legal document that informs property owners and interested parties about a lien placed on personal property due to unpaid unsecured property taxes. It is essential for property owners to understand the implications of this certificate and take immediate action to resolve any outstanding tax obligations.

The Alameda California Certificate of Lien for Unsecured Property Taxes is a legal document that serves as a formal notice of a lien placed on a property due to unpaid unsecured property taxes. Unsecured property taxes refer to taxes on personal property, such as boats, aircraft, business equipment, and fixtures, rather than real estate. The certificate of lien is issued by the Alameda County Tax Collector's Office when the property owner fails to pay the unsecured property taxes within the specified due date. It is a legal claim that attaches to the property, indicating that the taxes must be paid to release the lien. Keywords: Alameda California, Certificate of Lien, Unsecured Property Taxes, Alameda County Tax Collector's Office, personal property, boats, aircraft, business equipment, fixtures, unpaid taxes, due date, legal claim. There are two types of Alameda California Certificate of Lien for Unsecured Property Taxes: 1. Regular Certificate of Lien: This type of certificate is issued when the property owner fails to pay the unsecured property taxes by the due date. It notifies the property owner and any interested parties that a lien has been placed on the property. The lien remains in effect until the taxes are paid. 2. Certificate of Redemption: This certificate is issued when the property owner pays off the outstanding unsecured property taxes along with any penalties and fees accrued. It serves as proof of redemption, indicating that the lien on the property has been released and that the property is no longer encumbered by the unpaid taxes. Keywords: Regular Certificate of Lien, Certificate of Redemption, outstanding taxes, penalties, fees, proof of redemption, encumbered property. It is important for property owners in Alameda, California, to address any unpaid unsecured property taxes promptly to avoid the issuance of a Certificate of Lien. Failure to do so may result in additional legal actions, such as a tax lien foreclosure, which could lead to the loss of the property. Overall, the Alameda California Certificate of Lien for Unsecured Property Taxes is a crucial legal document that informs property owners and interested parties about a lien placed on personal property due to unpaid unsecured property taxes. It is essential for property owners to understand the implications of this certificate and take immediate action to resolve any outstanding tax obligations.