El Monte, California Certificate of Lien for Unsecured Property Taxes is an important document designed to publicly establish a claim on a property with outstanding unsecured property tax debts. Unsecured property taxes typically refer to taxes levied on movable, personal property rather than real estate. When a property owner fails to meet their tax obligations, the city of El Monte may issue a Certificate of Lien as a means to recover the unpaid taxes. This document is filed with the County Recorder's Office and serves as a public notice to potential buyers or lenders that the property has an outstanding tax debt. It can affect the property owner's ability to sell, refinance, or transfer the property until the lien is satisfied. There are different types of Certificates of Lien for Unsecured Property Taxes in El Monte, California, depending on the tax year and amount owed. These may include current-year non-business unsecured property tax liens, prior-year non-business unsecured property tax liens, and business unsecured property tax liens. The current-year non-business unsecured property tax lien is applicable when a property owner has failed to pay their unsecured property taxes for the current fiscal year. This lien is placed on the property and becomes effective from the date it is recorded. The property owner is given a certain time period to fulfill their tax obligations before further actions are taken. The prior-year non-business unsecured property tax lien is imposed when delinquent property taxes from previous fiscal years remain unpaid. Once recorded, this lien also takes legal precedence and must be cleared before any property transactions can take place. For businesses in El Monte, a business unsecured property tax lien may be filed against commercial entities or self-employed individuals who fail to fulfill their tax obligations pertaining to their unsecured property. This lien poses a financial burden as it affects the business's ability to secure loans, sell assets, or engage in certain business activities. Obtaining a Certificate of Lien for Unsecured Property Taxes in El Monte, California is an essential step for the city in ensuring tax compliance and revenue collection. It serves as a powerful tool to motivate property owners to pay their outstanding property taxes promptly, thereby supporting the municipality's budget and provision of essential public services.

El Monte California Certificate of Lien for Unsecured Property Taxes

Description

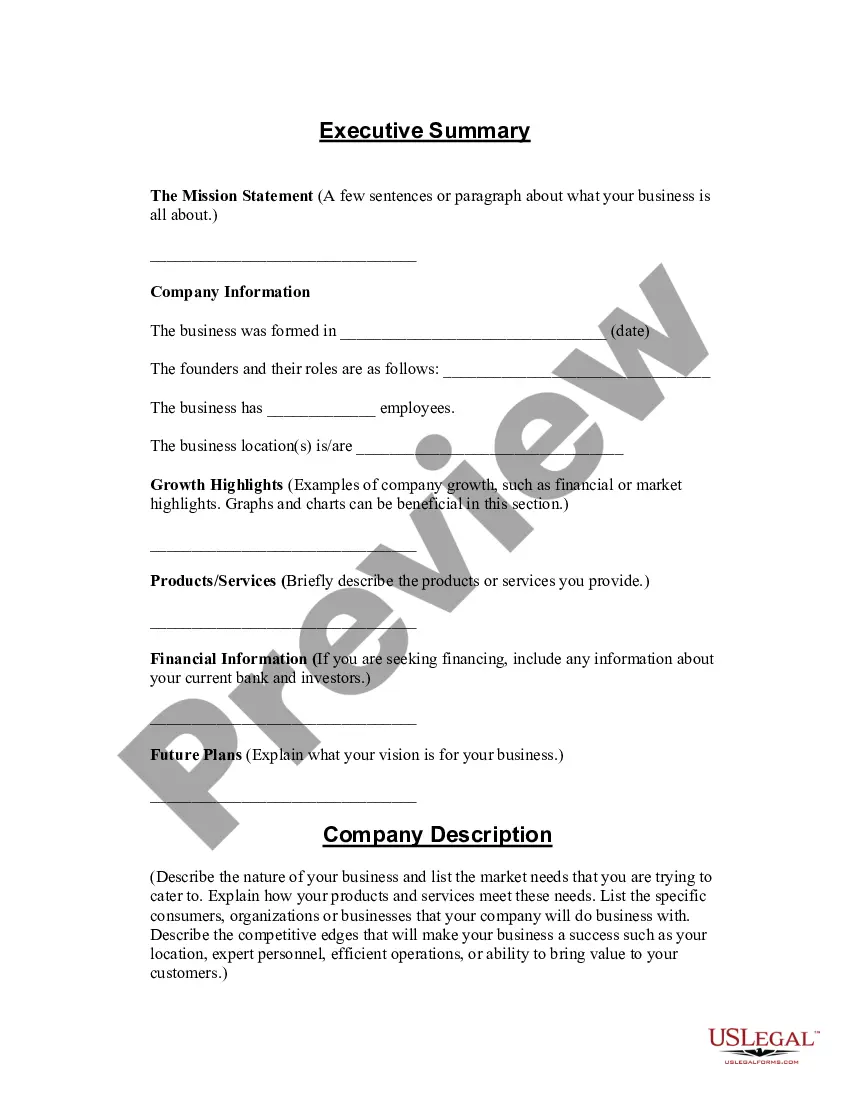

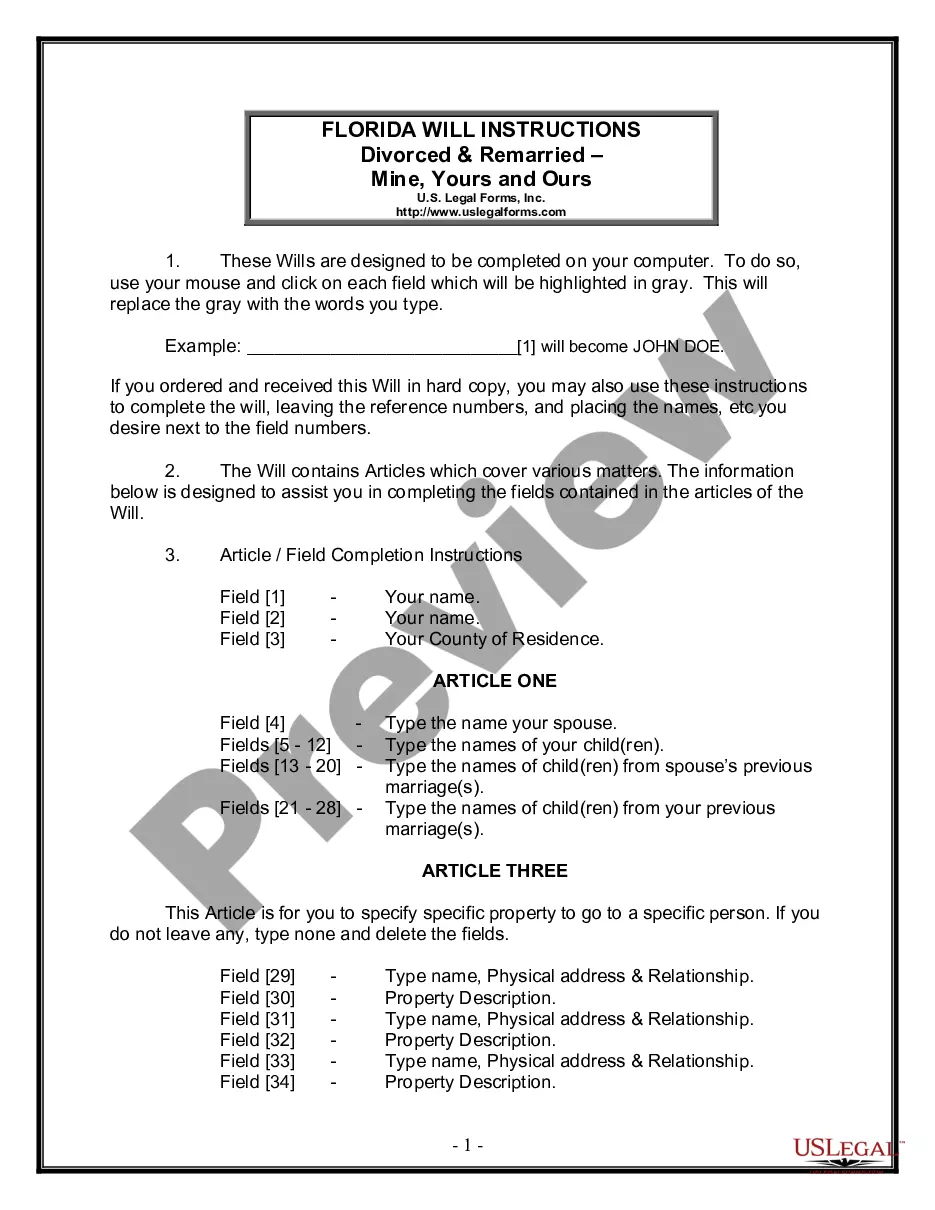

How to fill out El Monte California Certificate Of Lien For Unsecured Property Taxes?

Regardless of social or professional status, filling out law-related forms is an unfortunate necessity in today’s professional environment. Too often, it’s virtually impossible for a person with no legal background to create this sort of paperwork cfrom the ground up, mostly due to the convoluted terminology and legal subtleties they entail. This is where US Legal Forms comes in handy. Our platform offers a huge library with more than 85,000 ready-to-use state-specific forms that work for almost any legal case. US Legal Forms also serves as an excellent asset for associates or legal counsels who want to to be more efficient time-wise using our DYI tpapers.

Whether you need the El Monte California Certificate of Lien for Unsecured Property Taxes or any other document that will be good in your state or area, with US Legal Forms, everything is on hand. Here’s how you can get the El Monte California Certificate of Lien for Unsecured Property Taxes in minutes employing our reliable platform. If you are presently a subscriber, you can go ahead and log in to your account to download the needed form.

Nevertheless, if you are a novice to our library, make sure to follow these steps before downloading the El Monte California Certificate of Lien for Unsecured Property Taxes:

- Ensure the form you have chosen is suitable for your location because the regulations of one state or area do not work for another state or area.

- Preview the form and read a brief description (if available) of cases the paper can be used for.

- If the one you picked doesn’t meet your needs, you can start over and look for the needed form.

- Click Buy now and choose the subscription plan that suits you the best.

- Access an account {using your credentials or create one from scratch.

- Choose the payment method and proceed to download the El Monte California Certificate of Lien for Unsecured Property Taxes as soon as the payment is through.

You’re good to go! Now you can go ahead and print out the form or complete it online. Should you have any problems locating your purchased forms, you can quickly access them in the My Forms tab.

Whatever case you’re trying to sort out, US Legal Forms has got you covered. Try it out today and see for yourself.