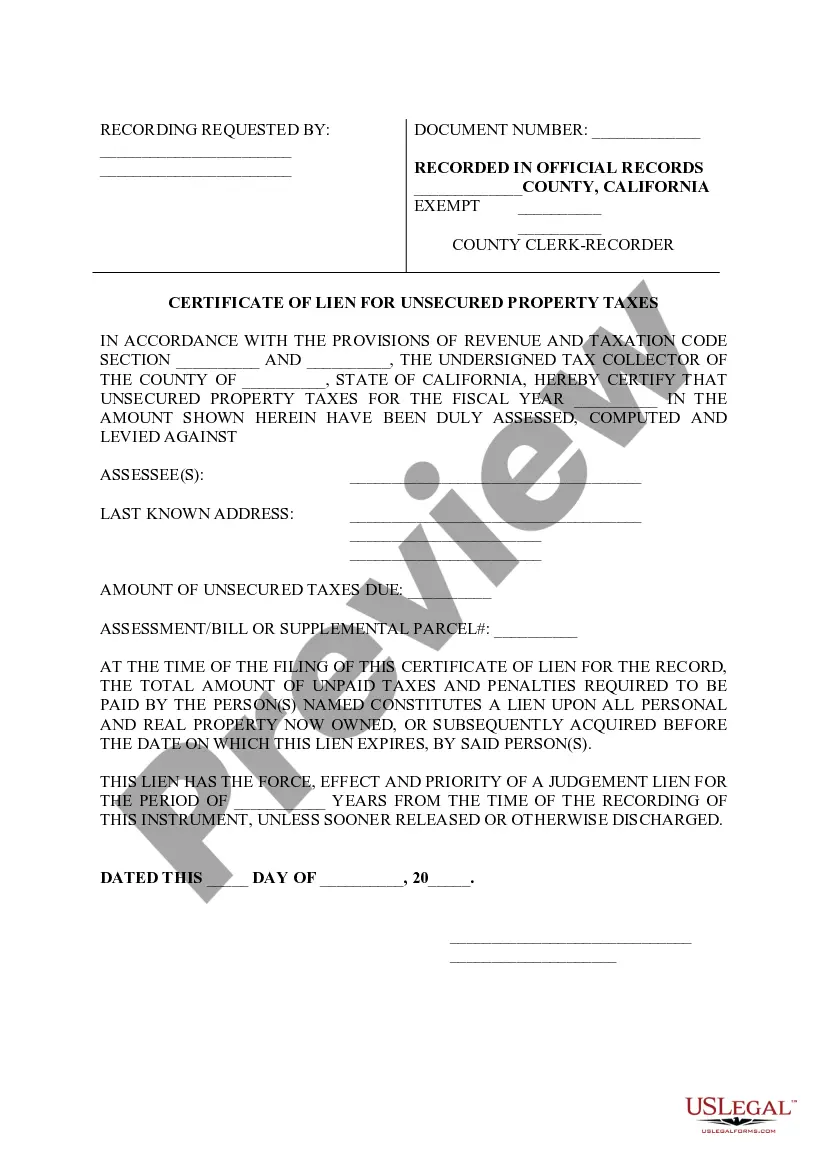

The Hayward California Certificate of Lien for Unsecured Property Taxes is an essential legal document that signifies the existence of a lien on a property due to unpaid property taxes. This certificate acts as a proof of the outstanding tax debt and grants the county the authority to collect the owed taxes from the property owner. In Hayward, California, there are primarily two types of Hayward California Certificates of Lien for Unsecured Property Taxes: 1. Standard Certificate of Lien: This type of certificate is issued when the property owner fails to pay their unsecured property taxes by the specified due date. The lien is then placed on the property, putting the county in the position of a priority creditor. The standard certificate remains in effect until the delinquent taxes, including any accrued penalties and interest, are paid in full. 2. Subsequent Certificate of Lien: If the property owner continues to neglect their tax obligations even after the issuance of a standard certificate of lien, the county may issue a subsequent certificate of lien. This certificate secures additional unpaid unsecured property taxes, penalties, and accrued interest that have accumulated since the previous certificate was issued. It adds to the overall lien amount, making it important for the property owner to address the outstanding debt promptly. It is crucial for property owners to understand the implications of a Hayward California Certificate of Lien for Unsecured Property Taxes. Upon issuance, the certificate becomes a public record and may have severe consequences on the property's marketability. The lien can hinder refinancing, transferring ownership, or selling the property until the outstanding taxes, and related penalties and interest, are fully satisfied. Property owners facing a Hayward California Certificate of Lien for Unsecured Property Taxes are advised to contact the Hayward County tax collector's office promptly. Ignoring the certificate can lead to further complications, such as additional penalties, potential foreclosure, or the county pursuing legal action to recover the unpaid amounts. In conclusion, the Hayward California Certificate of Lien for Unsecured Property Taxes serves as a legal document indicating the existence of a lien on a property due to unpaid unsecured property taxes. The standard and subsequent certificates of lien highlight different stages of delinquency, and property owners must address these matters diligently to avoid serious financial and legal repercussions.

Hayward California Certificate of Lien for Unsecured Property Taxes

Category:

State:

California

City:

Hayward

Control #:

CA-LR015T

Format:

Word;

Rich Text

Instant download

Description

This form is for a lien for unpaid taxes. The taxes are not secured by real property such as land, these taxes are called "Unsecured." Property taxes.

The Hayward California Certificate of Lien for Unsecured Property Taxes is an essential legal document that signifies the existence of a lien on a property due to unpaid property taxes. This certificate acts as a proof of the outstanding tax debt and grants the county the authority to collect the owed taxes from the property owner. In Hayward, California, there are primarily two types of Hayward California Certificates of Lien for Unsecured Property Taxes: 1. Standard Certificate of Lien: This type of certificate is issued when the property owner fails to pay their unsecured property taxes by the specified due date. The lien is then placed on the property, putting the county in the position of a priority creditor. The standard certificate remains in effect until the delinquent taxes, including any accrued penalties and interest, are paid in full. 2. Subsequent Certificate of Lien: If the property owner continues to neglect their tax obligations even after the issuance of a standard certificate of lien, the county may issue a subsequent certificate of lien. This certificate secures additional unpaid unsecured property taxes, penalties, and accrued interest that have accumulated since the previous certificate was issued. It adds to the overall lien amount, making it important for the property owner to address the outstanding debt promptly. It is crucial for property owners to understand the implications of a Hayward California Certificate of Lien for Unsecured Property Taxes. Upon issuance, the certificate becomes a public record and may have severe consequences on the property's marketability. The lien can hinder refinancing, transferring ownership, or selling the property until the outstanding taxes, and related penalties and interest, are fully satisfied. Property owners facing a Hayward California Certificate of Lien for Unsecured Property Taxes are advised to contact the Hayward County tax collector's office promptly. Ignoring the certificate can lead to further complications, such as additional penalties, potential foreclosure, or the county pursuing legal action to recover the unpaid amounts. In conclusion, the Hayward California Certificate of Lien for Unsecured Property Taxes serves as a legal document indicating the existence of a lien on a property due to unpaid unsecured property taxes. The standard and subsequent certificates of lien highlight different stages of delinquency, and property owners must address these matters diligently to avoid serious financial and legal repercussions.

How to fill out Hayward California Certificate Of Lien For Unsecured Property Taxes?

If you’ve already utilized our service before, log in to your account and save the Hayward California Certificate of Lien for Unsecured Property Taxes on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, follow these simple actions to get your file:

- Ensure you’ve found an appropriate document. Read the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t suit you, utilize the Search tab above to get the appropriate one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Obtain your Hayward California Certificate of Lien for Unsecured Property Taxes. Choose the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to each piece of paperwork you have bought: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to easily find and save any template for your personal or professional needs!