The Inglewood California Certificate of Lien for Unsecured Property Taxes is a legal document that is issued by the Inglewood Tax Collector's Office when property taxes on unsecured properties are not paid on time. It serves as a notice to the property owner that there is a lien placed on their property due to the outstanding tax amount. This certificate is an important tool for the city to recover unpaid property taxes and ensure proper collection of funds for public services and amenities. The Inglewood California Certificate of Lien for Unsecured Property Taxes includes various essential details. Firstly, it contains information about the property owner, including their name and address. It also includes details about the property itself, such as its address, parcel number, and legal description. Furthermore, the certificate specifies the total amount of unpaid property taxes, penalties, and interest that are owed by the property owner. It outlines the date the taxes were due and the duration of delinquency. It is important to note that the lien attaches to the property and not the property owner, meaning it remains in effect even if the property is sold or transferred to a new owner. The Inglewood California Certificate of Lien for Unsecured Property Taxes serves as a public record, indicating that the lien is in effect and that the property owner has an obligation to pay the outstanding taxes. It alerts potential buyers or institutions about the property's lien status, potentially affecting any future transactions involving the property. Inglewood California may have different types of certificates of lien for unsecured property taxes based on the specific circumstances. Some possible variations may include: 1. Inglewood California Certificate of Lien Release: This certificate is issued when the property owner has successfully paid off their outstanding property taxes, penalties, and interest. It signifies that the lien on the property has been released, allowing the owner to regain full control of the property without any encumbrances. 2. Inglewood California Certificate of Lien Sale: This certificate is issued when the property owner fails to pay their outstanding taxes, penalties, and interest within a specified period. It authorizes the county to conduct a public auction or sale of the property to recover the unpaid amounts. The certificate is issued to the successful bidder/purchaser at the lien sale. In conclusion, the Inglewood California Certificate of Lien for Unsecured Property Taxes is a crucial document that notifies property owners about delinquent property taxes and places a lien on their property until the outstanding amounts are paid. It serves as a public record and may have different types, including the Certificate of Lien Release and Certificate of Lien Sale, depending on the circumstances.

Inglewood California Certificate of Lien for Unsecured Property Taxes

Description

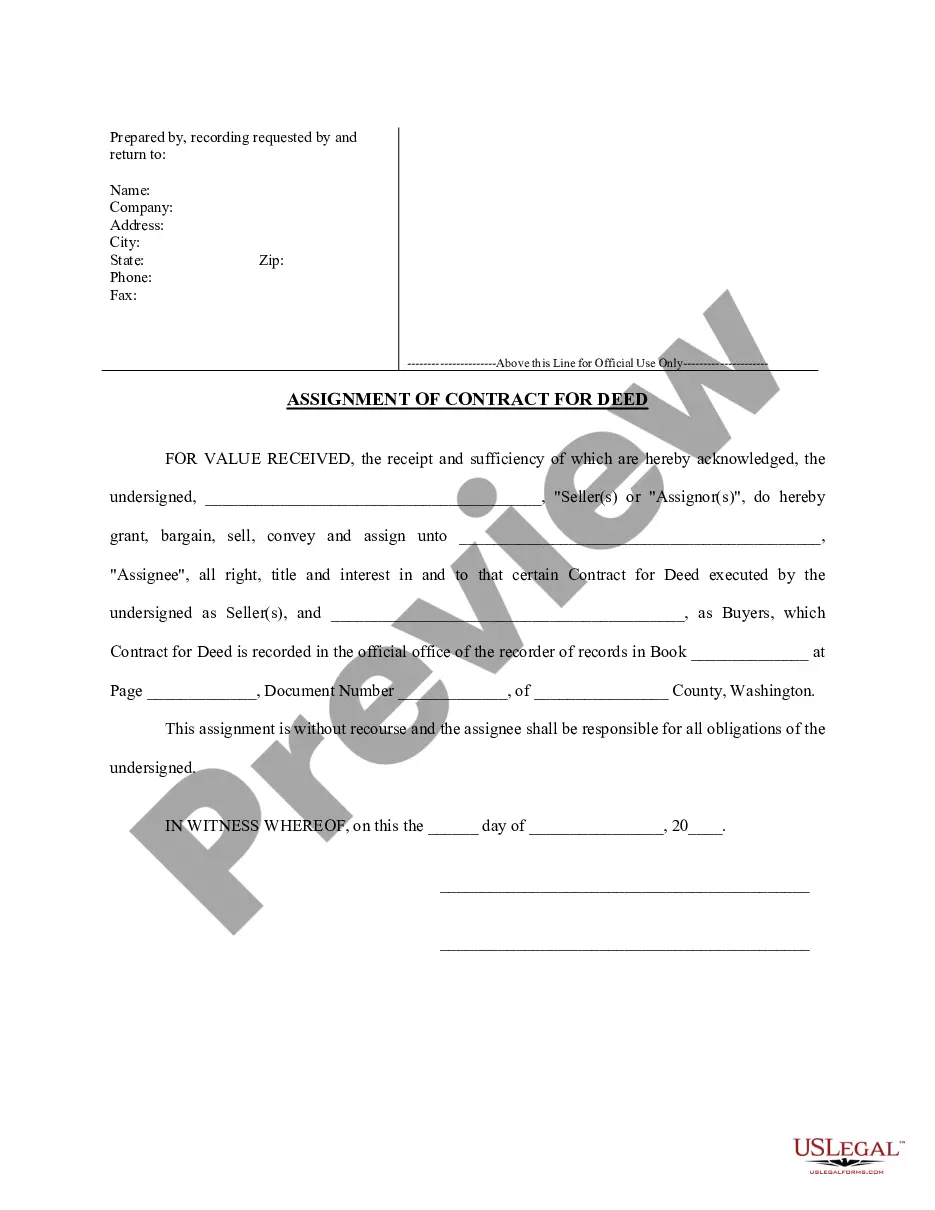

How to fill out Inglewood California Certificate Of Lien For Unsecured Property Taxes?

Locating verified templates specific to your local laws can be challenging unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both individual and professional needs and any real-life scenarios. All the documents are properly categorized by area of usage and jurisdiction areas, so locating the Inglewood California Certificate of Lien for Unsecured Property Taxes becomes as quick and easy as ABC.

For everyone already acquainted with our library and has used it before, obtaining the Inglewood California Certificate of Lien for Unsecured Property Taxes takes just a couple of clicks. All you need to do is log in to your account, opt for the document, and click Download to save it on your device. This process will take just a few additional actions to make for new users.

Follow the guidelines below to get started with the most extensive online form collection:

- Check the Preview mode and form description. Make certain you’ve selected the right one that meets your needs and totally corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you find any inconsistency, utilize the Search tab above to find the right one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and select the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the subscription.

- Download the Inglewood California Certificate of Lien for Unsecured Property Taxes. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Take advantage of the US Legal Forms library to always have essential document templates for any demands just at your hand!