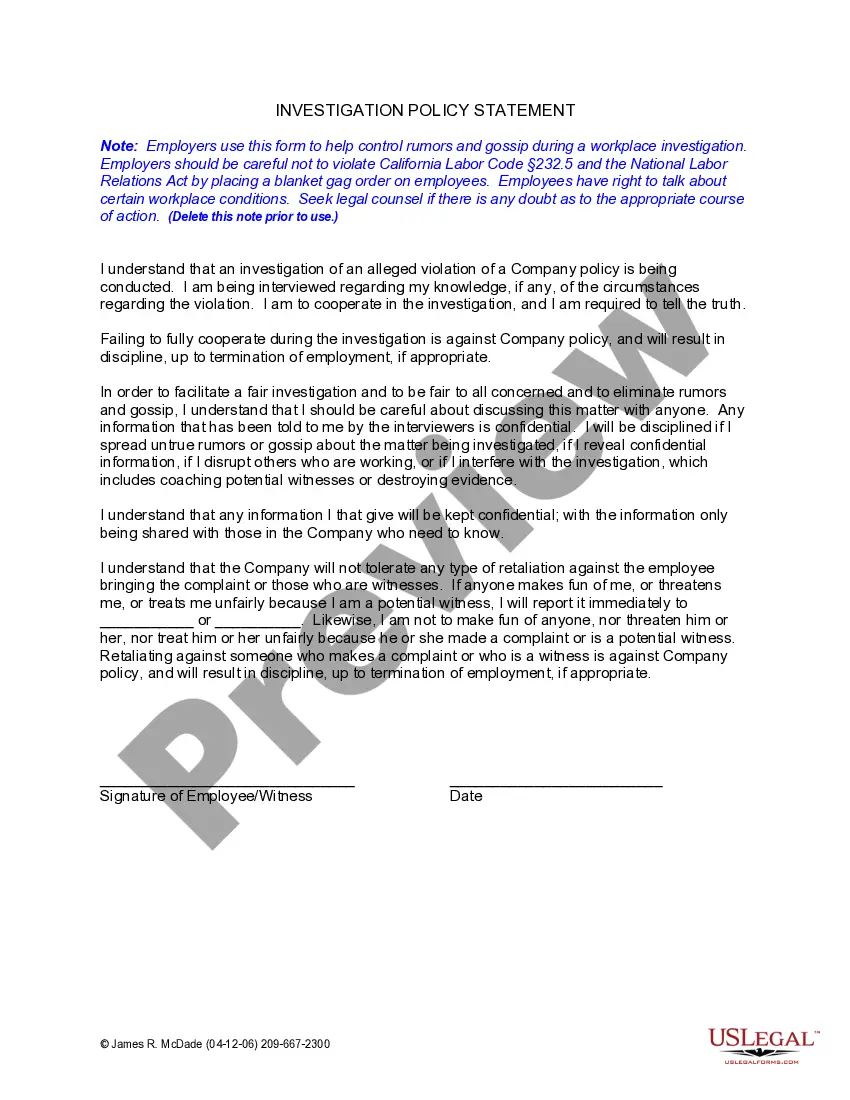

The Oxnard California Certificate of Lien for Unsecured Property Taxes is an official document that represents a legal claim against a property owner who has unpaid property taxes on unsecured properties. Unsecured properties generally include assets that are not physically attached to real estate, such as boats, airplanes, business equipment, and mobile homes. When property taxes on unsecured properties become delinquent, the City of Oxnard or the Oxnard Tax Collector's Office may issue a Certificate of Lien to secure the payment of these taxes. This lien places a legal hold on the property, preventing its transfer or sale until the outstanding taxes are paid. Additionally, the Certificate of Lien may accrue penalties and interest on the unpaid tax amount, increasing the financial obligation for the property owner. It is important to note that there are two main types of Oxnard California Certificates of Lien for Unsecured Property Taxes: 1. Annual Unsecured Property Tax Lien: This type of lien is issued when a property owner fails to pay the annual property taxes on unsecured assets. The Tax Collector's Office sends notices to property owners who are behind on their taxes, providing them with an opportunity to pay before a lien is imposed. If the taxes remain unpaid, the Tax Collector's Office will issue an Annual Unsecured Property Tax Lien, officially recording the debt and initiating the collection process. 2. Escape Assessment Unsecured Property Tax Lien: In certain situations, the Assessor's Office in Oxnard may issue an "escape assessment" if it is discovered that a property owner has underreported or omitted certain unsecured property assets for taxation. An Escape Assessment Unsecured Property Tax Lien is then filed against the property owner to recover the necessary taxes on these assets. This type of lien is generally issued after an audit or an assessment review. Property owners burdened with a Certificate of Lien for Unsecured Property Taxes should promptly address the outstanding tax balance with the Oxnard Tax Collector's Office. Failure to resolve the taxes may result in further legal action, such as tax sale auctions or foreclosure proceedings, which can have severe consequences for the property owner. It is crucial for property owners to prioritize resolving any tax issues and to seek professional advice if needed.

Oxnard California Certificate of Lien for Unsecured Property Taxes

Description

How to fill out Oxnard California Certificate Of Lien For Unsecured Property Taxes?

Regardless of social or professional status, completing law-related forms is an unfortunate necessity in today’s professional environment. Very often, it’s almost impossible for a person with no law background to create this sort of papers cfrom the ground up, mostly because of the convoluted terminology and legal subtleties they involve. This is where US Legal Forms can save the day. Our platform provides a huge catalog with more than 85,000 ready-to-use state-specific forms that work for practically any legal scenario. US Legal Forms also is a great resource for associates or legal counsels who want to save time utilizing our DYI tpapers.

No matter if you need the Oxnard California Certificate of Lien for Unsecured Property Taxes or any other document that will be valid in your state or area, with US Legal Forms, everything is at your fingertips. Here’s how to get the Oxnard California Certificate of Lien for Unsecured Property Taxes in minutes employing our trustworthy platform. If you are presently a subscriber, you can proceed to log in to your account to get the needed form.

However, if you are a novice to our platform, ensure that you follow these steps prior to obtaining the Oxnard California Certificate of Lien for Unsecured Property Taxes:

- Ensure the template you have found is good for your area because the rules of one state or area do not work for another state or area.

- Review the form and go through a brief outline (if provided) of cases the document can be used for.

- If the form you selected doesn’t meet your requirements, you can start again and search for the needed document.

- Click Buy now and pick the subscription option you prefer the best.

- with your login information or create one from scratch.

- Pick the payment method and proceed to download the Oxnard California Certificate of Lien for Unsecured Property Taxes once the payment is completed.

You’re all set! Now you can proceed to print the form or complete it online. In case you have any problems getting your purchased forms, you can easily find them in the My Forms tab.

Whatever situation you’re trying to solve, US Legal Forms has got you covered. Try it out now and see for yourself.