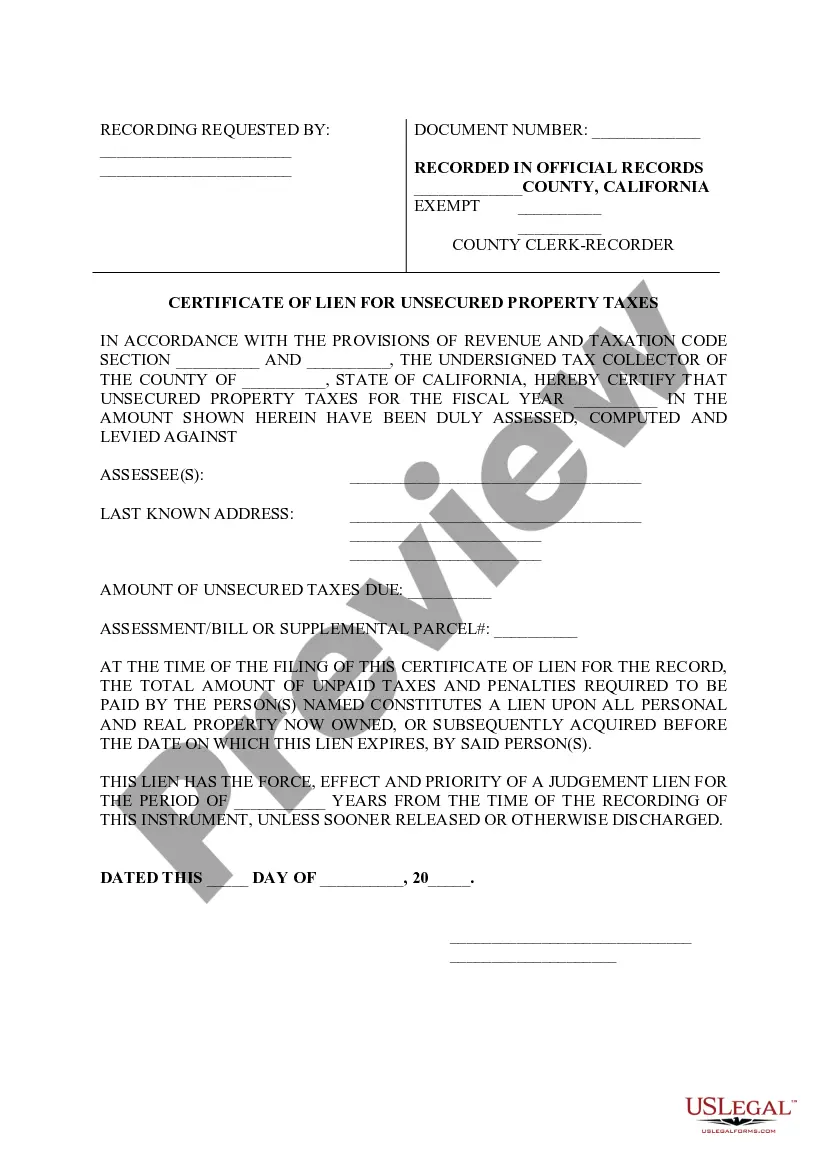

The Santa Clara California Certificate of Lien for Unsecured Property Taxes is an official document that serves as evidence of a tax lien on unsecured properties within the Santa Clara County. This lien is imposed when property taxes remain unpaid after the due date, and it gives the local government the right to claim the debt from the property owner. The Santa Clara County Tax Collector's Office is responsible for issuing and maintaining these certificates. They ensure that property taxes are paid promptly and accurately, enabling the government to fund various public services and infrastructures within the county. When a property owner fails to pay their unsecured property taxes, the county can issue different types of certificates of lien to secure these outstanding tax debts: 1. General Unsecured Property Tax Lien: This is the most common type of lien applied to unsecured properties that have overdue taxes. It represents the county's claim for the unpaid taxes on moveable assets such as boats, airplanes, business equipment, and supplies. 2. Business Lien Certificate: This type of lien is specifically issued for unpaid unsecured property taxes on commercial properties. If a business fails to pay its property taxes, the lien will be placed, and the county can take legal action to collect the debt. 3. Mobile Home Lien Certificate: When the owner of a mobile home in Santa Clara County fails to pay their unsecured property taxes on time, a specific lien will be placed on that property. This ensures that the county has a right to claim the tax debt from the mobile home if necessary. It is essential for property owners to promptly pay their unsecured property taxes in order to avoid the issuance of a Certificate of Lien. When a lien is imposed, it can negatively impact the property owner's credit score, making it difficult to obtain loans or sell the property in the future. To resolve a Certificate of Lien, property owners must pay the outstanding tax debt, along with any penalties and interest accrued. Once the payment is received, the lien will be released, and the property owner will regain full control over their property. In summary, the Santa Clara California Certificate of Lien for Unsecured Property Taxes is important for enforcing the payment of unsecured property taxes. It serves as a legal claim on the property when the taxes remain unpaid, and there are different types of certificates issued depending on the nature of the property.

Santa Clara California Certificate of Lien for Unsecured Property Taxes

Category:

State:

California

County:

Santa Clara

Control #:

CA-LR015T

Format:

Word;

Rich Text

Instant download

Description

This form is for a lien for unpaid taxes. The taxes are not secured by real property such as land, these taxes are called "Unsecured." Property taxes.

The Santa Clara California Certificate of Lien for Unsecured Property Taxes is an official document that serves as evidence of a tax lien on unsecured properties within the Santa Clara County. This lien is imposed when property taxes remain unpaid after the due date, and it gives the local government the right to claim the debt from the property owner. The Santa Clara County Tax Collector's Office is responsible for issuing and maintaining these certificates. They ensure that property taxes are paid promptly and accurately, enabling the government to fund various public services and infrastructures within the county. When a property owner fails to pay their unsecured property taxes, the county can issue different types of certificates of lien to secure these outstanding tax debts: 1. General Unsecured Property Tax Lien: This is the most common type of lien applied to unsecured properties that have overdue taxes. It represents the county's claim for the unpaid taxes on moveable assets such as boats, airplanes, business equipment, and supplies. 2. Business Lien Certificate: This type of lien is specifically issued for unpaid unsecured property taxes on commercial properties. If a business fails to pay its property taxes, the lien will be placed, and the county can take legal action to collect the debt. 3. Mobile Home Lien Certificate: When the owner of a mobile home in Santa Clara County fails to pay their unsecured property taxes on time, a specific lien will be placed on that property. This ensures that the county has a right to claim the tax debt from the mobile home if necessary. It is essential for property owners to promptly pay their unsecured property taxes in order to avoid the issuance of a Certificate of Lien. When a lien is imposed, it can negatively impact the property owner's credit score, making it difficult to obtain loans or sell the property in the future. To resolve a Certificate of Lien, property owners must pay the outstanding tax debt, along with any penalties and interest accrued. Once the payment is received, the lien will be released, and the property owner will regain full control over their property. In summary, the Santa Clara California Certificate of Lien for Unsecured Property Taxes is important for enforcing the payment of unsecured property taxes. It serves as a legal claim on the property when the taxes remain unpaid, and there are different types of certificates issued depending on the nature of the property.

How to fill out Santa Clara California Certificate Of Lien For Unsecured Property Taxes?

If you’ve already utilized our service before, log in to your account and download the Santa Clara California Certificate of Lien for Unsecured Property Taxes on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple actions to get your document:

- Ensure you’ve found a suitable document. Look through the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t fit you, utilize the Search tab above to get the proper one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Get your Santa Clara California Certificate of Lien for Unsecured Property Taxes. Select the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to every piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your personal or professional needs!