Visalia California Certificate of Lien for Unsecured Property Taxes: An In-Depth Overview In Visalia, California, the Certificate of Lien for Unsecured Property Taxes is an important document that serves as legal proof of an outstanding tax debt on unsecured properties. This lien acts as a security interest and ensures that the municipality has a claim over the property owner's assets until the unpaid taxes are settled. Unsecured property taxes, in contrast to real estate taxes, are typically imposed on personal property such as boats, aircraft, business equipment, and mobile homes. These taxes are levied based on the assessed value of the property, and property owners are obligated to pay them annually. The Visalia California Certificate of Lien for Unsecured Property Taxes is issued by the county tax collector's office and indicates that the property owner has failed to pay their due unsecured property taxes. It lists essential details including the property owner's name, the property's address, the tax amount owed, and the tax year(s) in question. The lien is officially recorded with the county recorder's office, thereby establishing a public record of the outstanding tax liability. Once the certificate is issued, the county tax collector has the authority to take various actions to collect the unpaid tax debt. These actions may include seizing and selling the property, garnishing wages, or placing a levy on bank accounts, among others. The issuance of the certificate also affects the property owner's credit rating and may limit their ability to obtain loans or credit in the future. It is crucial to note that there are different types or categories of Visalia California Certificates of Lien for Unsecured Property Taxes. These variations primarily depend on the specific circumstances or nature of the unpaid tax debt. Some common types include: 1. Regular Certificates of Lien: These are issued for standard cases where property owners fail to pay their annual unsecured property taxes. The certificate represents the standard lien process initiated by the tax collector's office. 2. Delinquent Certificates of Lien: Delinquent certificates are issued when property owners have accumulated years of unpaid unsecured property taxes. These certificates consolidate all the outstanding tax liabilities into one comprehensive lien, making it easier for the tax collector to pursue the outstanding debt as a whole. 3. Supplemental Certificates of Lien: Sometimes, the initial certificate may not cover the entirety of the unpaid tax debt due to additions or corrections made to the property's assessed value. In such cases, a supplemental certificate is issued to encompass the updated tax obligations, ensuring the property owner is liable for the accurate amount owed. It is important for property owners to promptly address and resolve any outstanding unsecured property tax debts to remove the lien and prevent further financial and credit consequences. Seeking professional advice from tax experts or legal professionals is recommended to navigate the complex process and explore the available options for payment or resolution.

Visalia California Certificate of Lien for Unsecured Property Taxes

Description

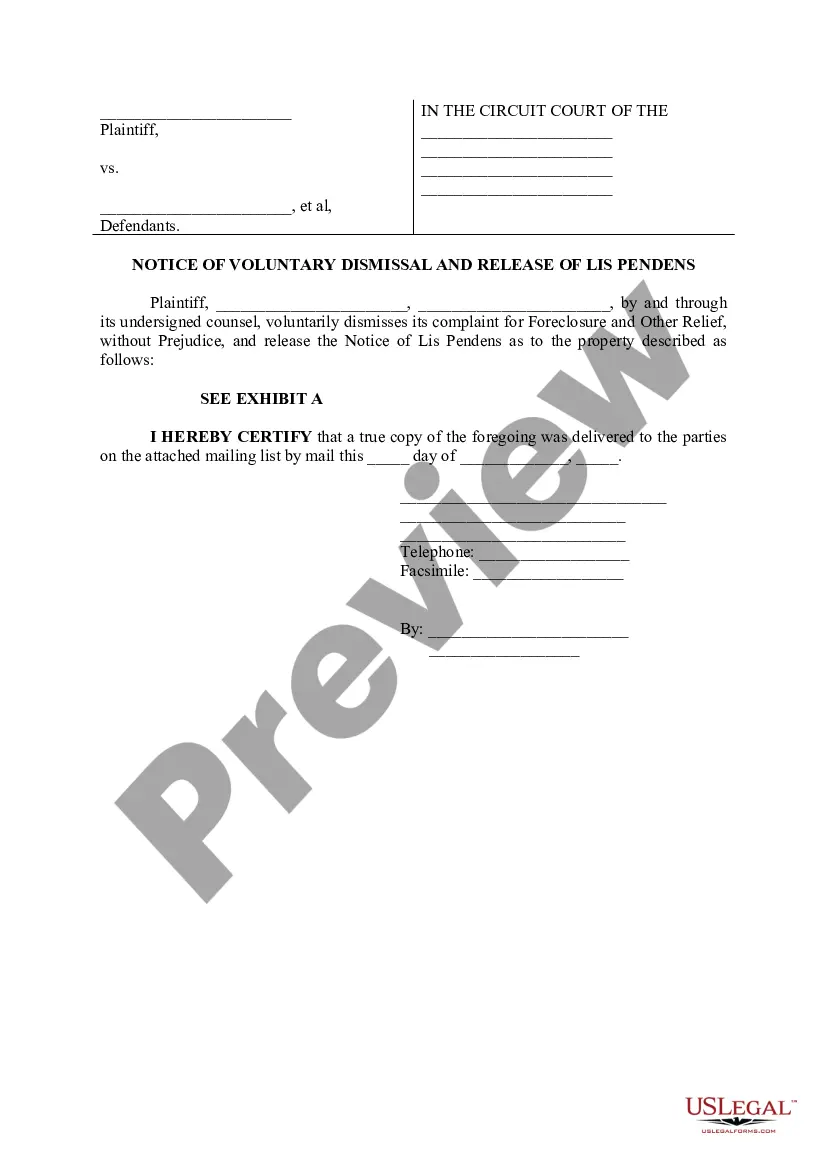

How to fill out Visalia California Certificate Of Lien For Unsecured Property Taxes?

If you are searching for a relevant form, it’s impossible to choose a more convenient platform than the US Legal Forms site – one of the most comprehensive libraries on the web. Here you can find a huge number of form samples for business and personal purposes by categories and regions, or keywords. With the high-quality search function, discovering the latest Visalia California Certificate of Lien for Unsecured Property Taxes is as easy as 1-2-3. Furthermore, the relevance of each record is proved by a team of expert lawyers that regularly review the templates on our platform and revise them based on the most recent state and county demands.

If you already know about our system and have an account, all you need to receive the Visalia California Certificate of Lien for Unsecured Property Taxes is to log in to your account and click the Download option.

If you use US Legal Forms for the first time, just follow the guidelines below:

- Make sure you have opened the form you require. Check its description and make use of the Preview option to check its content. If it doesn’t meet your needs, utilize the Search option near the top of the screen to get the needed document.

- Confirm your selection. Select the Buy now option. After that, choose your preferred pricing plan and provide credentials to register an account.

- Make the transaction. Make use of your credit card or PayPal account to finish the registration procedure.

- Get the form. Choose the file format and download it to your system.

- Make changes. Fill out, modify, print, and sign the received Visalia California Certificate of Lien for Unsecured Property Taxes.

Each form you save in your account does not have an expiration date and is yours permanently. You can easily access them via the My Forms menu, so if you need to get an extra copy for enhancing or printing, you may return and download it once more anytime.

Take advantage of the US Legal Forms professional catalogue to get access to the Visalia California Certificate of Lien for Unsecured Property Taxes you were seeking and a huge number of other professional and state-specific templates on a single platform!