The Anaheim California Certificate of Delinquent Personal Property Tax is a legal document issued by the City of Anaheim to notify individuals or businesses of their outstanding personal property tax liabilities. This certificate is designed to inform taxpayers about the delinquency and the consequences of failing to pay their taxes promptly. By providing a detailed description of the certificate's purpose and its various types, taxpayers will gain a better understanding of the implications and potential penalties associated with non-compliance. The City of Anaheim issues different types of Certificates of Delinquent Personal Property Tax to address various scenarios and ensure compliance with tax laws. These certificates include: 1. Notice of Delinquent Personal Property Tax: This type of certificate is sent to taxpayers with outstanding personal property tax amounts. It informs them about the specific taxes due, along with the penalties and interest accrued on the delinquent amounts. This notice serves as a reminder and provides taxpayers with an opportunity to rectify their tax obligations promptly. 2. Certificate of Delinquency for Personal Property Tax: This certificate is issued when taxpayers fail to respond or make payment after receiving the initial notice. It states the total amount due and the consequences of continued non-payment. Taxpayers are urged to take immediate action to avoid further penalties, legal actions, or potential property liens. 3. Certificate of Personal Property Tax Sale: In cases where delinquent taxes remain unpaid, the city may initiate a personal property tax sale. This certificate notifies the taxpayer of the impending tax sale, where their property may be auctioned to recover the unpaid taxes. It highlights the final opportunity for taxpayers to settle their obligations before losing ownership of their properties. It is important for individuals and businesses in Anaheim, California to be familiar with the Anaheim Certificate of Delinquent Personal Property Tax and to respond promptly upon receipt. Failure to address the delinquency can lead to additional penalties, interest, property liens, or even loss of ownership. To avoid such consequences, taxpayers should promptly review, understand, and take necessary action upon receiving any of the aforementioned certificates. Compliance with tax obligations is crucial for maintaining a positive financial standing and avoiding legal issues.

Anaheim California Certificate of Delinquent Personal Property Tax

Category:

State:

California

City:

Anaheim

Control #:

CA-LR016T

Format:

Word;

Rich Text

Instant download

Description

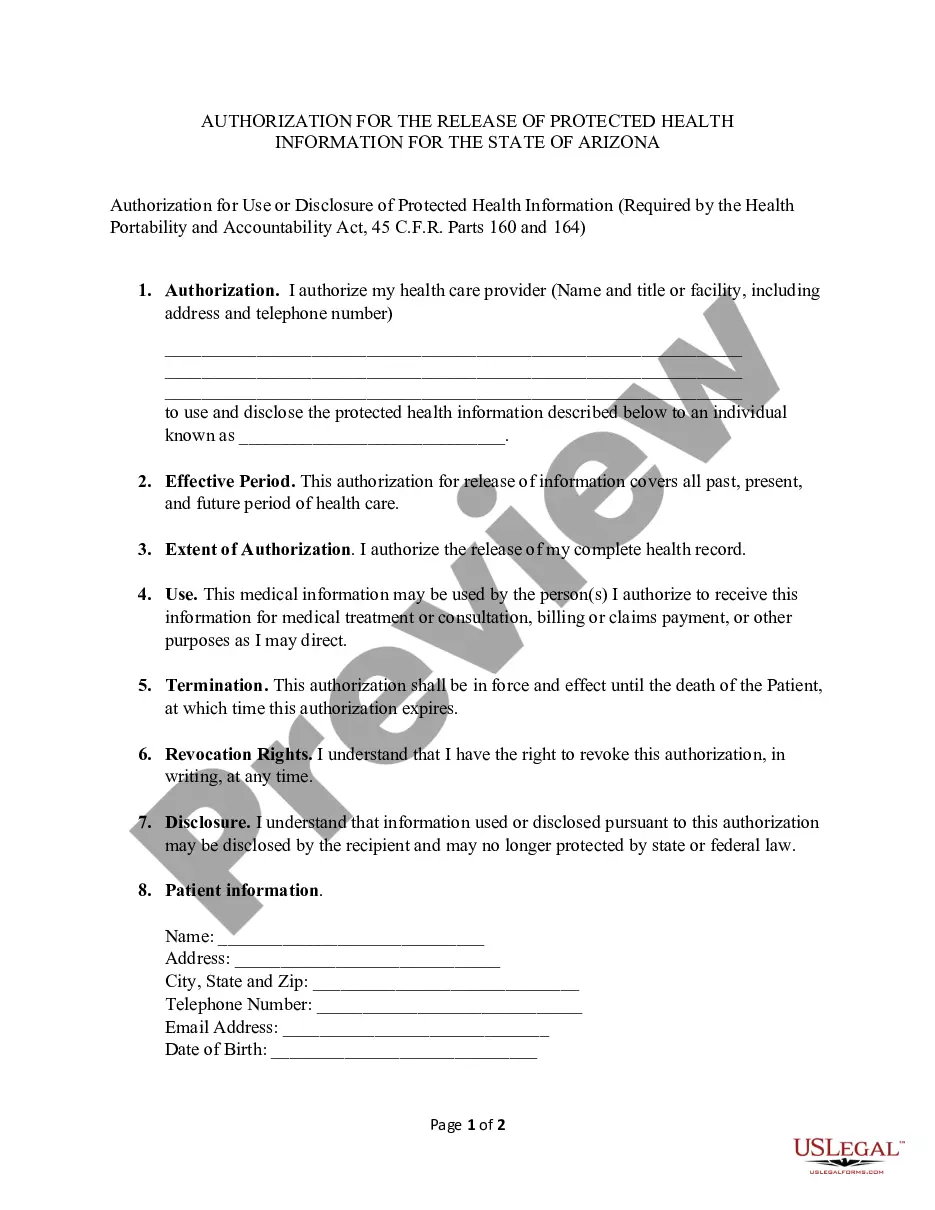

Certificate of unpaid delinquent unsecured property taxes, Tax collector placed a lien upon all personal and real property now owned by said persons.

The Anaheim California Certificate of Delinquent Personal Property Tax is a legal document issued by the City of Anaheim to notify individuals or businesses of their outstanding personal property tax liabilities. This certificate is designed to inform taxpayers about the delinquency and the consequences of failing to pay their taxes promptly. By providing a detailed description of the certificate's purpose and its various types, taxpayers will gain a better understanding of the implications and potential penalties associated with non-compliance. The City of Anaheim issues different types of Certificates of Delinquent Personal Property Tax to address various scenarios and ensure compliance with tax laws. These certificates include: 1. Notice of Delinquent Personal Property Tax: This type of certificate is sent to taxpayers with outstanding personal property tax amounts. It informs them about the specific taxes due, along with the penalties and interest accrued on the delinquent amounts. This notice serves as a reminder and provides taxpayers with an opportunity to rectify their tax obligations promptly. 2. Certificate of Delinquency for Personal Property Tax: This certificate is issued when taxpayers fail to respond or make payment after receiving the initial notice. It states the total amount due and the consequences of continued non-payment. Taxpayers are urged to take immediate action to avoid further penalties, legal actions, or potential property liens. 3. Certificate of Personal Property Tax Sale: In cases where delinquent taxes remain unpaid, the city may initiate a personal property tax sale. This certificate notifies the taxpayer of the impending tax sale, where their property may be auctioned to recover the unpaid taxes. It highlights the final opportunity for taxpayers to settle their obligations before losing ownership of their properties. It is important for individuals and businesses in Anaheim, California to be familiar with the Anaheim Certificate of Delinquent Personal Property Tax and to respond promptly upon receipt. Failure to address the delinquency can lead to additional penalties, interest, property liens, or even loss of ownership. To avoid such consequences, taxpayers should promptly review, understand, and take necessary action upon receiving any of the aforementioned certificates. Compliance with tax obligations is crucial for maintaining a positive financial standing and avoiding legal issues.

How to fill out Anaheim California Certificate Of Delinquent Personal Property Tax?

If you’ve already utilized our service before, log in to your account and save the Anaheim California Certificate of Delinquent Personal Property Tax on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple actions to get your document:

- Ensure you’ve located an appropriate document. Look through the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t suit you, utilize the Search tab above to find the appropriate one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Get your Anaheim California Certificate of Delinquent Personal Property Tax. Opt for the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to every piece of paperwork you have purchased: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily find and save any template for your individual or professional needs!