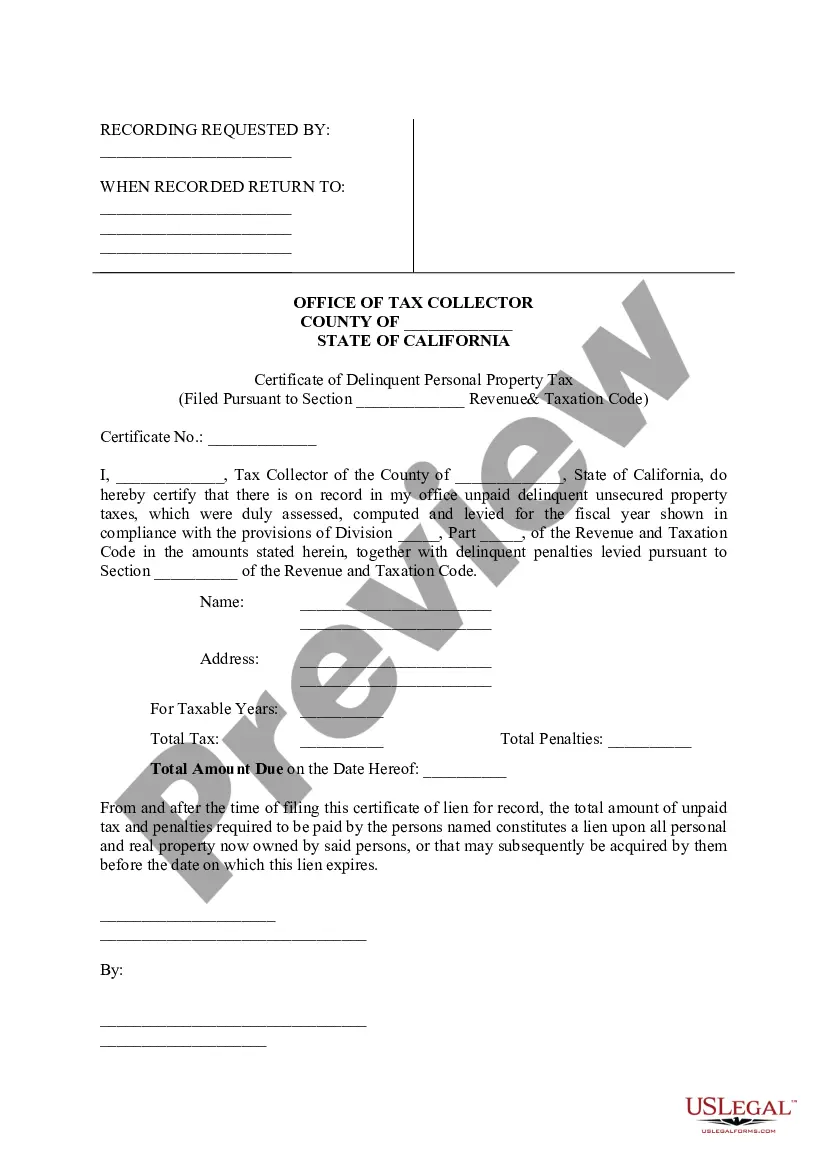

The Costa Mesa California Certificate of Delinquent Personal Property Tax is an important document that signifies the presence of unpaid personal property taxes in Costa Mesa, California. It serves as a legal record of outstanding tax balances regarding personal property ownership within the city. Personal property refers to items that are not fixed or immovable, such as vehicles, boats, aircraft, and business equipment. These assets are subject to annual property taxes based on their assessed value. Failure to pay these taxes results in the issuance of a Certificate of Delinquency by the Costa Mesa Tax Collector's Office. This certificate indicates the specific amount of delinquent personal property taxes owed by the taxpayer. It includes details such as the taxpayer's name, address, and the tax year for which the taxes are past due. Additionally, the certificate outlines any penalties, interest, or fees associated with the delinquent taxes. The document is an official notice that the taxpayer is in arrears and must settle their outstanding balance promptly to avoid further legal consequences. The Costa Mesa California Certificate of Delinquent Personal Property Tax can take on different forms depending on the circumstances. Some notable types include: 1. Individual Taxpayer Certificate: This type of certificate is issued when an individual taxpayer fails to pay their personal property taxes within the designated timeframe. It applies to residents who own personal property in Costa Mesa but have fallen behind on their tax obligations. 2. Business Taxpayer Certificate: Businesses operating in Costa Mesa are also liable for paying personal property taxes on their equipment and assets. A Business Taxpayer Certificate is issued to companies or organizations that have failed to fulfill their tax obligations, indicating the amount owed and any related charges. 3. Multiple-Year Delinquency Certificate: In cases where a taxpayer has accumulated delinquent personal property taxes over multiple years, a Multiple-Year Delinquency Certificate may be issued. This certificate consolidates the outstanding balances from various tax years into a single document, making it easier for the taxpayer to understand the full extent of their liabilities. 4. Redemption Certificate: Once a taxpayer has paid their delinquent personal property taxes in full, they can obtain a Redemption Certificate. This document attests that the outstanding balance has been settled, and the taxpayer is now in good standing with the Costa Mesa Tax Collector's Office. It is essential for taxpayers in Costa Mesa, California, to address any delinquent personal property tax liabilities promptly. Ignoring these obligations can lead to additional penalties, interest, or even legal action. The Certificate of Delinquent Personal Property Tax serves as a clear reminder of a taxpayer's outstanding debts, urging them to rectify the situation and bring their tax payments up to date.

Costa Mesa California Certificate of Delinquent Personal Property Tax

Category:

State:

California

City:

Costa Mesa

Control #:

CA-LR016T

Format:

Word;

Rich Text

Instant download

Description

Certificate of unpaid delinquent unsecured property taxes, Tax collector placed a lien upon all personal and real property now owned by said persons.

The Costa Mesa California Certificate of Delinquent Personal Property Tax is an important document that signifies the presence of unpaid personal property taxes in Costa Mesa, California. It serves as a legal record of outstanding tax balances regarding personal property ownership within the city. Personal property refers to items that are not fixed or immovable, such as vehicles, boats, aircraft, and business equipment. These assets are subject to annual property taxes based on their assessed value. Failure to pay these taxes results in the issuance of a Certificate of Delinquency by the Costa Mesa Tax Collector's Office. This certificate indicates the specific amount of delinquent personal property taxes owed by the taxpayer. It includes details such as the taxpayer's name, address, and the tax year for which the taxes are past due. Additionally, the certificate outlines any penalties, interest, or fees associated with the delinquent taxes. The document is an official notice that the taxpayer is in arrears and must settle their outstanding balance promptly to avoid further legal consequences. The Costa Mesa California Certificate of Delinquent Personal Property Tax can take on different forms depending on the circumstances. Some notable types include: 1. Individual Taxpayer Certificate: This type of certificate is issued when an individual taxpayer fails to pay their personal property taxes within the designated timeframe. It applies to residents who own personal property in Costa Mesa but have fallen behind on their tax obligations. 2. Business Taxpayer Certificate: Businesses operating in Costa Mesa are also liable for paying personal property taxes on their equipment and assets. A Business Taxpayer Certificate is issued to companies or organizations that have failed to fulfill their tax obligations, indicating the amount owed and any related charges. 3. Multiple-Year Delinquency Certificate: In cases where a taxpayer has accumulated delinquent personal property taxes over multiple years, a Multiple-Year Delinquency Certificate may be issued. This certificate consolidates the outstanding balances from various tax years into a single document, making it easier for the taxpayer to understand the full extent of their liabilities. 4. Redemption Certificate: Once a taxpayer has paid their delinquent personal property taxes in full, they can obtain a Redemption Certificate. This document attests that the outstanding balance has been settled, and the taxpayer is now in good standing with the Costa Mesa Tax Collector's Office. It is essential for taxpayers in Costa Mesa, California, to address any delinquent personal property tax liabilities promptly. Ignoring these obligations can lead to additional penalties, interest, or even legal action. The Certificate of Delinquent Personal Property Tax serves as a clear reminder of a taxpayer's outstanding debts, urging them to rectify the situation and bring their tax payments up to date.

How to fill out Costa Mesa California Certificate Of Delinquent Personal Property Tax?

If you’ve already used our service before, log in to your account and save the Costa Mesa California Certificate of Delinquent Personal Property Tax on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple steps to obtain your file:

- Make sure you’ve found a suitable document. Look through the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t fit you, use the Search tab above to obtain the proper one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Get your Costa Mesa California Certificate of Delinquent Personal Property Tax. Choose the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have purchased: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your personal or professional needs!