The Daly City California Certificate of Delinquent Personal Property Tax is a legal document that serves as proof of unpaid personal property taxes in the city of Daly City, California. Personal property refers to tangible items owned by individuals or businesses that are not considered real estate, such as furniture, vehicles, machinery, equipment, and other movable assets. The certificate is issued by the Daly City tax authority to individuals or businesses who have failed to fulfill their personal property tax obligations within the specified timeframe. It outlines the details of the delinquent taxes owed, including the tax year, the amount overdue, any penalties or interest accrued, and the property or properties associated with the outstanding tax liability. The Daly City California Certificate of Delinquent Personal Property Tax serves as a lien against the property until the outstanding tax balance is paid in full. It is important to note that the certificate can adversely affect the property owner's credit rating and ability to obtain loans or sell the property until the tax debt is resolved. There are different types of Daly City California Certificates of Delinquent Personal Property Tax based on the specific tax year and delinquent amount. Some common types may include: 1. Annual Delinquent Certificate: This certificate is issued for delinquent personal property taxes for a specific tax year. It includes the total unpaid tax amount, penalties, interest, and any other associated charges. 2. Aggregate Delinquent Certificate: This certificate is issued when an individual or business has multiple unpaid tax liabilities for multiple tax years. It consolidates all the delinquent amounts, penalties, interest, and charges into a single certificate. 3. Supplemental Delinquent Certificate: This certificate is issued for additional personal property taxes owed when changes or updates occur after the initial tax assessment. It covers any supplemental assessments, including improvements made to the property or changes in ownership, which were not included in the original tax bill. 4. Penalty and Interest Delinquent Certificate: This certificate is issued solely for the outstanding penalties and interest accrued on delinquent personal property taxes. It indicates the amount owed in fines and additional charges resulting from late or unpaid tax payments. It is important for property owners in Daly City, California, to promptly address any outstanding personal property tax liabilities to avoid the issuance of a Certificate of Delinquent Personal Property Tax. Failure to resolve the outstanding tax debts can have severe consequences, including additional penalties, interest, and the potential loss of the property through tax foreclosure.

Daly City California Certificate of Delinquent Personal Property Tax

Description

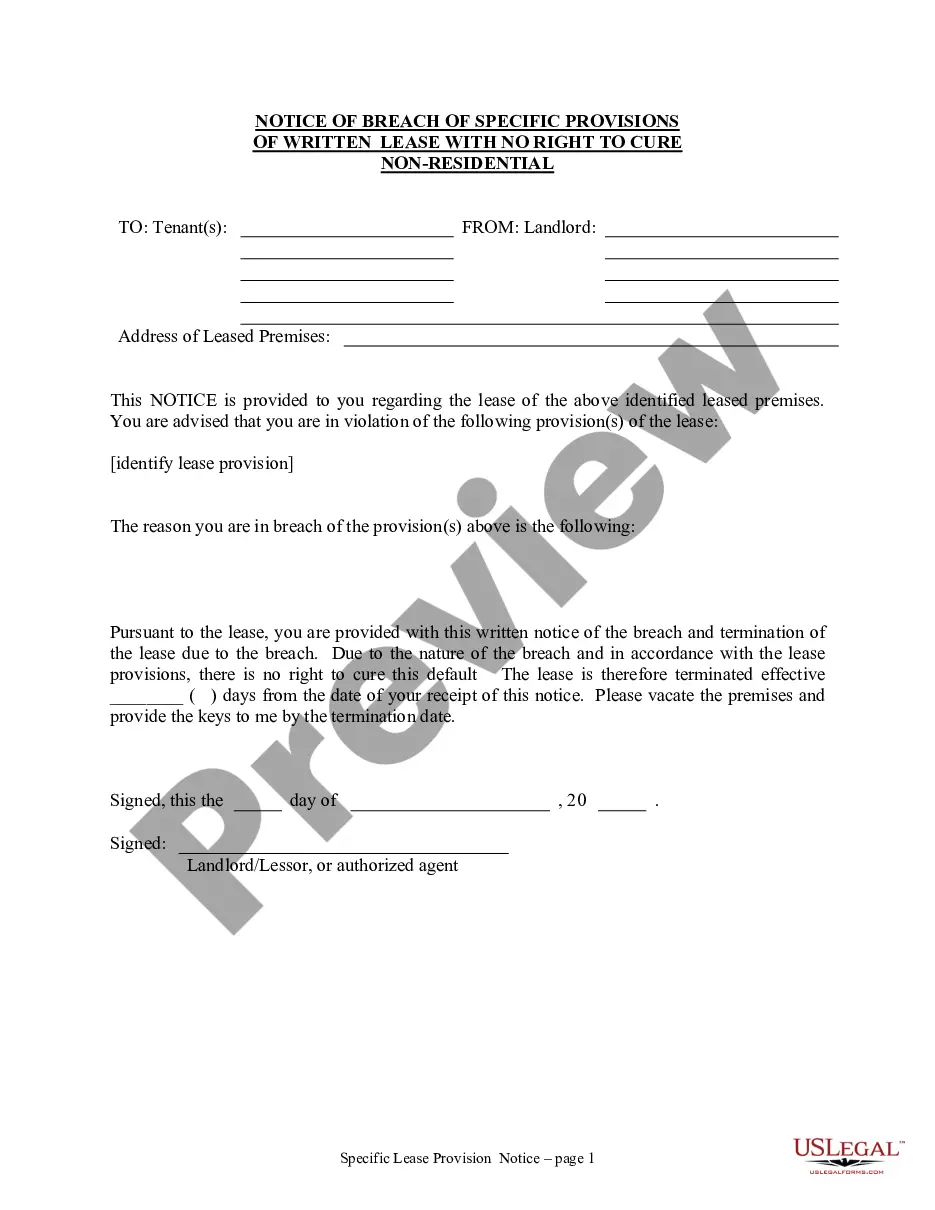

How to fill out Daly City California Certificate Of Delinquent Personal Property Tax?

Are you looking for a trustworthy and inexpensive legal forms supplier to buy the Daly City California Certificate of Delinquent Personal Property Tax? US Legal Forms is your go-to choice.

No matter if you need a simple arrangement to set regulations for cohabitating with your partner or a set of forms to advance your separation or divorce through the court, we got you covered. Our website offers more than 85,000 up-to-date legal document templates for personal and company use. All templates that we offer aren’t universal and framed based on the requirements of specific state and area.

To download the form, you need to log in account, locate the needed template, and click the Download button next to it. Please take into account that you can download your previously purchased form templates at any time in the My Forms tab.

Is the first time you visit our platform? No worries. You can create an account with swift ease, but before that, make sure to do the following:

- Check if the Daly City California Certificate of Delinquent Personal Property Tax conforms to the regulations of your state and local area.

- Go through the form’s description (if provided) to learn who and what the form is good for.

- Start the search over if the template isn’t good for your specific scenario.

Now you can register your account. Then pick the subscription plan and proceed to payment. As soon as the payment is done, download the Daly City California Certificate of Delinquent Personal Property Tax in any provided file format. You can return to the website when you need and redownload the form without any extra costs.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a try today, and forget about wasting hours learning about legal paperwork online for good.