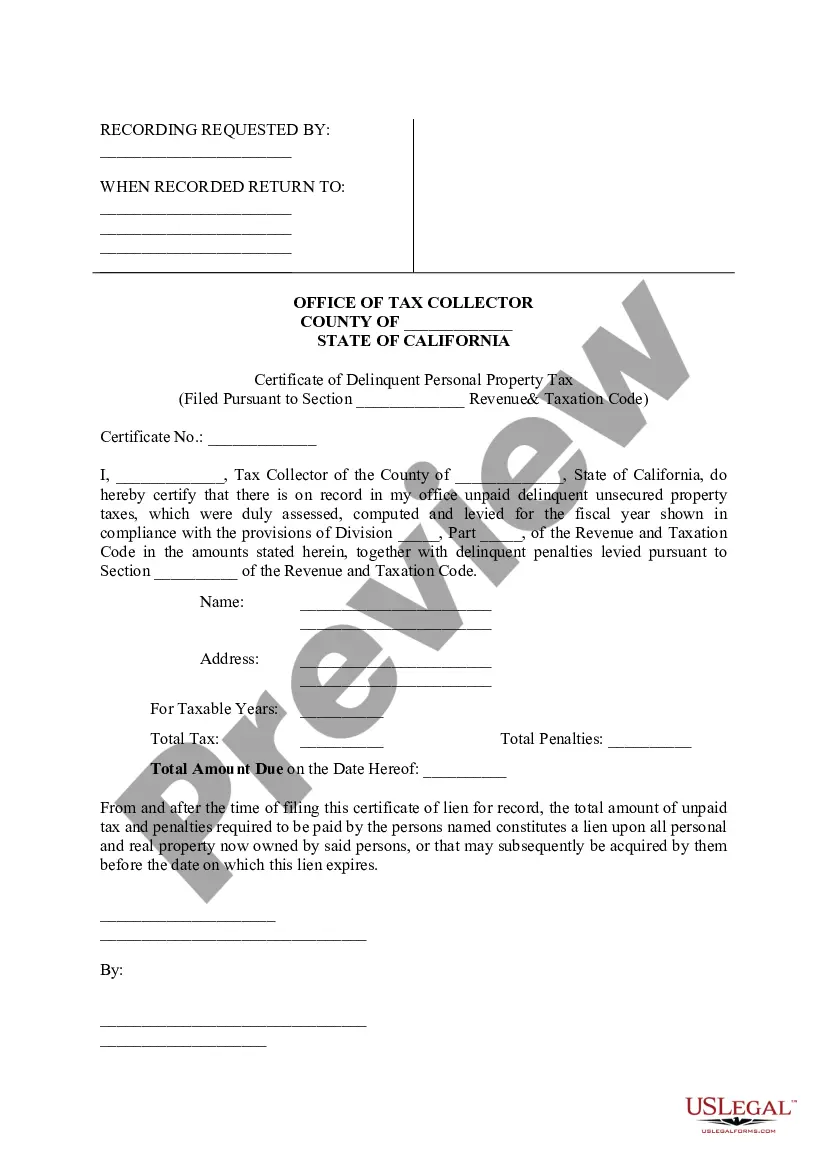

The El Monte California Certificate of Delinquent Personal Property Tax is an official document issued by the City of El Monte to notify taxpayers of their outstanding personal property tax liabilities. This certificate serves as proof of non-payment and provides crucial information regarding the delinquent taxes owed. The purpose of the El Monte California Certificate of Delinquent Personal Property Tax is to ensure compliance with tax laws and to enforce prompt payment of taxes to fund essential public services. This includes the maintenance of infrastructure, education, healthcare, and other municipal services that benefit the residents and businesses of El Monte. The certificate contains vital details such as the taxpayer's name, address, and identification number, along with the amount owed, tax year, and any accrued interest or penalties. It also includes the due date for payment and penalties for non-payment within the stipulated timeframe. Different types of El Monte California Certificates of Delinquent Personal Property Tax may include: 1. Residential Property Tax Certificate: This certificate is specific to individuals or families who own residential properties within El Monte. It notifies them of their outstanding personal property tax obligations related to their residential assets. 2. Commercial Property Tax Certificate: This type of certificate is issued to owners of commercial properties, including office spaces, retail stores, and industrial properties. It informs them about their delinquent personal property tax liabilities related to their commercial assets. 3. Vacant Land Property Tax Certificate: If a property in El Monte is unoccupied or used solely for agricultural purposes, a vacant land property tax certificate may be issued. This document notifies the landowner of their unpaid personal property taxes associated with the vacant land. 4. Rental Property Tax Certificate: This certificate is applicable to individuals or businesses that own rental properties in El Monte. It informs them about their delinquent personal property taxes owed on their rental assets, such as apartment complexes, houses, or commercial spaces. It is important for taxpayers to promptly address any outstanding personal property tax liabilities mentioned on the El Monte California Certificate of Delinquent Personal Property Tax. Failure to pay the owed amounts within the designated period may result in further penalties, legal action, or even potential seizure of assets. Seeking guidance from tax professionals or reaching out to the City of El Monte's tax department can provide assistance in resolving any issues related to these certificates.

El Monte California Certificate of Delinquent Personal Property Tax

Category:

State:

California

City:

El Monte

Control #:

CA-LR016T

Format:

Word;

Rich Text

Instant download

Description

Certificate of unpaid delinquent unsecured property taxes, Tax collector placed a lien upon all personal and real property now owned by said persons.

The El Monte California Certificate of Delinquent Personal Property Tax is an official document issued by the City of El Monte to notify taxpayers of their outstanding personal property tax liabilities. This certificate serves as proof of non-payment and provides crucial information regarding the delinquent taxes owed. The purpose of the El Monte California Certificate of Delinquent Personal Property Tax is to ensure compliance with tax laws and to enforce prompt payment of taxes to fund essential public services. This includes the maintenance of infrastructure, education, healthcare, and other municipal services that benefit the residents and businesses of El Monte. The certificate contains vital details such as the taxpayer's name, address, and identification number, along with the amount owed, tax year, and any accrued interest or penalties. It also includes the due date for payment and penalties for non-payment within the stipulated timeframe. Different types of El Monte California Certificates of Delinquent Personal Property Tax may include: 1. Residential Property Tax Certificate: This certificate is specific to individuals or families who own residential properties within El Monte. It notifies them of their outstanding personal property tax obligations related to their residential assets. 2. Commercial Property Tax Certificate: This type of certificate is issued to owners of commercial properties, including office spaces, retail stores, and industrial properties. It informs them about their delinquent personal property tax liabilities related to their commercial assets. 3. Vacant Land Property Tax Certificate: If a property in El Monte is unoccupied or used solely for agricultural purposes, a vacant land property tax certificate may be issued. This document notifies the landowner of their unpaid personal property taxes associated with the vacant land. 4. Rental Property Tax Certificate: This certificate is applicable to individuals or businesses that own rental properties in El Monte. It informs them about their delinquent personal property taxes owed on their rental assets, such as apartment complexes, houses, or commercial spaces. It is important for taxpayers to promptly address any outstanding personal property tax liabilities mentioned on the El Monte California Certificate of Delinquent Personal Property Tax. Failure to pay the owed amounts within the designated period may result in further penalties, legal action, or even potential seizure of assets. Seeking guidance from tax professionals or reaching out to the City of El Monte's tax department can provide assistance in resolving any issues related to these certificates.

How to fill out El Monte California Certificate Of Delinquent Personal Property Tax?

If you’ve already used our service before, log in to your account and download the El Monte California Certificate of Delinquent Personal Property Tax on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple actions to get your document:

- Ensure you’ve located the right document. Look through the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t suit you, use the Search tab above to find the proper one.

- Buy the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Obtain your El Monte California Certificate of Delinquent Personal Property Tax. Pick the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your individual or professional needs!