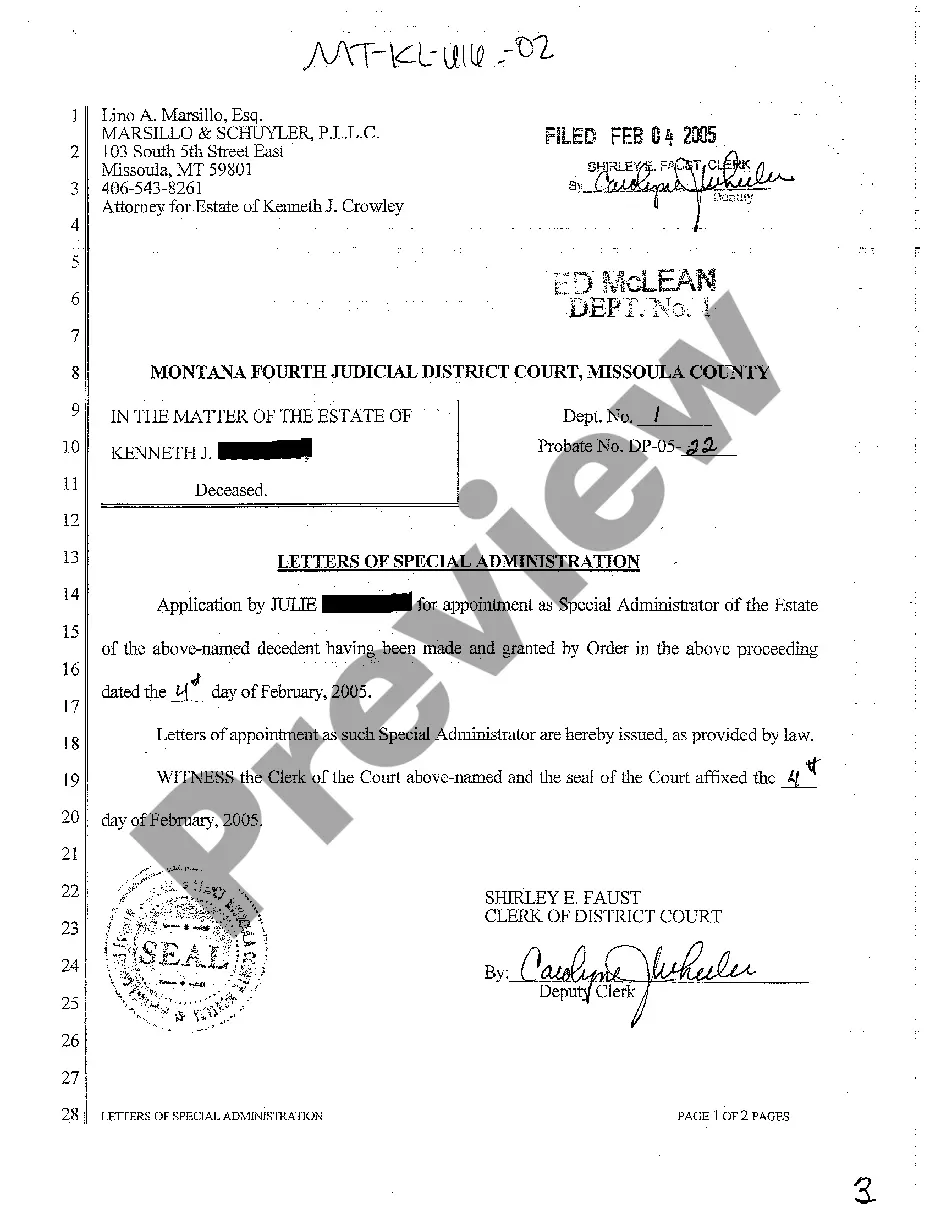

The Oceanside California Certificate of Delinquent Personal Property Tax is a legal document issued by the Oceanside government to notify taxpayers of unpaid personal property taxes. It serves as a warning for property owners who have failed to pay their due taxes on time. This certificate is a crucial aspect of tax collection efforts, helping the government recover unpaid taxes and ensure compliance with the law. Taxpayers who receive this certificate are required to settle their outstanding tax liabilities promptly to avoid further financial consequences or legal actions. Different types of Oceanside California Certificates of Delinquent Personal Property Tax include: 1. Standard Delinquent Personal Property Tax Certificate: This certificate is issued to individual taxpayers or businesses that have not paid their personal property taxes within the specified timeframe. 2. Escrow Delinquent Personal Property Tax Certificate: This certificate is issued in cases where a real estate transaction is pending, and it is discovered that the property involved has unpaid personal property taxes. The certificate ensures that the buyer and seller are aware of the delinquency, allowing them to resolve the issue before closing the transaction. 3. Lien Delinquent Personal Property Tax Certificate: When a property owner has repeatedly failed to pay their personal property taxes, the government may place a lien on their property. This certificate is issued as part of the lien process, alerting potential buyers or lenders of the outstanding tax debt associated with the property. Receiving an Oceanside California Certificate of Delinquent Personal Property Tax can have serious repercussions for taxpayers. It can result in penalties, interest charges, or even legal action taken by the government to recover the unpaid taxes. It is imperative for property owners to promptly address any delinquencies and fulfill their tax obligations to avoid these consequences. By implementing an effective tax payment system and staying informed about the property tax due dates, taxpayers can minimize the chances of receiving such certificates. Consulting with a tax professional or contacting the Oceanside tax department can provide valuable guidance on tax payment strategies and help ensure compliance with personal property tax regulations.

Oceanside California Certificate of Delinquent Personal Property Tax

Description

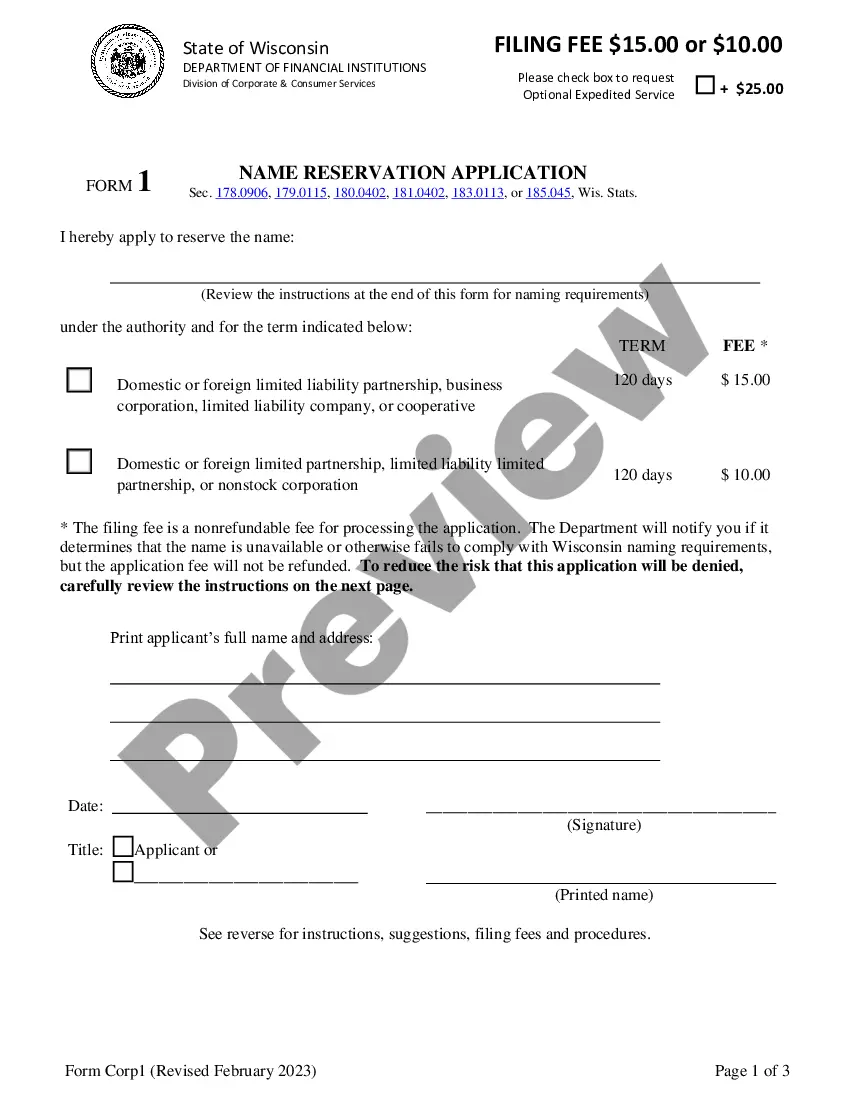

How to fill out Oceanside California Certificate Of Delinquent Personal Property Tax?

If you are looking for a suitable form, it’s incredibly challenging to select a more suitable location than the US Legal Forms website – one of the most extensive online repositories.

With this collection, you can locate numerous templates for both organization and personal use by categories and states, or keyword phrases.

With the high-quality search feature, obtaining the latest Oceanside California Certificate of Delinquent Personal Property Tax is as simple as 1-2-3.

Complete the payment. Utilize your credit card or PayPal account to finalize the registration process.

Obtain the template. Choose the file format and save it to your device.

- Additionally, the relevance of each document is validated by a team of expert attorneys who regularly review the templates on our site and refresh them according to the most recent state and county regulations.

- If you are already familiar with our platform and possess an account, all you need to do to obtain the Oceanside California Certificate of Delinquent Personal Property Tax is to Log In to your account and click the Download button.

- If you are utilizing US Legal Forms for the very first time, simply follow the instructions outlined below.

- Ensure you have located the form you require. Review its description and use the Preview feature to examine its content. If it doesn’t satisfy your requirements, use the Search function at the top of the page to find the appropriate document.

- Confirm your choice. Click the Buy now button. After that, select your desired pricing plan and provide information to create an account.

Form popularity

FAQ

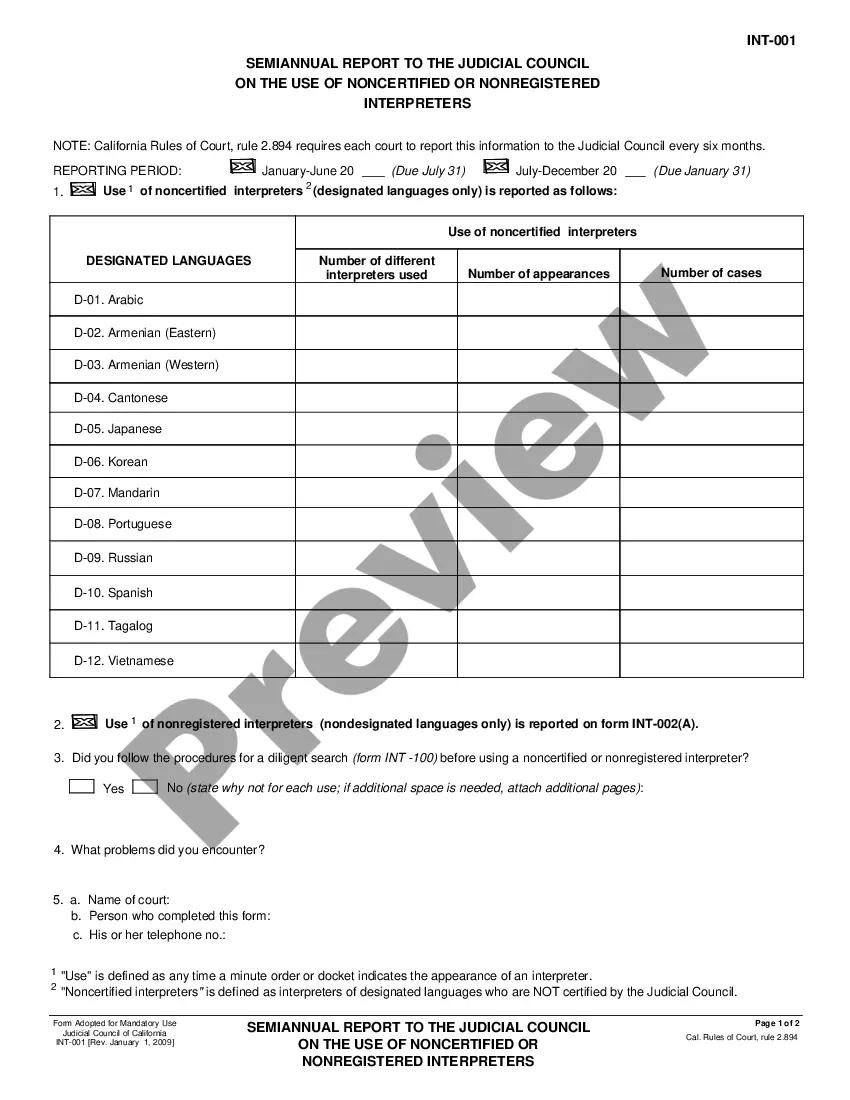

The property tax due date in California is the date by which payments must be received to avoid penalties, typically occurring twice a year. The delinquent date is the point at which unpaid taxes become delinquent, resulting in additional interest and penalties. Understanding this difference is critical to maintaining good standing with property taxes. The Oceanside California Certificate of Delinquent Personal Property Tax provides key insights into these deadlines and their implications.

The property tax loophole in California refers to a provision in Proposition 13 that limits tax increases based on property value assessments. This means that properties sold may not see a significant tax increase until there is a change in ownership. While this offers some financial relief, it may also create disparities in tax burdens among property owners. Awareness of the Oceanside California Certificate of Delinquent Personal Property Tax can help owners navigate this complex landscape.

To find property records in San Diego County, you can visit the county's Assessor-Recorder's office or access their online database. Searching by property address or APN number typically yields the necessary information. If you're interested in properties with delinquent taxes, the Oceanside California Certificate of Delinquent Personal Property Tax is a useful reference to locate relevant records and understand obligations.

In California, property owners can be delinquent on property taxes for up to five years before the county begins the foreclosure process. After the initial deadline, the county may begin to assess additional penalties and interest. It is essential to address any outstanding obligations before reaching this limit to prevent losing your property. The Oceanside California Certificate of Delinquent Personal Property Tax can help you understand your timeline and options.

When property taxes become delinquent in California, local governments can impose penalties, interest, and eventually place a lien on the property. This lien can lead to foreclosure if the taxes remain unpaid. In specific cases, the county may also sell the certificate of delinquent taxes, affecting the property owner's credit standing. Understanding the implications of the Oceanside California Certificate of Delinquent Personal Property Tax is crucial for timely compliance.

To obtain a copy of your property tax bill in California, you can start by visiting the local tax assessor's office or their website. Additionally, some counties allow you to access your tax information online; simply enter your property details. If you're facing issues or need further assistance, you can consider using the US Legal Forms platform to easily navigate the process related to the Oceanside California Certificate of Delinquent Personal Property Tax. This ensures you have the necessary documents at your fingertips.

In California, property owners can go for up to five years without paying property taxes before their property is auctioned. During this time, the county issues an Oceanside California Certificate of Delinquent Personal Property Tax to formally document the delinquency. It’s crucial to address your delinquent taxes promptly, as the auction process could lead to the loss of your property. Understanding this timeline can help you make informed decisions regarding tax payments.

To buy abandoned property in California, you must first identify the property and verify its status. Often, abandoned properties may be tied to delinquent taxes, and acquiring an Oceanside California Certificate of Delinquent Personal Property Tax can assist you in understanding the tax obligations. Once you have the necessary information, you may need to take steps such as contacting the owner or attending a tax lien sale. Consulting experts, like the ones at uslegalforms, can help guide you through the purchasing process.