The Pomona California Certificate of Delinquent Personal Property Tax is an important document that reflects unpaid taxes on personal property within the city. This certificate is issued by the Pomona City Treasurer's Office in compliance with California state laws. It serves as evidence of unpaid taxes and provides detailed information regarding the property owner, amount due, and the specific delinquent tax year. When a taxpayer fails to pay their personal property taxes before the specified deadline, the City Treasurer's Office initiates the delinquent tax process. The process may include sending multiple notices and reminders to the taxpayer. If the overdue taxes remain unpaid, a Certificate of Delinquent Personal Property Tax is ultimately issued, highlighting the outstanding tax balance. The Pomona California Certificate of Delinquent Personal Property Tax includes several key details. It mentions the taxpayer's name, address, and contact information. Additionally, it provides a comprehensive account of the specific personal property on which taxes have not been paid. This certificate also outlines the tax year(s) for which the payment is overdue and indicates the total amount owed, including any associated penalties or interest. It is important to note that there are different types of Pomona California Certificates of Delinquent Personal Property Tax, depending on the severity and duration of the delinquency. 1. Initial Notice of Delinquency: This is the first notification sent to taxpayers who have failed to pay their personal property taxes on time. It outlines the amount overdue and provides instructions for payment. 2. Second Notice of Delinquency: If the taxpayer fails to respond or make payment after the initial notice, a second notice is sent. This typically includes a stricter warning of potential consequences for continued non-payment. 3. Final Notice of Delinquency: If the tax remains unpaid after the second notice, a final notice is issued. This notice may list the specific penalties, interest, or legal actions that could be taken against the taxpayer. 4. Certificate of Delinquent Personal Property Tax: This certificate is the culmination of the delinquent tax process. It is generated after all the required notices have been sent and provides an official record of the outstanding tax liability. It is important for taxpayers in Pomona, California, to promptly address any Personal Property Tax obligations to avoid the issuance of a Certificate of Delinquent Personal Property Tax. Failure to resolve the delinquent taxes may result in legal actions such as property liens, tax sales, or further penalties, impacting both the taxpayer's financial standing and property ownership rights.

Pomona California Certificate of Delinquent Personal Property Tax

Description

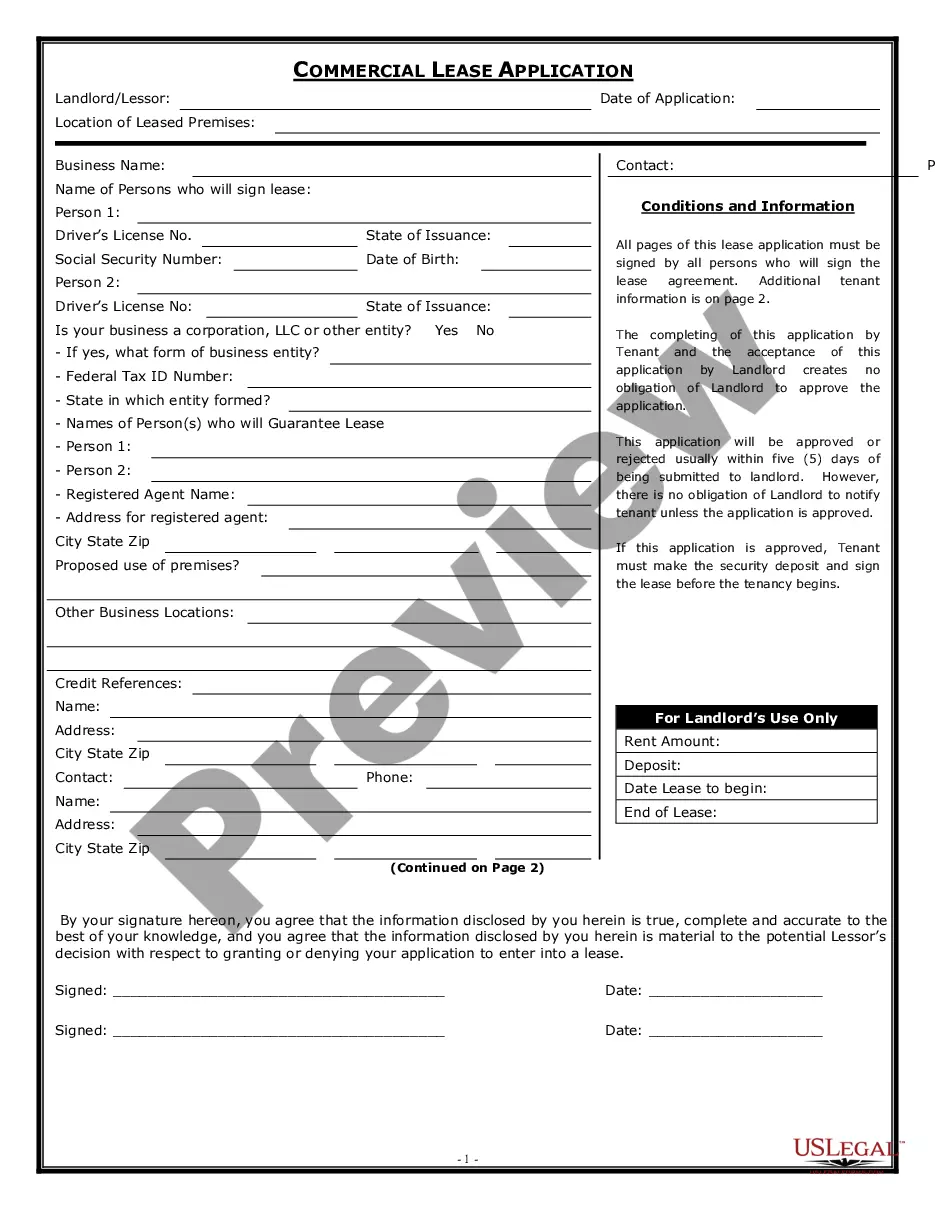

How to fill out Pomona California Certificate Of Delinquent Personal Property Tax?

We always want to reduce or avoid legal damage when dealing with nuanced legal or financial affairs. To do so, we apply for legal services that, as a rule, are extremely costly. Nevertheless, not all legal matters are as just complex. Most of them can be taken care of by ourselves.

US Legal Forms is an online catalog of up-to-date DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without using services of a lawyer. We provide access to legal form templates that aren’t always openly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Pomona California Certificate of Delinquent Personal Property Tax or any other form quickly and safely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always re-download it in the My Forms tab.

The process is just as effortless if you’re new to the website! You can create your account in a matter of minutes.

- Make sure to check if the Pomona California Certificate of Delinquent Personal Property Tax complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s description (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve ensured that the Pomona California Certificate of Delinquent Personal Property Tax would work for your case, you can choose the subscription plan and make a payment.

- Then you can download the document in any available file format.

For more than 24 years of our presence on the market, we’ve served millions of people by offering ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save efforts and resources!