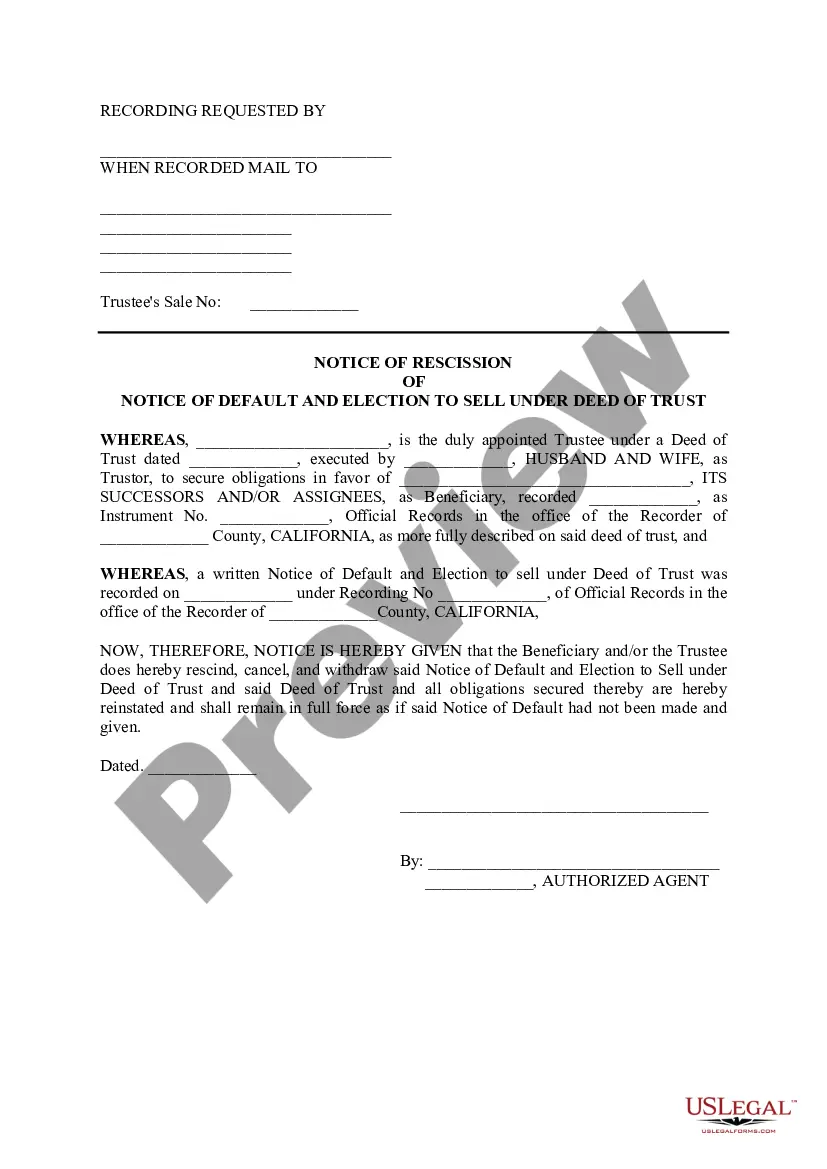

The Certificate of Delinquent Personal Property Tax in Rancho Cucamonga, California is an important document used to address outstanding personal property tax obligations. This certificate is issued by the County Treasurer-Tax Collector's office to individuals or organizations that have failed to pay their personal property taxes in a timely manner. The Certificate of Delinquent Personal Property Tax serves as a legal instrument for the enforcement of tax collection and is typically issued after multiple attempts have been made to inform and remind taxpayers of their unpaid taxes. This document outlines the specific amount of delinquent taxes owed, as well as any penalties or interest that may have accrued. When a taxpayer receives a Certificate of Delinquent Personal Property Tax, it is important to take immediate action to rectify the situation. Failure to address the outstanding taxes can lead to further penalties, potential liens on personal property, and even the possibility of a tax sale. There are different types of Rancho Cucamonga, California Certificates of Delinquent Personal Property Tax, which include: 1. Annual Personal Property Taxes: These are taxes assessed on tangible personal property used for business purposes, such as equipment, machinery, furniture, and fixtures. The certificate for delinquent annual personal property taxes specifically addresses the unpaid taxes related to these assets. 2. Unsecured Property Taxes: Unsecured property taxes are levied on personal property that does not have a lien or claim against it, such as boats, aircraft, and business licenses. The certificate for delinquent unsecured property taxes applies to the outstanding taxes related to these types of assets. Obtaining a Rancho Cucamonga, California Certificate of Delinquent Personal Property Tax can be a serious matter, as it puts the taxpayer on notice that their overdue taxes must be addressed promptly. It serves as a warning sign that immediate action is necessary to bring the tax account up to date. To resolve the delinquency, taxpayers should contact the County Treasurer-Tax Collector's office and inquire about the payment options available. Various payment methods, such as installments or lump-sum payments, may be offered based on individual circumstances. Timely payment of the delinquent taxes and any associated fees will help prevent further consequences and safeguard the taxpayer's personal property from potential liens or tax sales. In conclusion, the Rancho Cucamonga, California Certificate of Delinquent Personal Property Tax is a crucial document that communicates the existence of outstanding personal property taxes. It is essential for taxpayers to address these delinquencies promptly to avoid potential penalties, liens, or tax sales.

Rancho Cucamonga California Certificate of Delinquent Personal Property Tax

Description

How to fill out Rancho Cucamonga California Certificate Of Delinquent Personal Property Tax?

Are you looking for a reliable and inexpensive legal forms supplier to get the Rancho Cucamonga California Certificate of Delinquent Personal Property Tax? US Legal Forms is your go-to solution.

No matter if you need a basic arrangement to set regulations for cohabitating with your partner or a package of documents to move your separation or divorce through the court, we got you covered. Our website offers over 85,000 up-to-date legal document templates for personal and business use. All templates that we offer aren’t generic and framed in accordance with the requirements of separate state and county.

To download the form, you need to log in account, find the required form, and hit the Download button next to it. Please remember that you can download your previously purchased document templates at any time from the My Forms tab.

Is the first time you visit our platform? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Find out if the Rancho Cucamonga California Certificate of Delinquent Personal Property Tax conforms to the laws of your state and local area.

- Read the form’s description (if available) to learn who and what the form is good for.

- Restart the search in case the form isn’t good for your specific scenario.

Now you can create your account. Then choose the subscription option and proceed to payment. As soon as the payment is done, download the Rancho Cucamonga California Certificate of Delinquent Personal Property Tax in any available format. You can get back to the website at any time and redownload the form free of charge.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a try today, and forget about spending hours learning about legal papers online once and for all.