Title: Understanding the Vacaville, California Certificate of Delinquent Personal Property Tax Introduction: The Vacaville, California Certificate of Delinquent Personal Property Tax is an official document issued by the Vacaville Municipal Government. It serves as a notification and proof of unpaid personal property taxes in the city. In this article, we will delve into the details of the Vacaville California Certificate of Delinquent Personal Property Tax, its purpose, types, and procedures to resolve any outstanding tax delinquencies. Purpose of the Certificate: The main purpose of the Vacaville California Certificate of Delinquent Personal Property Tax is to alert property owners of their unpaid personal property taxes, emphasizing the urgency in settling them. It acts as a legal record to confirm and notify property owners about the outstanding tax amount along with any penalties and interest accrued. Types of Vacaville California Certificate of Delinquent Personal Property Tax: 1. Initial Notice of Delinquency: This type of certificate is issued to property owners who have failed to pay their personal property taxes within the specified deadline. It serves as an initial warning regarding the outstanding taxes and provides information about the overdue amount, penalties, and interest. 2. Final Notice of Delinquency: If property owners fail to clear their unpaid personal property taxes after receiving the initial notice, a final notice is issued. This certificate is sent as a last warning before further legal actions are taken or a lien is placed on the delinquent property. 3. Certificate of Sale: In cases where property owners continue to neglect their unpaid personal property taxes, the Vacaville Municipal Government may proceed with a tax sale. The Certificate of Sale is then issued, stating that the property will be auctioned off to recover the outstanding taxes and any associated fees. Procedure to Resolve Delinquent Personal Property Taxes: To resolve any outstanding personal property taxes mentioned in the Vacaville California Certificate of Delinquent Personal Property Tax, property owners must follow these steps: 1. Contact the Tax Collector's Office: The property owner should get in touch with the Vacaville Municipal Government Tax Collector's Office to discuss the delinquent taxes, obtain accurate information about the outstanding amount, and explore available payment options. 2. Clearing the Debt: Upon contacting the Tax Collector's Office, various payment options can be explored, including full payment, setting up a payment plan, or negotiating a reduced settlement amount. The property owner should abide by the agreed-upon payment terms promptly to avoid further penalties. 3. Disputing the Delinquency: If property owners believe an error has occurred or wish to dispute the delinquency claim mentioned in the certificate, they should communicate their concerns with the Vacaville Tax Collector's Office. Providing adequate documentation and evidence to substantiate the dispute is necessary for a favorable resolution. Conclusion: The Vacaville, California Certificate of Delinquent Personal Property Tax plays a crucial role in notifying property owners about their unpaid personal property taxes. It is essential for property owners to address and resolve these delinquencies promptly to avoid potential legal consequences. By understanding the types of certificates and following the appropriate procedures, property owners can protect their property rights and financial standing.

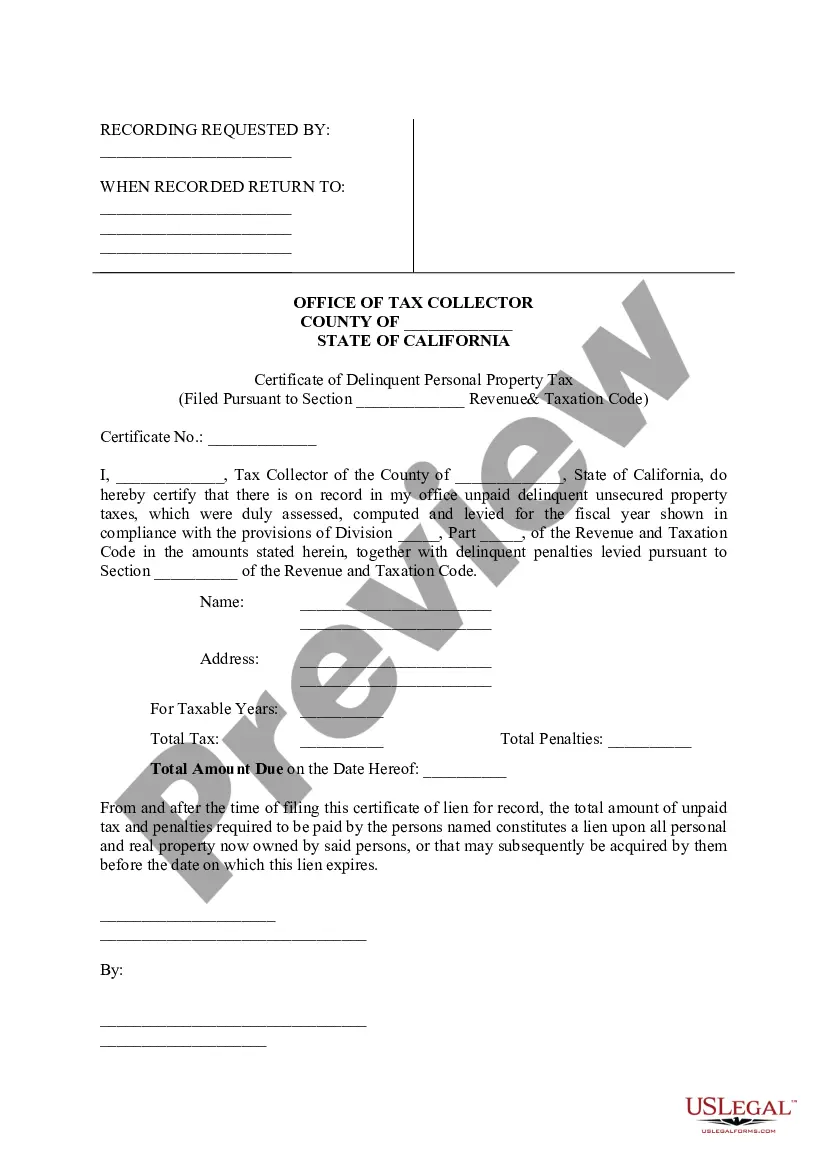

Vacaville California Certificate of Delinquent Personal Property Tax

Description

How to fill out Vacaville California Certificate Of Delinquent Personal Property Tax?

Finding verified templates specific to your local regulations can be difficult unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both individual and professional needs and any real-life situations. All the documents are properly grouped by area of usage and jurisdiction areas, so searching for the Vacaville California Certificate of Delinquent Personal Property Tax gets as quick and easy as ABC.

For everyone already acquainted with our service and has used it before, obtaining the Vacaville California Certificate of Delinquent Personal Property Tax takes just a few clicks. All you need to do is log in to your account, select the document, and click Download to save it on your device. This process will take just a couple of additional actions to complete for new users.

Follow the guidelines below to get started with the most extensive online form library:

- Check the Preview mode and form description. Make certain you’ve chosen the correct one that meets your requirements and totally corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you find any inconsistency, use the Search tab above to find the correct one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and choose the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the subscription.

- Download the Vacaville California Certificate of Delinquent Personal Property Tax. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Take advantage of the US Legal Forms library to always have essential document templates for any needs just at your hand!