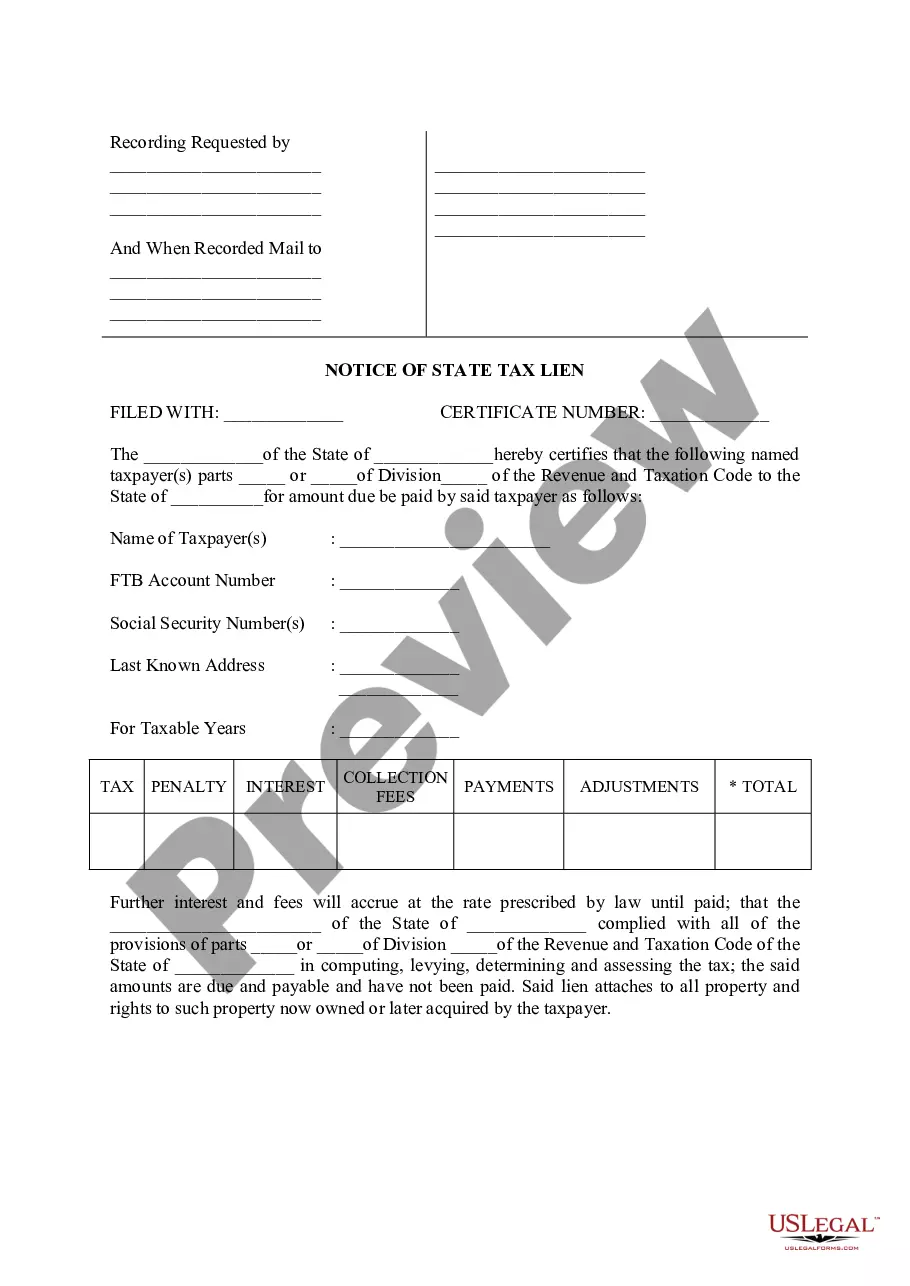

The Burbank California Notice of State Tax Lien is an important legal document that notifies individuals or businesses in Burbank, California about their outstanding tax liabilities to the state. It serves as a public record of the debt owed to the California Franchise Tax Board (FT) and is filed with the Burbank County Clerk's Office. When a taxpayer fails to pay their state taxes or fulfill their tax obligations, the FT has the authority to place a lien on their property or assets to secure the debt owed. The Burbank California Notice of State Tax Lien acts as a formal warning that the FT has a legal claim against the taxpayer's property. This lien serves to protect the interests of the state and ensures that the taxpayer cannot sell or transfer their property without satisfying their tax obligations. There are different types of Burbank California Notice of State Tax Liens, categorized based on their purpose or stage of enforcement. These include: 1. Preliminary Notice of State Tax Lien: This notice is typically sent to the taxpayer after initial attempts have been made to contact them regarding their tax liabilities. It serves as a preliminary warning that a lien may be filed if the taxpayer does not take appropriate action. 2. Notice of State Tax Lien Filing: This is the official notice that informs the taxpayer that a lien has been filed against their property or assets. It is recorded in the public records to establish the FT's legal claim. This notice can severely impact the taxpayer's credit score and may make it difficult for them to obtain credit. 3. Notice of State Tax Lien Release: This notice is issued when the taxpayer has paid off their outstanding tax debt or has successfully engaged in a resolution process such as an installment agreement or an offer in compromise. It signifies that the lien has been released, removing the legal claim against the taxpayer's property. 4. Notice of State Tax Lien Withdrawal: In certain cases, the FT may withdraw the Notice of State Tax Lien if there were errors in the filing or if it is determined that the lien was filed erroneously. The Notice of State Tax Lien Withdrawal is then filed to remove the lien from public records. It is crucial for taxpayers who receive a Burbank California Notice of State Tax Lien to take immediate action to resolve their tax debt. Ignoring or neglecting this notice can lead to more severe consequences, such as wage garnishment, bank levies, or property seizures. Seeking professional assistance from a tax attorney or certified public accountant is often advised to navigate the complex process of resolving a state tax lien and ensuring compliance with all necessary requirements.

Burbank California Notice of State Tax Lien

Description

How to fill out Burbank California Notice Of State Tax Lien?

We always want to reduce or prevent legal damage when dealing with nuanced legal or financial affairs. To do so, we apply for attorney services that, as a rule, are extremely expensive. Nevertheless, not all legal matters are as just complex. Most of them can be taken care of by ourselves.

US Legal Forms is an online collection of up-to-date DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without the need of turning to legal counsel. We provide access to legal form templates that aren’t always openly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Burbank California Notice of State Tax Lien or any other form quickly and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always re-download it in the My Forms tab.

The process is just as straightforward if you’re new to the platform! You can create your account within minutes.

- Make sure to check if the Burbank California Notice of State Tax Lien complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s description (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve made sure that the Burbank California Notice of State Tax Lien would work for your case, you can choose the subscription option and make a payment.

- Then you can download the form in any available format.

For over 24 years of our presence on the market, we’ve helped millions of people by offering ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save time and resources!