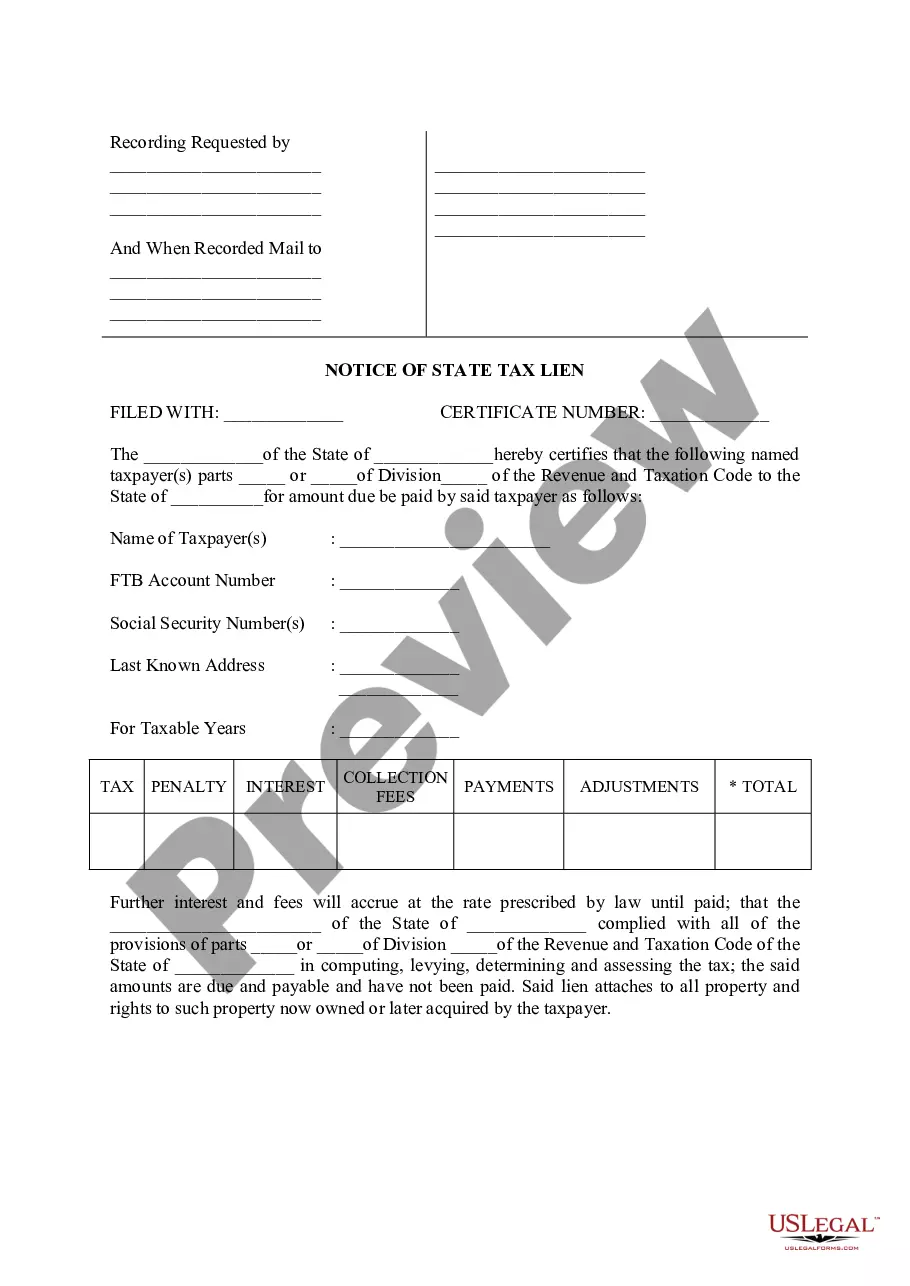

The El Cajon California Notice of State Tax Lien is an official document that serves as a public notice of a tax lien on a taxpayer's property in El Cajon, California due to unpaid state taxes. When an individual or business fails to pay their state taxes, the California Franchise Tax Board has the authority to place a tax lien on their property to secure the debt. This notice provides detailed information about the tax lien, including the amount owed, the date it was imposed, and the taxpayer's identification number. It also includes the specific property that has been encumbered by the lien, such as real estate, personal property, or financial accounts. The El Cajon California Notice of State Tax Lien is a crucial legal document that can have serious implications for the taxpayer. It serves as a public record and can negatively impact their credit rating, making it challenging to obtain loans or credit in the future. Additionally, the lien may also allow the state to seize the encumbered property to satisfy the outstanding tax debt. There are several types of El Cajon California Notice of State Tax Lien that can be issued, depending on the circumstances. Some different types include: 1. General Notice of State Tax Lien: This is the most common type of notice, issued to provide public notice of a tax lien on all property owned by the taxpayer in El Cajon, California. 2. Specific Notice of State Tax Lien: This notice is issued for a specific property, such as a particular piece of real estate or a specific bank account, that has been encumbered by the tax lien. 3. Subordination Notice of State Tax Lien: This type of notice is issued when the state tax lien is subordinated to another existing lien on the property. It means that the other lien holder has a higher priority in the event of a foreclosure or sale of the property. It is essential for taxpayers in El Cajon, California to take the El Cajon California Notice of State Tax Lien seriously and take appropriate action to resolve their tax obligations. Ignoring or neglecting this notice can result in severe consequences, including the potential loss of property and further financial difficulties. Seeking professional advice and assistance from tax professionals or lawyers specialized in tax matters is highly recommended navigating through the complexities of state tax liens.

El Cajon California Notice of State Tax Lien

Category:

State:

California

City:

El Cajon

Control #:

CA-LR017T

Format:

Word;

Rich Text

Instant download

Description

A lien exists in favor of the State of California for nonpayment of tax, interest, penalties, and costs as assessed.

The El Cajon California Notice of State Tax Lien is an official document that serves as a public notice of a tax lien on a taxpayer's property in El Cajon, California due to unpaid state taxes. When an individual or business fails to pay their state taxes, the California Franchise Tax Board has the authority to place a tax lien on their property to secure the debt. This notice provides detailed information about the tax lien, including the amount owed, the date it was imposed, and the taxpayer's identification number. It also includes the specific property that has been encumbered by the lien, such as real estate, personal property, or financial accounts. The El Cajon California Notice of State Tax Lien is a crucial legal document that can have serious implications for the taxpayer. It serves as a public record and can negatively impact their credit rating, making it challenging to obtain loans or credit in the future. Additionally, the lien may also allow the state to seize the encumbered property to satisfy the outstanding tax debt. There are several types of El Cajon California Notice of State Tax Lien that can be issued, depending on the circumstances. Some different types include: 1. General Notice of State Tax Lien: This is the most common type of notice, issued to provide public notice of a tax lien on all property owned by the taxpayer in El Cajon, California. 2. Specific Notice of State Tax Lien: This notice is issued for a specific property, such as a particular piece of real estate or a specific bank account, that has been encumbered by the tax lien. 3. Subordination Notice of State Tax Lien: This type of notice is issued when the state tax lien is subordinated to another existing lien on the property. It means that the other lien holder has a higher priority in the event of a foreclosure or sale of the property. It is essential for taxpayers in El Cajon, California to take the El Cajon California Notice of State Tax Lien seriously and take appropriate action to resolve their tax obligations. Ignoring or neglecting this notice can result in severe consequences, including the potential loss of property and further financial difficulties. Seeking professional advice and assistance from tax professionals or lawyers specialized in tax matters is highly recommended navigating through the complexities of state tax liens.

Free preview

How to fill out El Cajon California Notice Of State Tax Lien?

If you’ve already utilized our service before, log in to your account and download the El Cajon California Notice of State Tax Lien on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple steps to get your file:

- Ensure you’ve found the right document. Look through the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t fit you, use the Search tab above to find the appropriate one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Obtain your El Cajon California Notice of State Tax Lien. Pick the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have bought: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to easily find and save any template for your personal or professional needs!