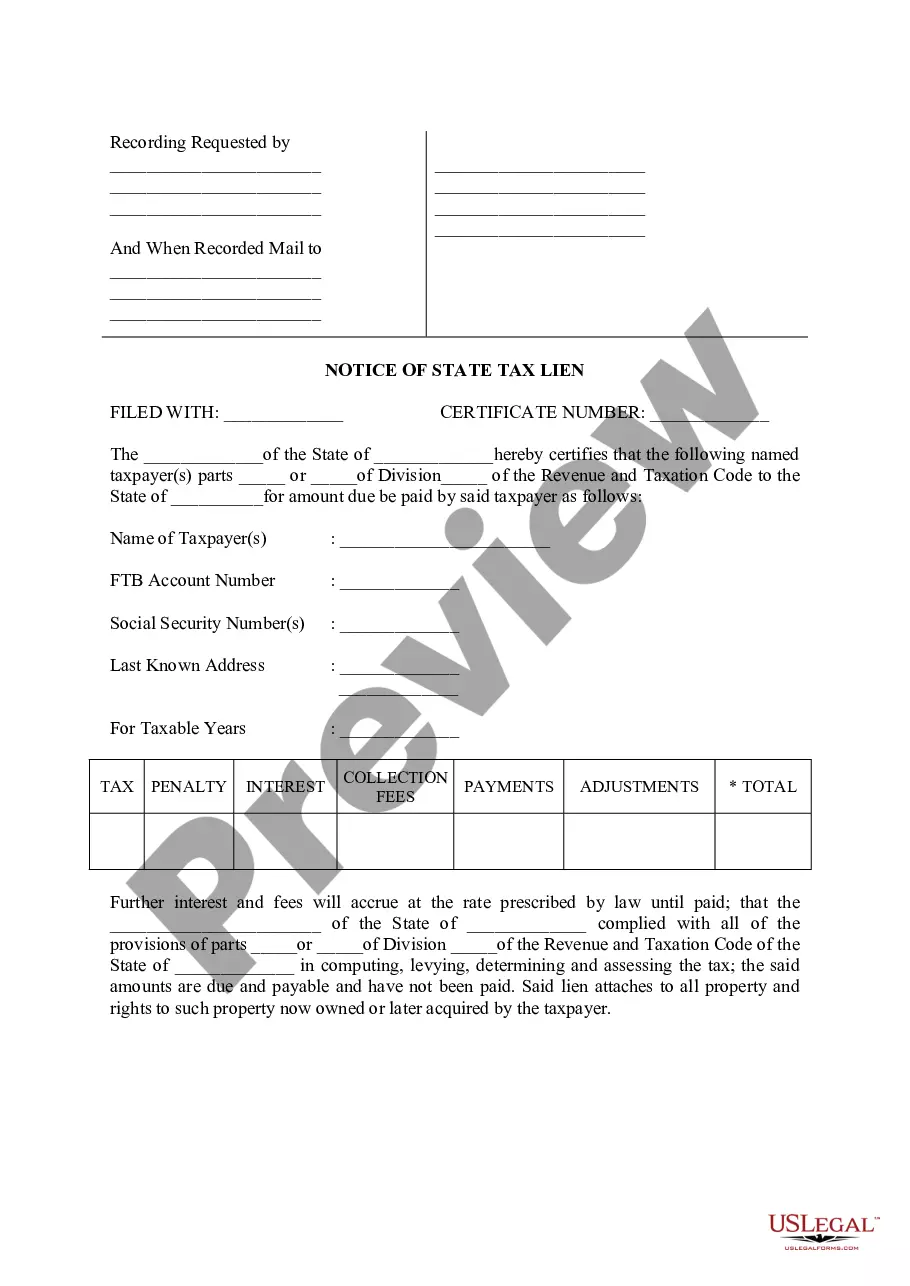

Elk Grove California Notice of State Tax Lien: A Comprehensive Overview Introduction: The Elk Grove California Notice of State Tax Lien is a legal document filed by the California Franchise Tax Board (FT) to inform the public that an individual or business owes delinquent state taxes. This lien serves as a public record of the debt and protects the state's interest in recovering the owed taxes. This comprehensive guide will provide an in-depth understanding of the Elk Grove California Notice of State Tax Lien, including its purpose, implications, types, and resolution options. Purpose of the Lien: The primary purpose of the Elk Grove California Notice of State Tax Lien is to establish a claim against the property and assets of the taxpayer. By filing the notice, the state ensures its priority over other creditors or potential buyers when it comes to seizure or sale of the taxpayer's assets to recover the unpaid taxes. It essentially acts as a public notification, warning creditors and potential buyers about the existence of the tax debt. Implications of the Lien: The filing of an Elk Grove California Notice of State Tax Lien can have significant implications for the taxpayer. These include: 1. Impact on Creditworthiness: The lien negatively affects the taxpayer's credit rating, making it difficult to secure loans, mortgages, or lines of credit in the future. It may also result in higher interest rates on existing credit accounts. 2. Limited Property Rights: The lien attaches to all real estate and personal property owned by the taxpayer, limiting their ability to sell or transfer assets without satisfying the tax debt. 3. Inhibited Business Operations: For businesses, the lien may hinder their ability to obtain necessary financing, secure contracts, or maintain business relationships. Types of Elk Grove California Notice of State Tax Lien: There are two main types of Elk Grove California Notice of State Tax Lien: 1. Statutory Lien: This is filed when a taxpayer neglects or refuses to pay their state tax liability after receiving multiple notices and demands for payment. The lien creates an automatic claim on the taxpayer's property and assets. 2. Final Lien: This is filed when the taxpayer has exhausted all administrative appeal options and the tax debt remains unpaid. The final lien serves as a formal notice of intent to seize and sell the taxpayer's assets to satisfy the outstanding taxes. Resolution Options: For taxpayers facing an Elk Grove California Notice of State Tax Lien, there are various options for resolution: 1. Paying the Debt in Full: The most straightforward option is to pay the full amount owed, including any accrued interest and penalties. This will result in the release of the lien. 2. Installment Agreement: Taxpayers can negotiate an installment agreement with the FT to repay the debt over time. This allows for manageable monthly payments, potentially preventing further collection actions. 3. Offer in Compromise: In specific circumstances, taxpayers can propose an offer in compromise to settle the tax debt for less than the full amount owed. The FT assesses the taxpayer's financial situation to determine if they qualify for this option. 4. Discharge of Property: Taxpayers can request the release of a specific property from the lien if it prevents the sale or refinancing of said property. The FT evaluates each request individually. Conclusion: Understanding the Elk Grove California Notice of State Tax Lien is crucial for taxpayers dealing with delinquent state tax liabilities. Being aware of its implications and the available resolution options empowers individuals and businesses in effectively managing their tax obligations. It is recommended to consult with a tax professional or attorney for personalized advice and assistance related to one's specific situation.

Elk Grove California Notice of State Tax Lien

Description

How to fill out Elk Grove California Notice Of State Tax Lien?

We always strive to minimize or avoid legal issues when dealing with nuanced law-related or financial affairs. To do so, we sign up for attorney solutions that, usually, are very costly. However, not all legal issues are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based library of up-to-date DIY legal forms covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without the need of turning to legal counsel. We offer access to legal form templates that aren’t always publicly accessible. Our templates are state- and area-specific, which significantly facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Elk Grove California Notice of State Tax Lien or any other form quickly and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always re-download it in the My Forms tab.

The process is equally straightforward if you’re unfamiliar with the website! You can register your account in a matter of minutes.

- Make sure to check if the Elk Grove California Notice of State Tax Lien complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s outline (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve made sure that the Elk Grove California Notice of State Tax Lien is suitable for your case, you can pick the subscription plan and proceed to payment.

- Then you can download the form in any available format.

For more than 24 years of our presence on the market, we’ve served millions of people by offering ready to customize and up-to-date legal forms. Take advantage of US Legal Forms now to save efforts and resources!