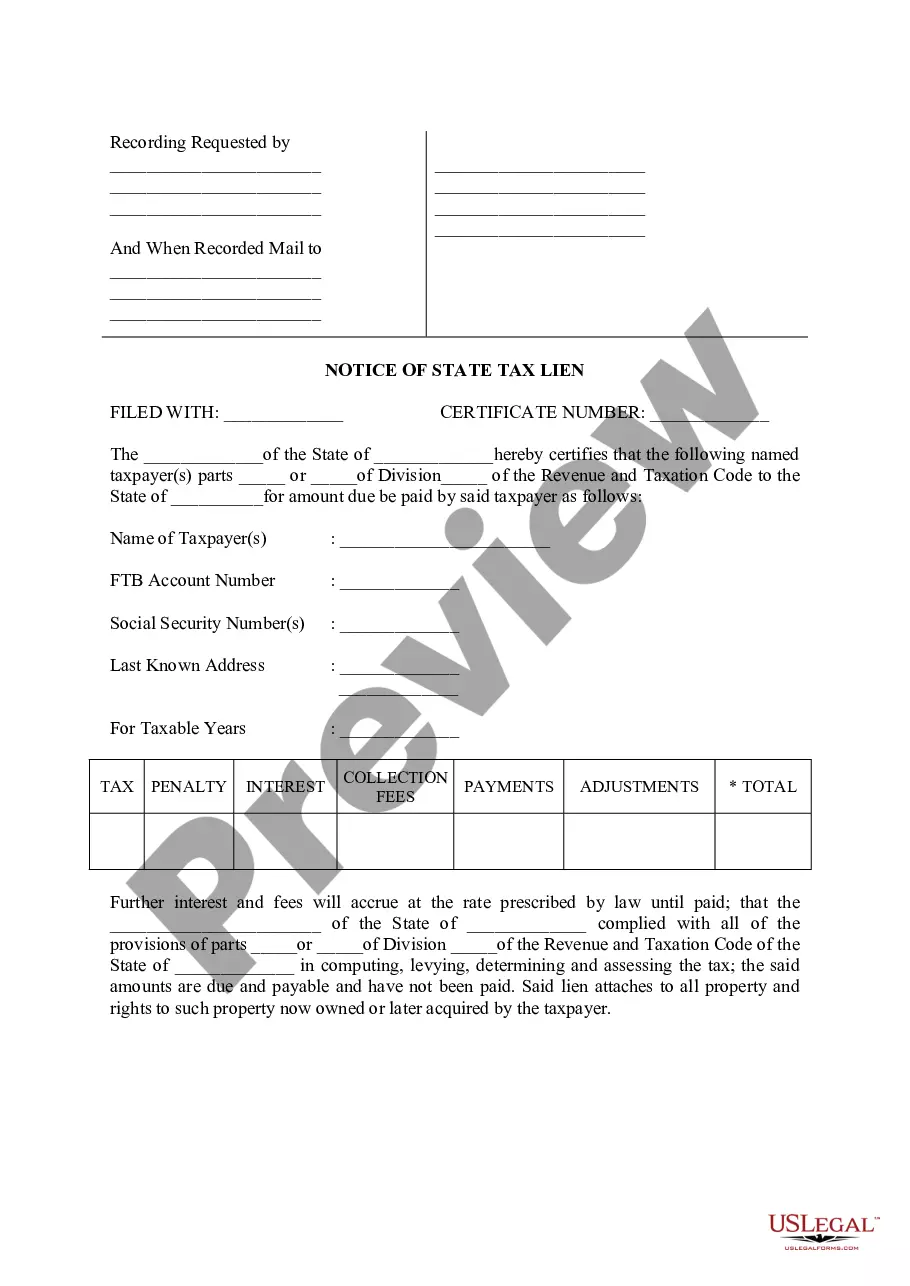

Huntington Beach, located in Orange County, California, is well-known for its stunning coastline, vibrant lifestyle, and flourishing business community. However, like any other city, Huntington Beach residents and businesses are required to pay their fair share of taxes. In the unfortunate event of delinquent taxes, the State of California may place a lien on an individual or business's property or assets until the outstanding taxes are paid. This legal document is referred to as the Huntington Beach California Notice of State Tax Lien. The Huntington Beach California Notice of State Tax Lien serves as a public record, alerting creditors, potential lenders, and interested parties of the outstanding tax debt. When the lien is filed, it attaches to the debtor's real estate, personal property, business assets, or any other property rights. This means that the debtor's property cannot be sold, refinanced, or transferred without clearing the lien or obtaining the necessary permissions from the state tax agency. There are a few different types of Huntington Beach California Notice of State Tax Liens, each pertaining to specific scenarios. These may include: 1. Personal Income Tax Lien: The State of California may file a notice of tax lien if an individual fails to pay their personal income taxes or neglects to resolve their outstanding tax debt. 2. Business-Related Tax Lien: This type of lien is commonly issued when a business owner fails to pay their business-related taxes, such as sales tax, use tax, or payroll taxes. 3. Property Tax Lien: Property owners who fall behind on their property tax payments may face a notice of lien, which can prevent them from selling or refinancing their property until the debt is settled. 4. Employment Tax Lien: Employers are required to withhold and pay employment taxes on behalf of their employees. If these taxes are not remitted, the State of California can file an employment tax lien against the business. It's essential to understand that a Huntington Beach California Notice of State Tax Lien can have severe consequences for the debtor. Aside from impeding property transactions, the presence of a lien may lower the debtor's creditworthiness, making it challenging to secure loans or credit. Additionally, the state may choose to pursue further legal actions, such as wage garnishment or asset seizure, to satisfy the outstanding tax debt. To remove the lien and regain control over their property, individuals or businesses must satisfy the tax debt. They can achieve this by paying the full amount owed, entering into a payment plan with the state tax agency, or negotiating a settlement agreement. Once the debt is resolved, the debtor should request a release of the lien, which will be recorded with the respective county recorder's office, officially clearing the encumbrance off their property. In summary, a Huntington Beach California Notice of State Tax Lien is a legal document that serves as public notice of a taxpayer's outstanding tax debt. Property owners and individuals in Huntington Beach should strive to meet their tax obligations promptly to avoid a lien being filed against their assets.

Huntington Beach California Notice of State Tax Lien

Description

How to fill out Huntington Beach California Notice Of State Tax Lien?

Getting verified templates specific to your local laws can be challenging unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both personal and professional needs and any real-life scenarios. All the documents are properly grouped by area of usage and jurisdiction areas, so searching for the Huntington Beach California Notice of State Tax Lien becomes as quick and easy as ABC.

For everyone already acquainted with our catalogue and has used it before, getting the Huntington Beach California Notice of State Tax Lien takes just a couple of clicks. All you need to do is log in to your account, pick the document, and click Download to save it on your device. This process will take just a couple of additional steps to complete for new users.

Adhere to the guidelines below to get started with the most extensive online form catalogue:

- Look at the Preview mode and form description. Make certain you’ve chosen the right one that meets your requirements and fully corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you see any inconsistency, utilize the Search tab above to get the right one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and choose the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the subscription.

- Download the Huntington Beach California Notice of State Tax Lien. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Take advantage of the US Legal Forms library to always have essential document templates for any needs just at your hand!