Norwalk California Notice of State Tax Lien: Understanding the Implications and Types If you reside in Norwalk, California, it is essential to have a clear understanding of the Norwalk California Notice of State Tax Lien and its implications. The Notice of State Tax Lien is an official document filed by the California Franchise Tax Board (FT) to alert individuals or businesses that they owe unpaid state taxes, and a lien has been placed on their property as collateral. A Norwalk California Notice of State Tax Lien can have severe consequences for the taxpayer, affecting their credit score, ability to acquire loans, and even potentially leading to property seizure or legal action. It is crucial to address the tax liability promptly and explore possible solutions to resolve the outstanding debts. There are different types of Norwalk California Notice of State Tax Lien, depending on the taxpayer's situation. These may include: 1. General Notice of State Tax Lien: This is the most common type and signifies that the taxpayer has an outstanding state tax debt. 2. Substitute Notice of State Tax Lien: If the taxpayer's address is unavailable or unknown, the FT may issue a substitute notice, publicly notifying the lien against the taxpayer's property. 3. Withdrawal of Notice of State Tax Lien: In some instances, the FT may agree to withdraw the Notice of State Tax Lien upon the taxpayer's request, typically when the outstanding debts have been fully settled or suitable payment arrangements have been established. 4. Release of Notice of State Tax Lien: Once the taxpayer has successfully resolved their tax liabilities, the FT will release the Notice of State Tax Lien within 30 days, removing the lien from the public record. It is crucial to note that addressing and resolving a Norwalk California Notice of State Tax Lien requires immediate action. Ignoring or delaying the payment may worsen the financial situation and exacerbate the consequences. It is advisable to consult with a tax professional or seek assistance from the Franchise Tax Board to explore options such as installment agreements, offers in compromise, or other available programs to settle the outstanding tax debt. In conclusion, the Norwalk California Notice of State Tax Lien serves as an official notification of unpaid state tax debts and the subsequent legal claim on the taxpayer's property as collateral. Understanding the implications and various types of notices is essential for timely resolution and to avoid further financial complications. Seek professional guidance to navigate through the process and find the best possible solution to address the outstanding tax liabilities promptly.

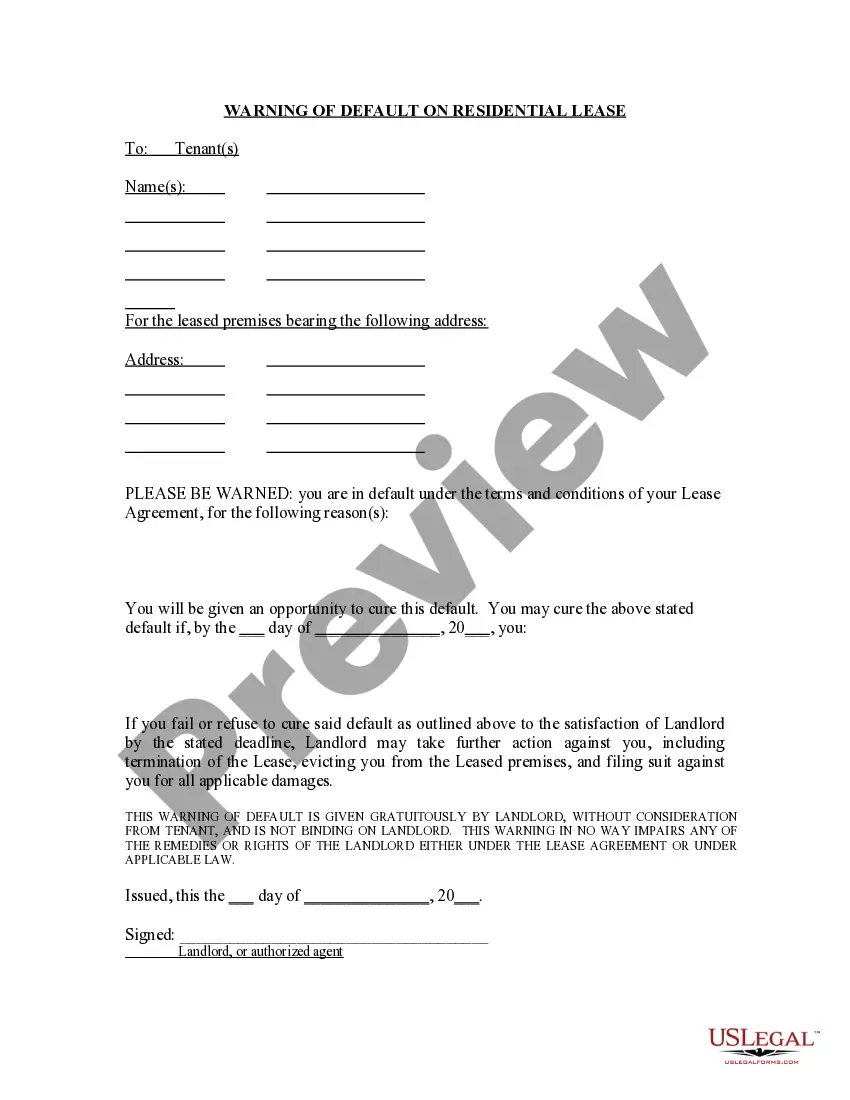

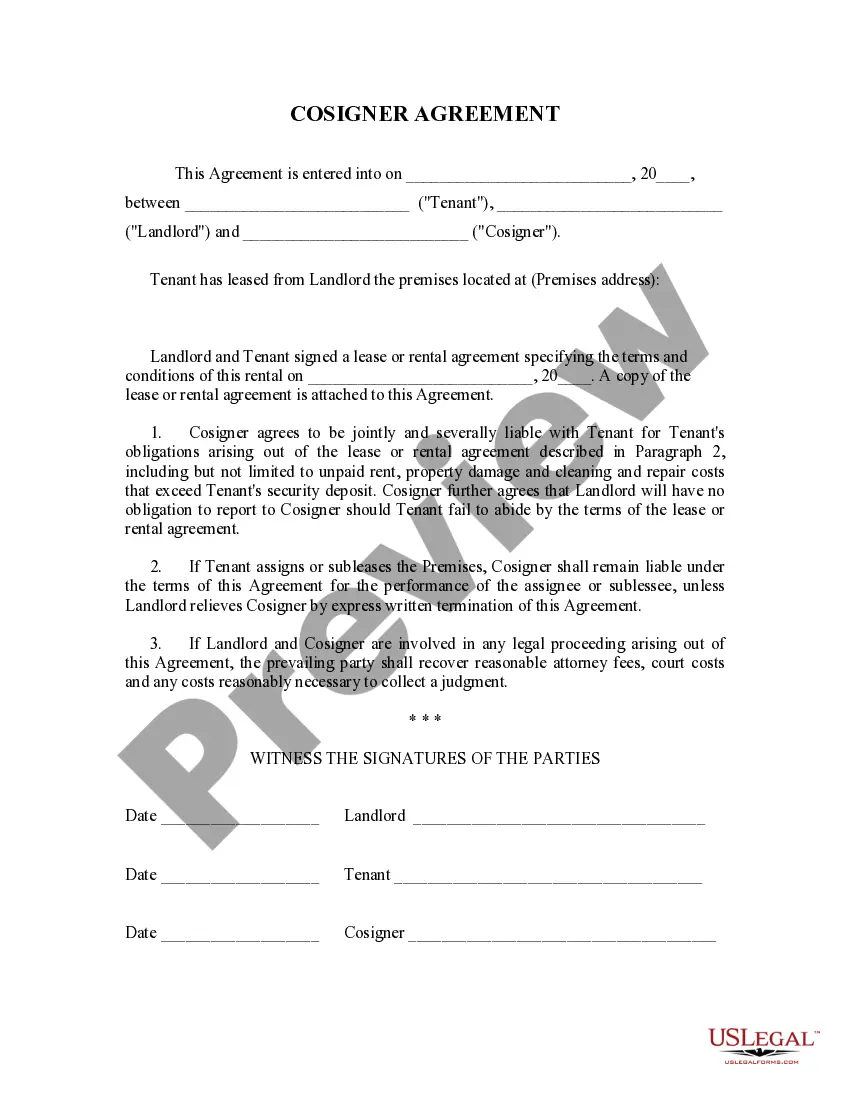

Norwalk California Notice of State Tax Lien

Description

How to fill out Norwalk California Notice Of State Tax Lien?

Are you looking for a trustworthy and affordable legal forms supplier to get the Norwalk California Notice of State Tax Lien? US Legal Forms is your go-to solution.

Whether you require a simple agreement to set regulations for cohabitating with your partner or a package of documents to move your separation or divorce through the court, we got you covered. Our platform offers more than 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t generic and framed in accordance with the requirements of specific state and area.

To download the form, you need to log in account, locate the needed template, and hit the Download button next to it. Please remember that you can download your previously purchased form templates at any time in the My Forms tab.

Are you new to our website? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Check if the Norwalk California Notice of State Tax Lien conforms to the laws of your state and local area.

- Go through the form’s description (if provided) to find out who and what the form is good for.

- Start the search over if the template isn’t good for your specific scenario.

Now you can register your account. Then select the subscription option and proceed to payment. As soon as the payment is completed, download the Norwalk California Notice of State Tax Lien in any provided file format. You can return to the website at any time and redownload the form free of charge.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a go today, and forget about spending hours researching legal papers online once and for all.