Oceanside California Notice of State Tax Lien: Understanding the Basics and Types If you reside or own property in Oceanside, California, it's crucial to be aware of the potential implications of a State Tax Lien. A State Tax Lien is a legal claim against your property and assets by the California Franchise Tax Board (FT) due to unpaid state taxes. This lien serves as a formal warning and a way for the FT to secure their financial interest. The Oceanside California Notice of State Tax Lien is a formal document that outlines the taxpayer's name, the amount owed, and the tax period in question. It is typically filed with the San Diego County Recorder's Office, making it a public record accessible to creditors, lenders, and individuals interested in your financial standing. Different Types of Oceanside California Notice of State Tax Lien: 1. General State Tax Lien: This is the most common type of State Tax Lien and is filed when you have an outstanding balance with the FT. It covers all your assets and properties that could potentially satisfy the debt. 2. Specific State Tax Lien: This type of lien is filed when the FT identifies a specific asset or property that can be held as collateral for the tax debt. It allows the FT to claim that specific asset if the debt remains unpaid. 3. Release of Lien: If you successfully pay off your outstanding taxes or reach a suitable agreement with the FT, they will issue a Release of Lien. This document officially removes the lien from the public record, demonstrating that your tax debt has been resolved. 4. Noticing State Tax Lien: When the FT files a Notice of State Tax Lien, they are required to notify the taxpayer promptly. If you receive this notice, it is crucial to take immediate action to prevent further repercussions and protect your assets. 5. State Tax Lien Removal: If you believe a State Tax Lien has been filed in error or due to incorrect information, you have the right to dispute it. Through various avenues such as providing proof of payment, showing a payment plan agreement, or outlining any extenuating circumstances, you may be able to have the lien removed. It's important to note that a State Tax Lien can have severe consequences on your financial well-being, including negatively impacting your credit score and making it challenging to obtain loans or credit in the future. To avoid such issues, it is best to address your tax obligations promptly, either by paying the owed amount or reaching out to the FT to establish a suitable payment plan. In conclusion, the Oceanside California Notice of State Tax Lien is a significant legal document that taxpayers in Oceanside should take seriously. By understanding the different types of liens, knowing your rights, and addressing outstanding taxes promptly, you can protect your assets and financial stability while ensuring compliance with California tax laws.

Oceanside California Notice of State Tax Lien

Description

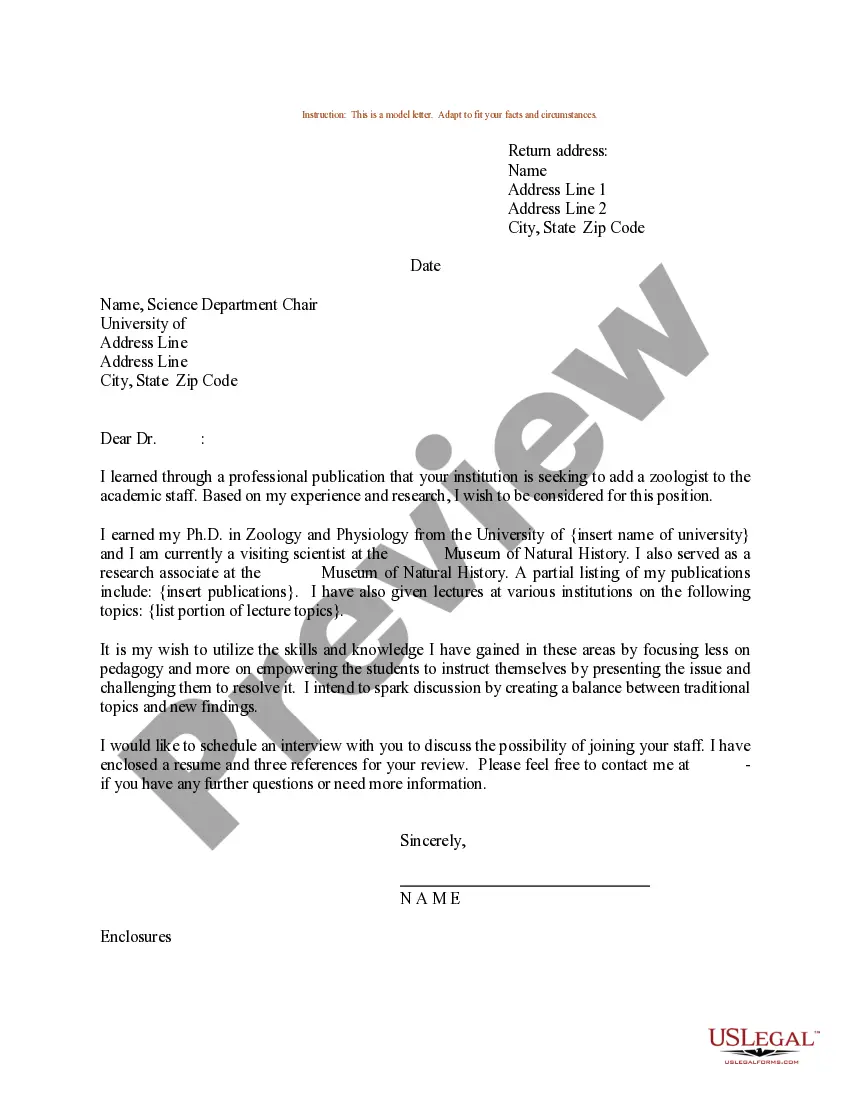

How to fill out Oceanside California Notice Of State Tax Lien?

Take advantage of the US Legal Forms and have immediate access to any form sample you need. Our beneficial platform with a large number of templates makes it simple to find and get almost any document sample you require. You can export, fill, and certify the Oceanside California Notice of State Tax Lien in a matter of minutes instead of surfing the Net for several hours seeking the right template.

Utilizing our catalog is an excellent way to improve the safety of your record submissions. Our experienced attorneys regularly review all the documents to make sure that the forms are appropriate for a particular region and compliant with new laws and regulations.

How can you obtain the Oceanside California Notice of State Tax Lien? If you already have a subscription, just log in to the account. The Download option will be enabled on all the documents you view. Furthermore, you can get all the previously saved files in the My Forms menu.

If you haven’t registered an account yet, follow the tips below:

- Find the form you need. Make certain that it is the form you were hoping to find: check its title and description, and utilize the Preview feature when it is available. Otherwise, use the Search field to find the appropriate one.

- Launch the downloading procedure. Click Buy Now and select the pricing plan you like. Then, sign up for an account and process your order with a credit card or PayPal.

- Download the document. Pick the format to obtain the Oceanside California Notice of State Tax Lien and change and fill, or sign it according to your requirements.

US Legal Forms is one of the most extensive and trustworthy template libraries on the web. We are always ready to help you in any legal procedure, even if it is just downloading the Oceanside California Notice of State Tax Lien.

Feel free to make the most of our form catalog and make your document experience as convenient as possible!