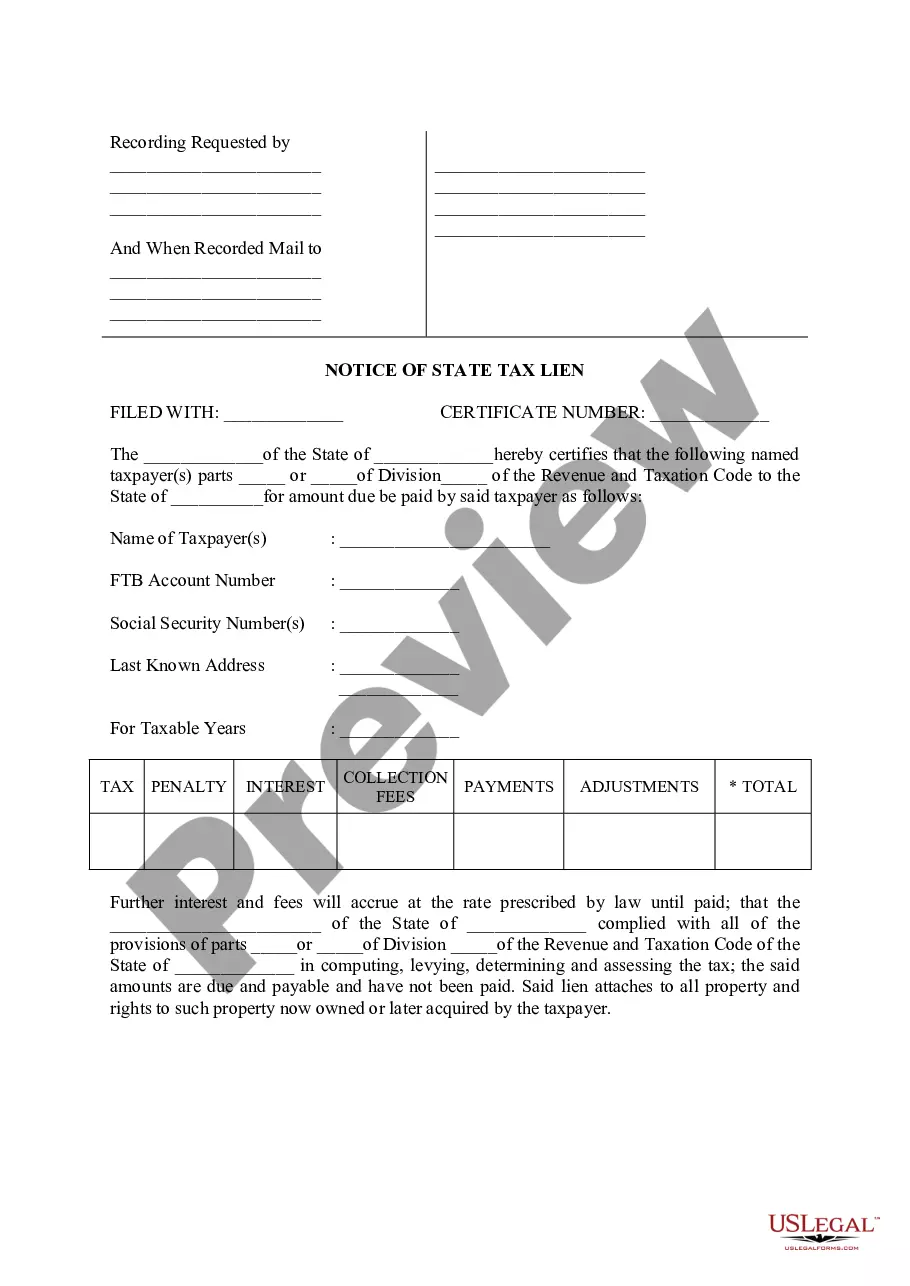

The Palmdale California Notice of State Tax Lien is an official document issued by the California Franchise Tax Board (FT) to indicate that an individual or business entity in Palmdale, California owes unpaid state taxes. This lien serves as a public notice, documenting the FT's claim against the taxpayer's property and/or assets until the outstanding tax debt is resolved. The Payroll Tax Lien is one particular type of Palmdale California Notice of State Tax Lien, which is imposed on employers who fail to remit payroll taxes on behalf of their employees. This type of lien aims to protect the interests of the state and the workers who are entitled to their wage withholding. Another type is the Income Tax Lien, which is issued if an individual or business entity has outstanding income tax obligations. This type of lien can affect not only real estate properties but also other assets owned by the taxpayer, such as motor vehicles, bank accounts, or securities. Additionally, the Sales Tax Lien may be issued to businesses in Palmdale, California who have not paid their sales tax liabilities. This type of lien ensures that the state can recover the unpaid sales tax amount by seizing the business's assets or placing a hold on their bank accounts. The Palmdale California Notice of State Tax Lien contains crucial information, including the taxpayer's name, address, and Social Security or employer identification number. It also specifies the amount owed, the tax years involved, and the date the lien was filed. The notice is recorded with the county recorder's office, thereby making it public information accessible to creditors, potential buyers, and other interested parties. It's important to note that Palmdale California Notice of State Tax Lien can significantly impact an individual or business's financial situation. Once the lien is filed, it may appear on credit reports, which could negatively affect creditworthiness and hinder obtaining loans or credit lines. Removing or releasing the lien requires satisfying the outstanding tax debt, either through full payment, installment agreements, or other tax resolution options provided by the FT. The Palmdale California Notice of State Tax Lien serves as a powerful tool for the state to reclaim unpaid taxes while safeguarding the interests of the public and encouraging compliance with tax laws. It is essential for individuals and businesses in Palmdale, California to promptly address any outstanding tax debts to avoid the negative consequences associated with a state tax lien.

Palmdale California Notice of State Tax Lien

Description

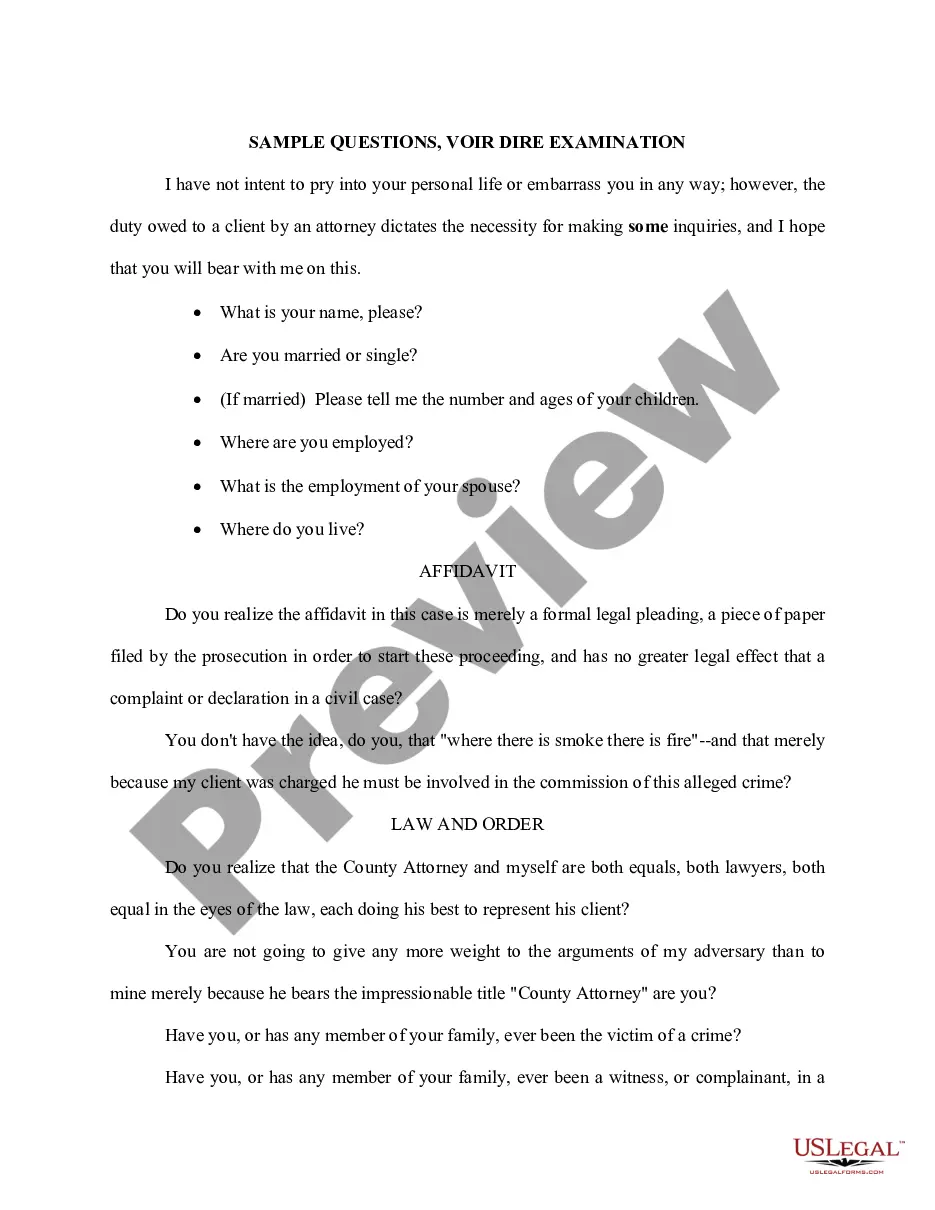

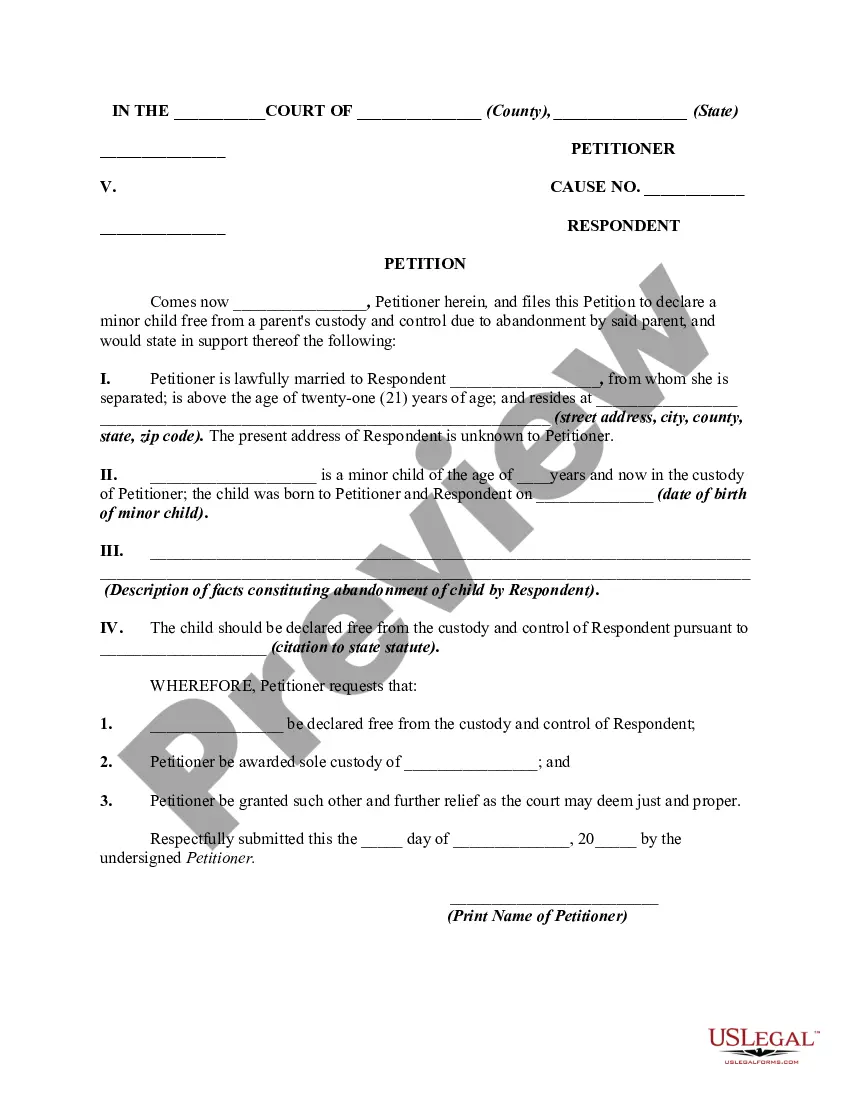

How to fill out Palmdale California Notice Of State Tax Lien?

Getting verified templates specific to your local regulations can be difficult unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both personal and professional needs and any real-life scenarios. All the documents are properly categorized by area of usage and jurisdiction areas, so searching for the Palmdale California Notice of State Tax Lien gets as quick and easy as ABC.

For everyone already familiar with our library and has used it before, getting the Palmdale California Notice of State Tax Lien takes just a couple of clicks. All you need to do is log in to your account, select the document, and click Download to save it on your device. This process will take just a few more steps to complete for new users.

Adhere to the guidelines below to get started with the most extensive online form collection:

- Look at the Preview mode and form description. Make sure you’ve chosen the correct one that meets your requirements and totally corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you find any inconsistency, use the Search tab above to obtain the right one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and choose the subscription plan you prefer. You should sign up for an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the service.

- Download the Palmdale California Notice of State Tax Lien. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Benefit from the US Legal Forms library to always have essential document templates for any needs just at your hand!