The Rialto California Notice of State Tax Lien is an essential document that taxpayers in Rialto, California should be familiar with. When an individual or business fails to pay their state taxes, the California Franchise Tax Board (FT) may issue a tax lien against their property or assets. This notice serves as a legal notification to the taxpayer and any interested parties that the state has a claim on their property to recover the unpaid taxes. There are a few different types of Rialto California Notice of State Tax Liens that individuals may encounter. The first type is the Notice of State Tax Lien Filing, which is the initial notice that the FT files with the county recorder's office. This document establishes the state's legal claim on the taxpayer's property. The second type is the Notice of State Tax Lien Release. This document is issued by the FT once the taxpayer fulfills their tax obligations, either by paying the outstanding balance or entering into an approved payment arrangement. The release removes the lien from the taxpayer's property and records. Another type is the Notice of State Tax Lien Withdrawal. This is issued when the FT determines that there was an error in filing the lien or if the lien is no longer necessary. The withdrawal effectively cancels the lien, removing it from the taxpayer's property records. It is important for taxpayers to understand the implications of receiving a Rialto California Notice of State Tax Lien. Once a lien is filed, it becomes a matter of public record, and it may negatively impact the taxpayer's creditworthiness and ability to access credit or loans. Additionally, the state may take further actions, such as wage garnishment or seizing assets, to satisfy the outstanding tax debt. To avoid the issuance of a Rialto California Notice of State Tax Lien, taxpayers should ensure they file their state tax returns accurately and on time. If they are unable to pay the full amount owed, they can explore options like installment agreements or offers in compromise to resolve their tax debt and prevent the filing of a lien. Overall, the Rialto California Notice of State Tax Lien is a legal document that serves as a warning to taxpayers regarding their unpaid state taxes. Understanding the different types of notices and taking appropriate actions to resolve tax debts promptly can help taxpayers avoid the damaging consequences of a tax lien on their property.

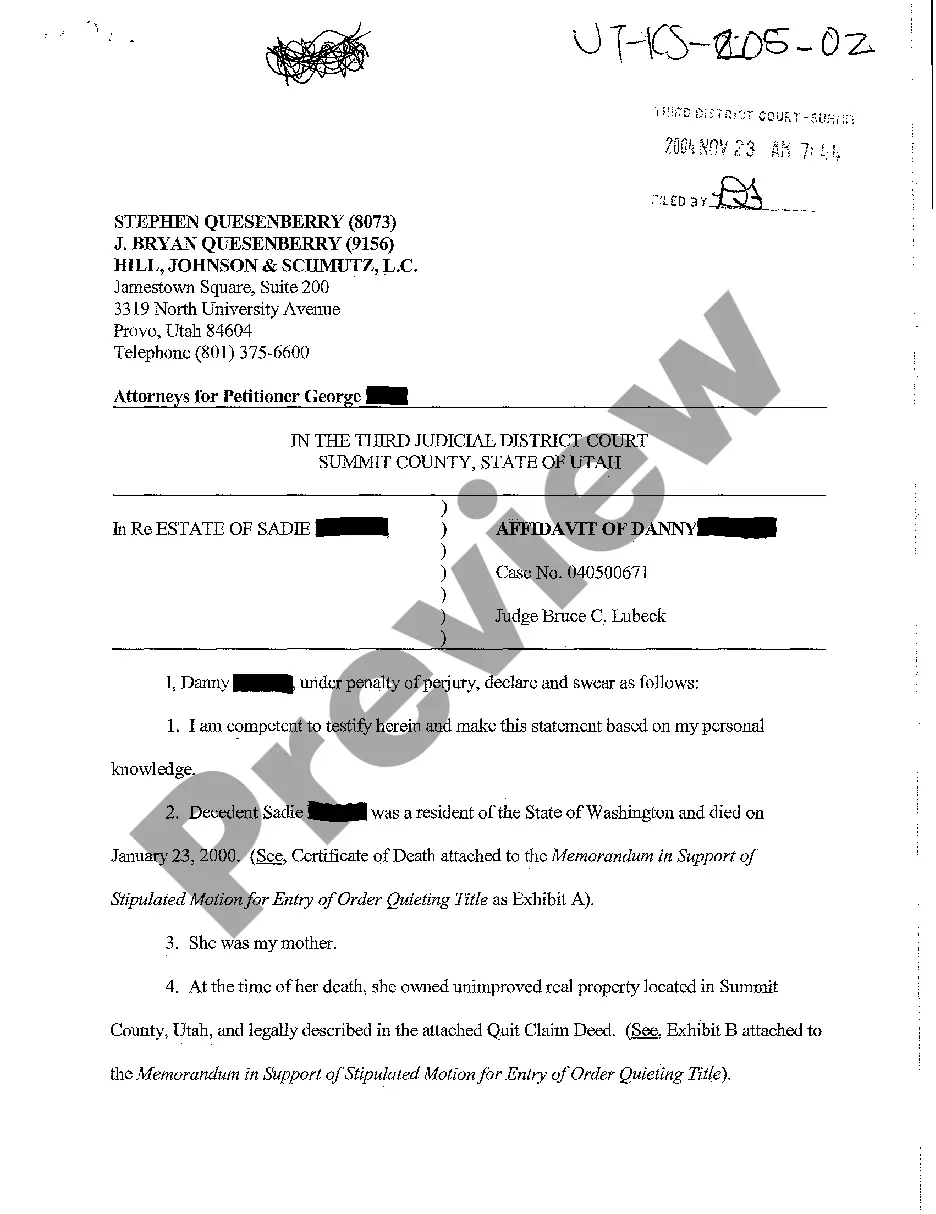

Rialto California Notice of State Tax Lien

Description

How to fill out Rialto California Notice Of State Tax Lien?

We always want to reduce or avoid legal damage when dealing with nuanced legal or financial matters. To do so, we apply for legal solutions that, usually, are very expensive. Nevertheless, not all legal issues are as just complex. Most of them can be taken care of by ourselves.

US Legal Forms is an online catalog of up-to-date DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your matters into your own hands without turning to legal counsel. We offer access to legal document templates that aren’t always openly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Rialto California Notice of State Tax Lien or any other document quickly and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always download it again in the My Forms tab.

The process is just as effortless if you’re new to the website! You can register your account in a matter of minutes.

- Make sure to check if the Rialto California Notice of State Tax Lien adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s description (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve ensured that the Rialto California Notice of State Tax Lien is proper for you, you can select the subscription option and proceed to payment.

- Then you can download the form in any available format.

For over 24 years of our presence on the market, we’ve served millions of people by providing ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save time and resources!