The Salinas California Notice of State Tax Lien is a legal document issued by the state tax authority to notify a taxpayer in Salinas, California of an outstanding tax debt. This notice serves as a warning that the state intends to place a lien on the taxpayer's property or assets due to their failure to pay their tax liabilities. The state tax lien is a powerful tool employed by the California Franchise Tax Board (FT) or the California State Board of Equalization (BOE) to recover unpaid taxes. It acts as a legal claim against the taxpayer's assets, including real estate, vehicles, bank accounts, and other valuable possessions. This lien is initiated when the taxpayer neglects to pay their tax debts or refuses to cooperate with the tax authorities to resolve the issue. The Salinas California Notice of State Tax Lien is typically filed with the county recorder's office where the taxpayer resides or owns property. By doing so, the lien effectively attaches to all the taxpayer's present and future assets, establishing priority over other creditors. This means that the taxpayer won't be able to sell or transfer their property without satisfying the lien first. There are a few types of Salinas California Notice of State Tax Lien that taxpayers might encounter, depending on their unique circumstances. This includes: 1. General Lien: This type of tax lien applies to all the taxpayer's property and assets, both current and acquired in the future. 2. Specific Lien: A specific lien is related to a particular property or asset. It only applies to the identified property and does not extend to other assets owned by the taxpayer. 3. Subordination of Lien: In some cases, the state tax authorities may agree to subordinate their tax lien to another creditor's lien. This allows the taxpayer to secure a loan or mortgage against their property. Receiving a Salinas California Notice of State Tax Lien is a serious matter that should not be ignored. It is crucial for taxpayers in Salinas to take immediate action to resolve their tax debts and prevent the state from seizing their assets. Seeking professional assistance from tax attorneys, accountants, or tax resolution firms can be beneficial in navigating the complex process of resolving a tax lien and ensuring compliance with tax laws.

Salinas California Notice of State Tax Lien

Category:

State:

California

City:

Salinas

Control #:

CA-LR017T

Format:

Word;

Rich Text

Instant download

Description

A lien exists in favor of the State of California for nonpayment of tax, interest, penalties, and costs as assessed.

The Salinas California Notice of State Tax Lien is a legal document issued by the state tax authority to notify a taxpayer in Salinas, California of an outstanding tax debt. This notice serves as a warning that the state intends to place a lien on the taxpayer's property or assets due to their failure to pay their tax liabilities. The state tax lien is a powerful tool employed by the California Franchise Tax Board (FT) or the California State Board of Equalization (BOE) to recover unpaid taxes. It acts as a legal claim against the taxpayer's assets, including real estate, vehicles, bank accounts, and other valuable possessions. This lien is initiated when the taxpayer neglects to pay their tax debts or refuses to cooperate with the tax authorities to resolve the issue. The Salinas California Notice of State Tax Lien is typically filed with the county recorder's office where the taxpayer resides or owns property. By doing so, the lien effectively attaches to all the taxpayer's present and future assets, establishing priority over other creditors. This means that the taxpayer won't be able to sell or transfer their property without satisfying the lien first. There are a few types of Salinas California Notice of State Tax Lien that taxpayers might encounter, depending on their unique circumstances. This includes: 1. General Lien: This type of tax lien applies to all the taxpayer's property and assets, both current and acquired in the future. 2. Specific Lien: A specific lien is related to a particular property or asset. It only applies to the identified property and does not extend to other assets owned by the taxpayer. 3. Subordination of Lien: In some cases, the state tax authorities may agree to subordinate their tax lien to another creditor's lien. This allows the taxpayer to secure a loan or mortgage against their property. Receiving a Salinas California Notice of State Tax Lien is a serious matter that should not be ignored. It is crucial for taxpayers in Salinas to take immediate action to resolve their tax debts and prevent the state from seizing their assets. Seeking professional assistance from tax attorneys, accountants, or tax resolution firms can be beneficial in navigating the complex process of resolving a tax lien and ensuring compliance with tax laws.

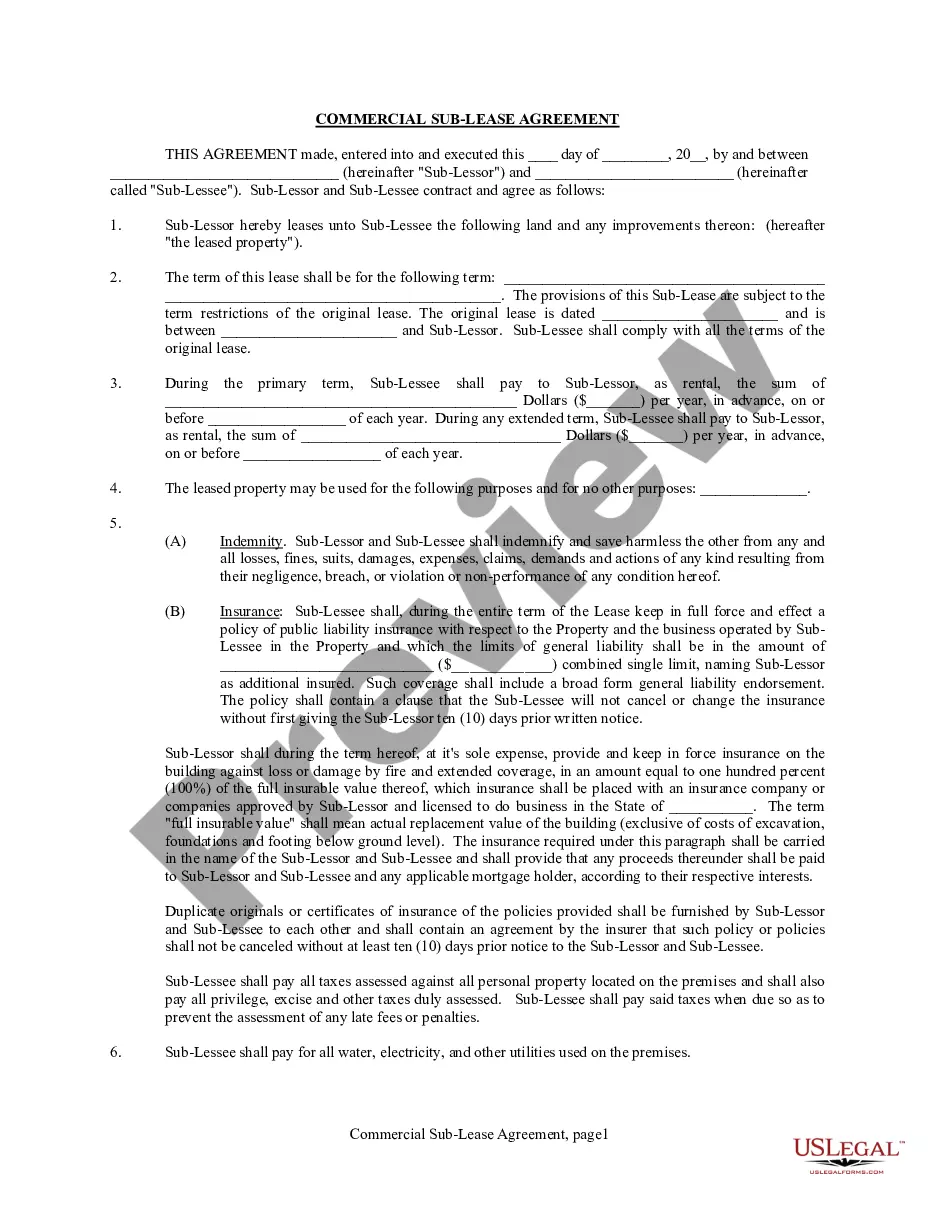

Free preview

How to fill out Salinas California Notice Of State Tax Lien?

If you’ve already utilized our service before, log in to your account and download the Salinas California Notice of State Tax Lien on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple actions to get your file:

- Ensure you’ve found the right document. Look through the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t fit you, utilize the Search tab above to find the proper one.

- Buy the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Get your Salinas California Notice of State Tax Lien. Opt for the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have bought: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your personal or professional needs!