The San Jose California Notice of State Tax Lien is a legal document that serves as a notice of an outstanding tax debt owed to the state of California by an individual or business located in San Jose. This lien is filed by the California Franchise Tax Board, the agency responsible for administering state tax laws, to protect the government's interest in the taxpayer's property and assets. A tax lien is generally filed when the taxpayer has failed to pay their state taxes, such as income tax, sales tax, or payroll tax, within the specified deadline. The document contains important information related to the tax debt, including the taxpayer's name and address, the type and amount of taxes owed, and the date when the lien was recorded. The lien essentially establishes a legal claim on the taxpayer's property, which may include real estate, vehicles, or any other assets, making it difficult for the taxpayer to sell or transfer ownership without first satisfying the outstanding tax liability. It is important to note that there might be several types of San Jose California Notice of State Tax Lien, categorized based on the specific type of tax owed. For instance, there could be notice of income tax lien, sales tax lien, or payroll tax lien. Each type of lien reflects the corresponding tax debt that has not been paid by the taxpayer. The specific type of lien would be mentioned in the notice, providing detailed information to the taxpayer and potential creditors regarding the nature of the tax liability. Receiving a San Jose California Notice of State Tax Lien can have serious implications for the taxpayer, as it could lead to negative consequences such as a damaged credit score, potential wage garnishment, or seizure and forced sale of assets. Therefore, it is crucial for the taxpayer to address the outstanding tax debt promptly and communicate with the California Franchise Tax Board to agree upon a suitable resolution, such as paying the debt in installments or negotiating a settlement. In summary, the San Jose California Notice of State Tax Lien is a crucial legal document that indicates an individual or business's failure to pay state taxes. It serves as a mechanism for the government to protect its interest in the taxpayer's assets and can have significant consequences for the taxpayer. It is important to understand the specific type of tax lien mentioned in the notice and take appropriate action to resolve the outstanding tax debt.

San Jose California Notice of State Tax Lien

Category:

State:

California

City:

San Jose

Control #:

CA-LR017T

Format:

Word;

Rich Text

Instant download

Description

A lien exists in favor of the State of California for nonpayment of tax, interest, penalties, and costs as assessed.

The San Jose California Notice of State Tax Lien is a legal document that serves as a notice of an outstanding tax debt owed to the state of California by an individual or business located in San Jose. This lien is filed by the California Franchise Tax Board, the agency responsible for administering state tax laws, to protect the government's interest in the taxpayer's property and assets. A tax lien is generally filed when the taxpayer has failed to pay their state taxes, such as income tax, sales tax, or payroll tax, within the specified deadline. The document contains important information related to the tax debt, including the taxpayer's name and address, the type and amount of taxes owed, and the date when the lien was recorded. The lien essentially establishes a legal claim on the taxpayer's property, which may include real estate, vehicles, or any other assets, making it difficult for the taxpayer to sell or transfer ownership without first satisfying the outstanding tax liability. It is important to note that there might be several types of San Jose California Notice of State Tax Lien, categorized based on the specific type of tax owed. For instance, there could be notice of income tax lien, sales tax lien, or payroll tax lien. Each type of lien reflects the corresponding tax debt that has not been paid by the taxpayer. The specific type of lien would be mentioned in the notice, providing detailed information to the taxpayer and potential creditors regarding the nature of the tax liability. Receiving a San Jose California Notice of State Tax Lien can have serious implications for the taxpayer, as it could lead to negative consequences such as a damaged credit score, potential wage garnishment, or seizure and forced sale of assets. Therefore, it is crucial for the taxpayer to address the outstanding tax debt promptly and communicate with the California Franchise Tax Board to agree upon a suitable resolution, such as paying the debt in installments or negotiating a settlement. In summary, the San Jose California Notice of State Tax Lien is a crucial legal document that indicates an individual or business's failure to pay state taxes. It serves as a mechanism for the government to protect its interest in the taxpayer's assets and can have significant consequences for the taxpayer. It is important to understand the specific type of tax lien mentioned in the notice and take appropriate action to resolve the outstanding tax debt.

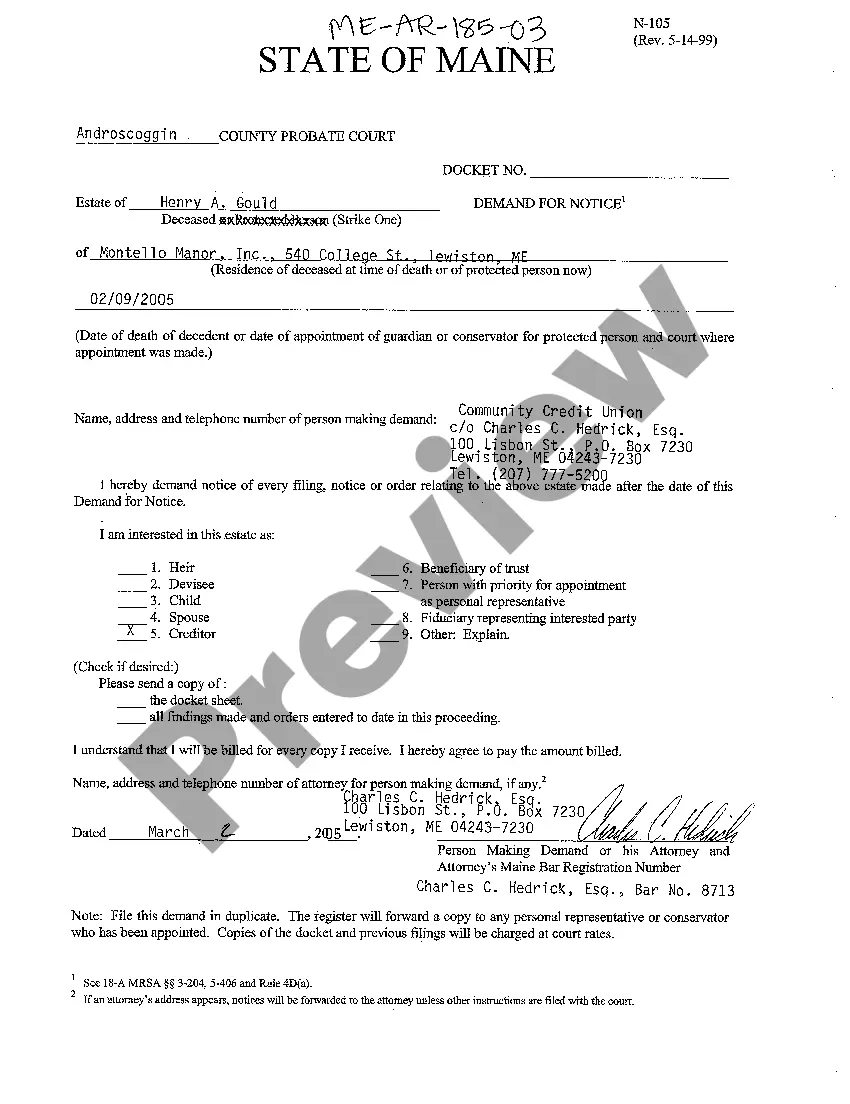

Free preview

How to fill out San Jose California Notice Of State Tax Lien?

If you’ve already used our service before, log in to your account and download the San Jose California Notice of State Tax Lien on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple steps to get your document:

- Make certain you’ve located the right document. Look through the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t suit you, utilize the Search tab above to find the proper one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Get your San Jose California Notice of State Tax Lien. Choose the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to every piece of paperwork you have bought: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily find and save any template for your personal or professional needs!