A Santa Ana California Notice of State Tax Lien is an official document issued by the state government to inform individuals or businesses that they owe unpaid taxes. It serves as a legal claim against a property or assets owned by the taxpayer until the tax debt is fully resolved. This lien can have serious implications on the taxpayer's financial standing and creditworthiness, potentially impacting their ability to obtain loans or sell properties. There are different types of Santa Ana California Notice of State Tax Liens, each representing a specific situation or stage in the tax collection process. These may include: 1. General State Tax Lien: This is the most common type of tax lien issued by the California State Franchise Tax Board (FT). It arises when a taxpayer fails to pay their income taxes, sales taxes, or other state taxes within the specified timeframe. 2. EDD Tax Lien: The Employment Development Department (EDD) in California can issue a tax lien when an employer has unpaid payroll taxes or fails to meet their employment tax obligations. 3. California State Board of Equalization (SHOE) Tax Lien: The SHOE handles tax collections related to sales and use taxes, as well as other special taxes. If a taxpayer fails to pay these taxes, a tax lien may be placed on their property. 4. FT/IRS Coordinated Tax Lien: In certain cases, California's FT and the Internal Revenue Service (IRS) can work together to place a joint federal-state tax lien on a delinquent taxpayer's property. This combined lien ensures both entities have a claim to the taxpayer's assets. Receiving a Santa Ana California Notice of State Tax Lien should be taken seriously. It is crucial for taxpayers to promptly address the outstanding tax debt to avoid further penalties, interest, and potential seizure of assets. Seeking professional advice from a tax attorney or a reputable tax resolution firm can greatly assist in navigating the complex tax collection process and resolving the lien.

Santa Ana California Notice of State Tax Lien

Description

How to fill out Santa Ana California Notice Of State Tax Lien?

Getting verified templates specific to your local laws can be difficult unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both personal and professional needs and any real-life situations. All the documents are properly grouped by area of usage and jurisdiction areas, so locating the Santa Ana California Notice of State Tax Lien gets as quick and easy as ABC.

For everyone already acquainted with our service and has used it before, obtaining the Santa Ana California Notice of State Tax Lien takes just a couple of clicks. All you need to do is log in to your account, choose the document, and click Download to save it on your device. This process will take just a couple of additional steps to complete for new users.

Adhere to the guidelines below to get started with the most extensive online form library:

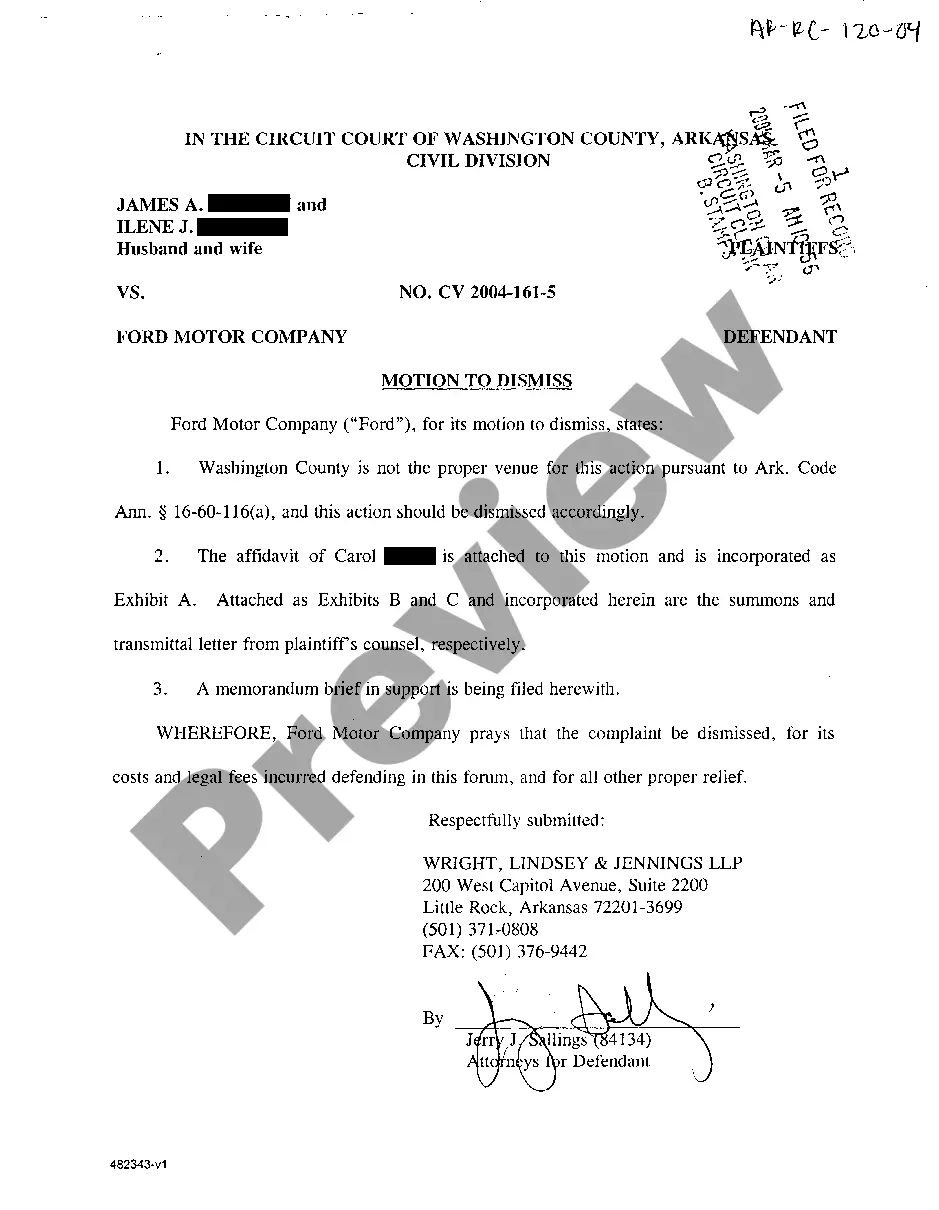

- Check the Preview mode and form description. Make certain you’ve selected the correct one that meets your needs and fully corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you find any inconsistency, use the Search tab above to obtain the correct one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and select the subscription plan you prefer. You should sign up for an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the subscription.

- Download the Santa Ana California Notice of State Tax Lien. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Benefit from the US Legal Forms library to always have essential document templates for any needs just at your hand!