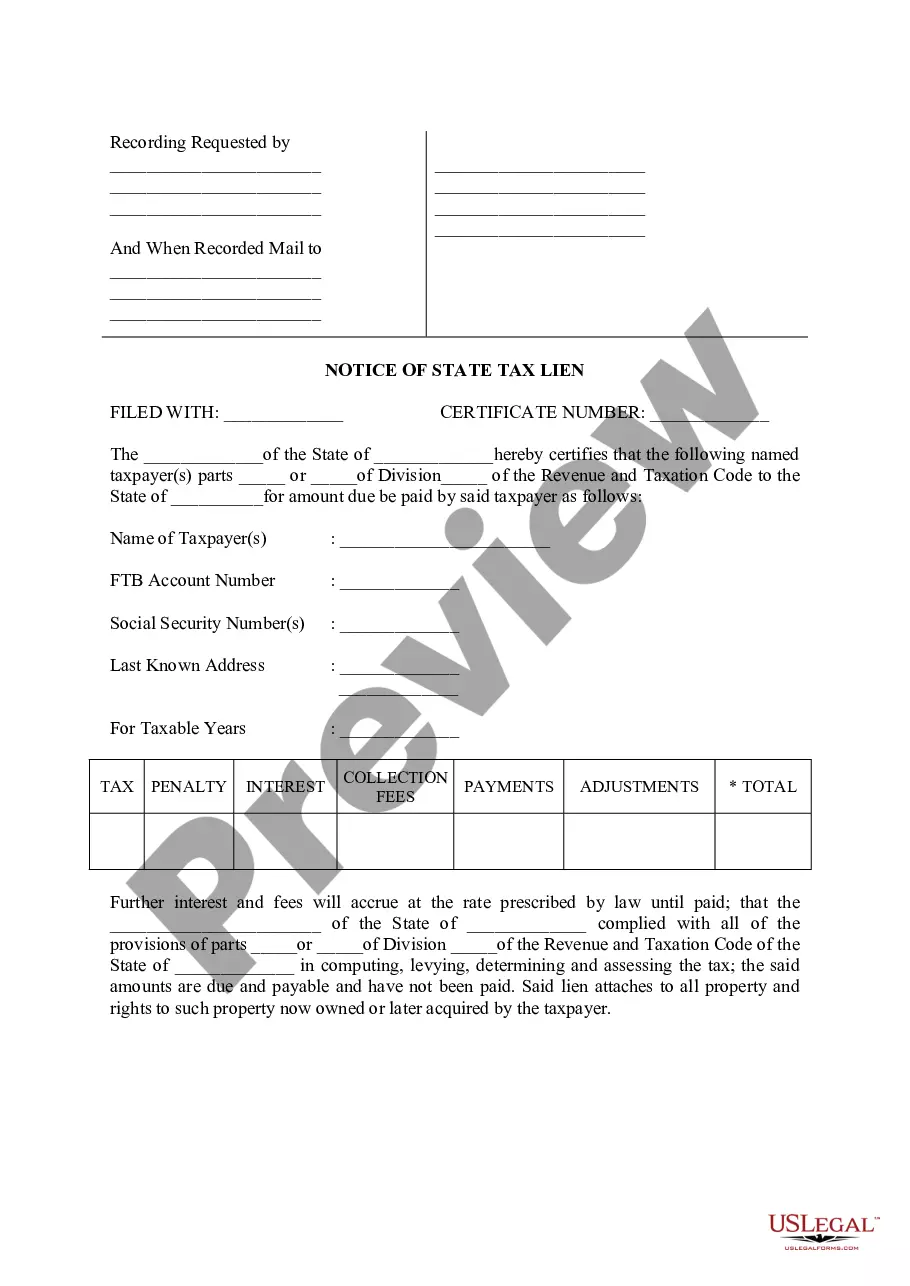

The Santa Clarita California Notice of State Tax Lien is an official document that serves as a notification to individuals or businesses in Santa Clarita, California, regarding a tax lien filed against their property or assets by the state government. This notice is issued by the California Franchise Tax Board (FT). A state tax lien is typically imposed when an individual or business fails to pay their state income taxes, sales taxes, or any other form of state-imposed tax debt. It is a legal claim placed upon the taxpayer's property, such as real estate, personal belongings, bank accounts, or any other valuable assets. The Santa Clarita California Notice of State Tax Lien acts as a public record, alerting creditors, financial institutions, and potential buyers that the taxpayer has an outstanding tax debt. It also serves as a means for the state to collect the unpaid taxes once the property or assets are sold. It's important to note that there can be different types of Santa Clarita California Notice of State Tax Lien, depending on the particular tax debt or situation. Some types of state tax liens that may be issued in Santa Clarita include: 1. Personal Income Tax Lien: This type of lien is filed against an individual who has failed to pay their state income taxes. It applies to both current and delinquent tax debts. 2. Business Tax Lien: This type of lien is filed against businesses that have outstanding state tax liabilities, such as sales and use taxes, payroll taxes, or other business-related taxes. 3. Trust Fund Recovery Penalty Lien: If an individual or business is responsible for collecting and remitting payroll taxes on behalf of their employees but fails to do so, the state may file a tax lien to recover the unpaid taxes. This type of lien is often issued for businesses. The Santa Clarita California Notice of State Tax Lien contains essential information, including the taxpayer's name, address, and Social Security number (for individuals) or Employer Identification Number (for businesses). It also specifies the amount of the tax debt and the tax years for which the lien is imposed. Receiving this notice can have serious consequences for the taxpayer, as it may negatively impact their credit score, hinder their ability to obtain loans or credit cards, and even result in the seizure of their property or assets if the tax debt remains unpaid. If you have received a Santa Clarita California Notice of State Tax Lien, it is crucial to take immediate action. Consulting with a qualified tax professional or seeking legal advice can help you understand your rights and options, such as negotiating a settlement agreement with the FT, requesting a lien release, or exploring other tax relief alternatives. Remember, the Santa Clarita California Notice of State Tax Lien should not be ignored, as it can lead to severe financial consequences. Taking prompt action is essential to resolve the tax debt and mitigate its potential impact on your financial well-being.

Santa Clarita California Notice of State Tax Lien

Description

How to fill out Santa Clarita California Notice Of State Tax Lien?

Getting verified templates specific to your local regulations can be challenging unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both individual and professional needs and any real-life situations. All the documents are properly categorized by area of usage and jurisdiction areas, so searching for the Santa Clarita California Notice of State Tax Lien gets as quick and easy as ABC.

For everyone already acquainted with our service and has used it before, obtaining the Santa Clarita California Notice of State Tax Lien takes just a few clicks. All you need to do is log in to your account, select the document, and click Download to save it on your device. The process will take just a few more actions to complete for new users.

Follow the guidelines below to get started with the most extensive online form collection:

- Check the Preview mode and form description. Make sure you’ve picked the correct one that meets your requirements and fully corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you see any inconsistency, utilize the Search tab above to find the correct one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should sign up for an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the subscription.

- Download the Santa Clarita California Notice of State Tax Lien. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Benefit from the US Legal Forms library to always have essential document templates for any needs just at your hand!