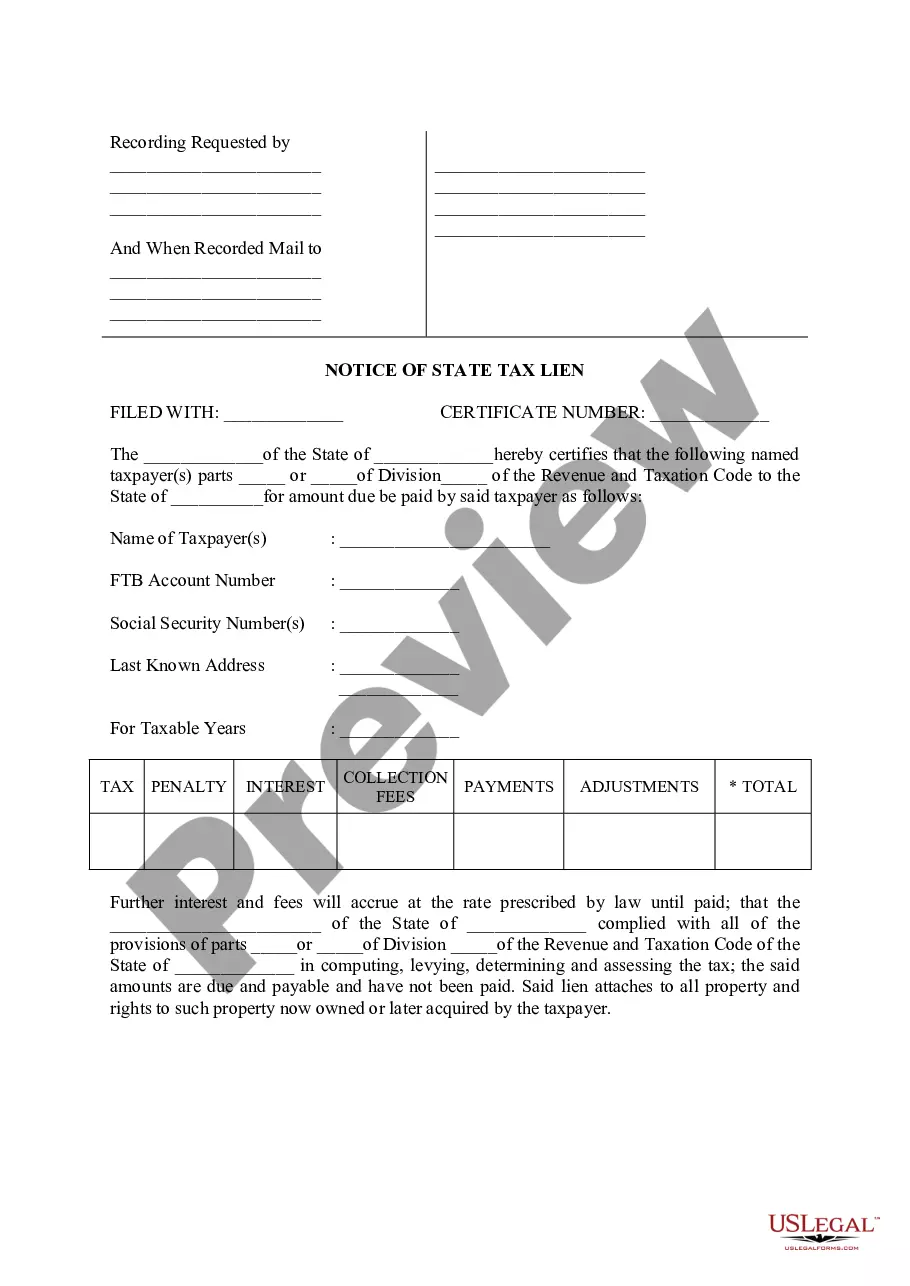

Simi Valley California Notice of State Tax Lien: Detailed Description and Types A Simi Valley California Notice of State Tax Lien is a legal document that serves as a public notice of the state's claim on a taxpayer's property due to unpaid state taxes. This lien is filed with the county recorder's office to establish the state's priority lien position over any other creditors, ensuring that the state will have the right to collect the unpaid taxes from the taxpayer's assets. In Simi Valley, California, there are primarily two types of state tax liens that can be issued: 1. General State Tax Lien: A general state tax lien is placed on a taxpayer's property when they fail to pay their state taxes on time. It applies to all current and future property owned by the taxpayer in the county. This type of lien acts as a warning to potential lenders and creditors that the state has a claim on the taxpayer's assets. 2. Specific State Tax Lien: A specific state tax lien is filed against a particular property owned by the taxpayer, typically real estate, when they have outstanding taxes related to that specific property. This lien is limited to the property specified and does not attach to any other assets the taxpayer may own. When a Simi Valley resident receives a Notice of State Tax Lien, it indicates that they have failed to fulfill their state tax obligations and that the state has taken legal action to secure the payment of delinquent taxes. The notice includes crucial information such as the taxpayer's name, the amount owed, the tax years involved, and contact details for the state taxing authority responsible for the lien. Receiving a Notice of State Tax Lien can have serious consequences for individuals as it negatively impacts their credit score and can hinder their ability to obtain loans, sell property, or engage in certain financial transactions. It is crucial to take immediate action and address the tax debt to remove the lien and avoid further complications. In conclusion, a Simi Valley California Notice of State Tax Lien is a legally significant document that notifies the public about the state's claim on a taxpayer's property due to unpaid state taxes. The two primary types of liens are general state tax liens, applying to all assets, and specific state tax liens, specific to a particular property. Prompt action should be taken to resolve the tax debt and have the lien removed to avoid potential financial and credit-related issues.

Simi Valley California Notice of State Tax Lien

Description

How to fill out Simi Valley California Notice Of State Tax Lien?

No matter the social or professional status, completing law-related documents is an unfortunate necessity in today’s world. Very often, it’s practically impossible for a person with no law background to create this sort of paperwork cfrom the ground up, mainly due to the convoluted terminology and legal nuances they involve. This is where US Legal Forms comes in handy. Our platform offers a huge collection with more than 85,000 ready-to-use state-specific documents that work for almost any legal scenario. US Legal Forms also serves as a great asset for associates or legal counsels who want to save time using our DYI forms.

No matter if you need the Simi Valley California Notice of State Tax Lien or any other document that will be valid in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Simi Valley California Notice of State Tax Lien quickly using our trustworthy platform. In case you are presently a subscriber, you can go on and log in to your account to get the needed form.

Nevertheless, if you are new to our platform, make sure to follow these steps prior to downloading the Simi Valley California Notice of State Tax Lien:

- Be sure the template you have chosen is good for your location since the rules of one state or county do not work for another state or county.

- Preview the form and read a quick outline (if available) of scenarios the document can be used for.

- In case the one you picked doesn’t meet your needs, you can start over and look for the suitable form.

- Click Buy now and pick the subscription plan you prefer the best.

- with your credentials or register for one from scratch.

- Choose the payment method and proceed to download the Simi Valley California Notice of State Tax Lien as soon as the payment is done.

You’re all set! Now you can go on and print out the form or fill it out online. Should you have any issues locating your purchased documents, you can quickly access them in the My Forms tab.

Whatever case you’re trying to solve, US Legal Forms has got you covered. Give it a try now and see for yourself.