Irvine California Notice of Lien: The Irvine California Notice of Lien is a legal document that serves as a notice of a claim or encumbrance placed on a property within the city of Irvine, California. This notice is typically filed by a creditor or a party seeking payment for a debt or obligation owed by the property owner. The Notice of Lien is an important step in the legal process of securing a debt or claim against a property. By filing this document, the creditor establishes their legal right to seek repayment by placing a lien on the property. This lien essentially acts as collateral for the debt and provides the creditor with a legal interest in the property until the debt is satisfied. There are different types of Irvine California Notice of Liens, each serving a specific purpose. Some common examples include: 1. Mechanic's Lien: This type of lien is often filed by contractors, subcontractors, or suppliers who have provided labor, materials, or services for a construction project. If they have not been paid for their work, they can file a mechanic's lien to assert their claim against the property. 2. Tax Lien: Tax agencies, such as the Internal Revenue Service (IRS) or the California Franchise Tax Board, can place a tax lien on a property if the property owner fails to pay their taxes. This lien allows the tax agency to secure the debt owed and potentially seize or sell the property to satisfy the outstanding taxes. 3. Judgment Lien: If a court awards a judgment in favor of a creditor in a lawsuit, the creditor can file a judgment lien against the property of the debtor. This lien ensures that the creditor has a legal claim to the property in order to satisfy the judgment. It is essential for property owners to take notice of an Irvine California Notice of Lien as it can have significant implications on their property rights. Once a lien is filed, it becomes a matter of public record and can affect the ability to sell or refinance the property. In conclusion, the Irvine California Notice of Lien is a legal document that establishes a creditor's claim against a property in Irvine, California. Different types of liens include mechanic's liens, tax liens, and judgment liens. Property owners should carefully address any notice of lien to avoid potential legal ramifications.

Irvine California Notice of Lien

Description

How to fill out Irvine California Notice Of Lien?

Regardless of the social or professional standing, filling out legal documents is an unfortunate requirement in today’s society.

Often, it’s nearly impossible for someone without a legal education to draft such documents from the ground up, mainly because of the intricate jargon and legal subtleties they contain.

This is where US Legal Forms can assist you.

Verify that the template you have selected is appropriate for your area since the regulations of one state or county may not apply to another.

Review the document and read a brief description (if available) of the situations the form can be utilized for.

- Our platform offers an extensive library with over 85,000 ready-to-use state-specific forms that cater to nearly any legal situation.

- US Legal Forms is also an outstanding resource for associates or legal advisors looking to save time by using our DIY forms.

- Whether you need the Irvine California Notice of Lien or any other documents suitable for your state or county, US Legal Forms has everything readily available.

- Here’s how to obtain the Irvine California Notice of Lien in minutes through our reliable service.

- If you are currently a member, you may simply Log In to your account to download the necessary document.

- However, if you are new to our site, please follow these instructions before acquiring the Irvine California Notice of Lien.

Form popularity

FAQ

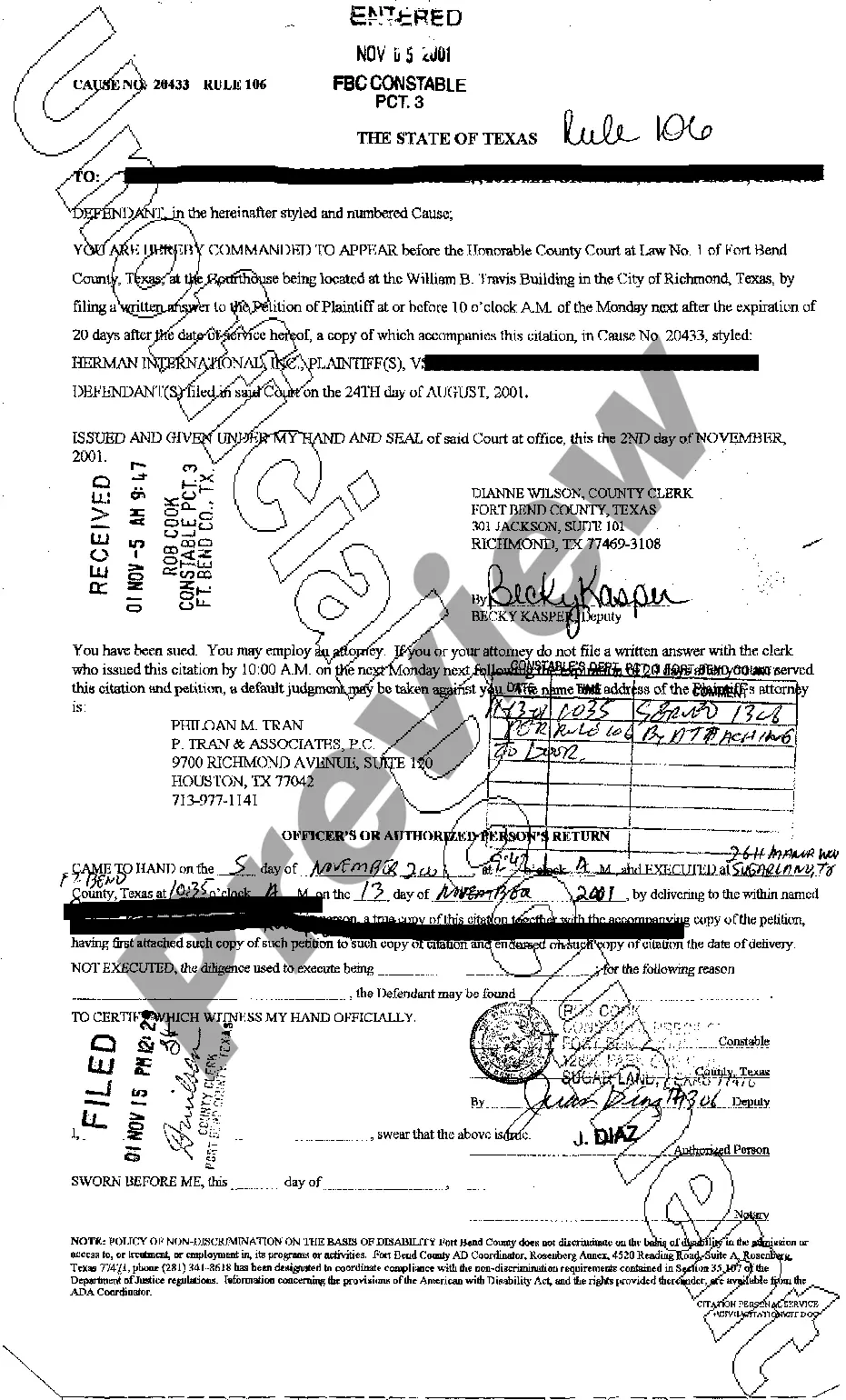

A judgment lien is one way to ensure that the person who won the judgment (the creditor) gets what he or she is owed. A judgment lien gives the creditor the right to be paid a certain amount of money from proceeds from the sale of the debtor's property.

A court can order that a money judgment be paid in instalments and, if this is ordered, a creditor is usually entitled to apply to court for enforcement of the whole judgment if the debtor misses just one instalment. The debtor must have been served with the judgment and be aware of its existence.

The easy definition is that a judgment is an official decision rendered by the court with regard to a civil matter. A judgment lien, sometimes referred to as an ?abstract of judgment,? is an involuntary lien that is filed to give constructive notice and is to attach to the Judgment Debtor's property and/or assets.

Renew the judgment Money judgments automatically expire (run out) after 10 years. To prevent this from happening, the creditor must file a request for renewal of the judgment with the court BEFORE the 10 years run out.

If your judgment has already expired, you should consult an attorney before taking any action. California judgments last for 10 years from the date they were entered. If you win a judgment issued by a federal court, you may start collecting right away. The defendant has 30 days to file an appeal or post a bond.

To remove a lien you have to pay the judgment and get the judgment creditor to complete a notarized Acknowledgment of Satisfaction of Judgment (EJ-100). Either party can eFile the form to the court. Then the judgment creditor or you have to record a certified copy of this form in the county where the property is.

You should pay the judgment against you as soon as it becomes final. If you do not pay, the creditor can start collecting the judgment right away as long as: The judgment has been entered. You can go to the court clerk's office and check the court's records to confirm that the judgment has been entered; and.

To remove a lien you have to pay the judgment and get the judgment creditor to complete a notarized Acknowledgment of Satisfaction of Judgment (EJ-100). Either party can eFile the form to the court. Then the judgment creditor or you have to record a certified copy of this form in the county where the property is.

A lien expires 10 years from the date of recording or filing, unless we extend it. If we extend the lien, we will send a new Notice of State Tax Lien and record or file it with the county recorder or California Secretary of State.

How do I collect my money? If you know where the Judgment Debtor banks, you can ask the Sheriff to collect money from their account (bank account levy). If you know where the Judgment Debtor works, the Sheriff can collect 25% of the debtor's wages each pay period until your judgment is paid in full (wage garnishment).