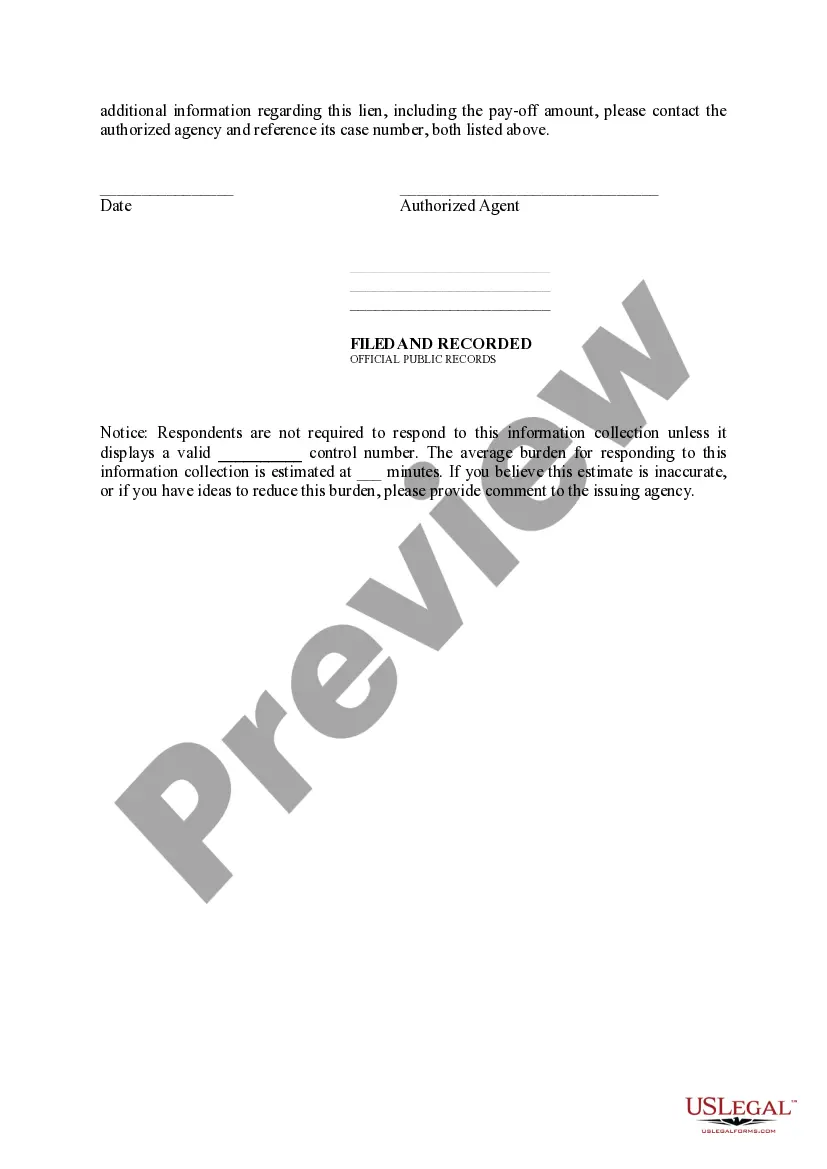

Long Beach, California Notice of Lien: Understanding the Basics In Long Beach, California, a Notice of Lien serves as a vital legal document that helps assert a creditor's claim against a property when the property owner fails to fulfill a debt or obligation. This process allows the creditor to ensure repayment or resolution through seizing the property or other legal means. Here, we will delve into the details of what a Long Beach Notice of Lien entails and outline the different types of liens commonly encountered in the area. A Long Beach Notice of Lien is primarily a written notice formally filed by a creditor, known as the lien holder, to assert their legal claim against a property in case of non-payment or default. This process is often initiated when a property owner fails to fulfill financial obligations such as unpaid taxes, outstanding judgments, delinquent homeowners' association dues, or unpaid contractor fees. Upon filing the Notice of Lien with the appropriate local government offices, the lien holder establishes their interest in the property, ensuring that they have a legal right to collect the debt owed to them. Various Types of Long Beach California Notice of Lien: 1. Tax Lien: A tax lien is imposed when property taxes are unpaid. The government places this lien on the property as a form of collateral to ensure repayment. The county tax collector's office handles the recording and processing of tax liens. 2. Judgment Lien: A judgment lien occurs when a court grants a judgment against a property owner for a monetary judgment or settlement. This type of lien is often the result of lawsuits, court judgments, or unpaid court fines. 3. Mechanics Lien: Mechanics liens are filed by contractors, subcontractors, or suppliers who have provided labor, materials, or services to enhance a property. If they are not paid in full or on time, they can file a mechanics lien against the property as a claim for the unpaid amount. 4. Homeowners' Association (HOA) Lien: HOA liens are recorded when property owners fail to pay their monthly HOA fees or assessments deemed necessary for the maintenance and improvement of common areas within a housing development or community. 5. Child Support Lien: Child support liens are typically filed by state or federal agencies responsible for enforcing child support orders. When a parent falls behind on child support payments, a lien may be placed on their property as a way to ensure support is provided. Navigating the Long Beach Notice of Lien process can be complex, involving strict legal requirements and timelines. It is essential for both property owners and lien holders to understand their rights and obligations when dealing with such matters. If you receive a Notice of Lien, it is crucial to seek legal advice promptly to take appropriate action and prevent further complications. Note: This content has been created for informational purposes and should not be considered legal advice.

Long Beach California Notice of Lien

Description

How to fill out Long Beach California Notice Of Lien?

If you are looking for a relevant form, it’s extremely hard to find a more convenient service than the US Legal Forms site – probably the most comprehensive libraries on the web. With this library, you can get thousands of templates for business and individual purposes by categories and states, or key phrases. Using our advanced search function, finding the most recent Long Beach California Notice of Lien is as elementary as 1-2-3. In addition, the relevance of each document is confirmed by a team of skilled lawyers that regularly check the templates on our website and update them based on the newest state and county regulations.

If you already know about our platform and have a registered account, all you need to get the Long Beach California Notice of Lien is to log in to your account and click the Download option.

If you utilize US Legal Forms the very first time, just follow the instructions listed below:

- Make sure you have chosen the sample you want. Read its description and utilize the Preview function to check its content. If it doesn’t meet your requirements, use the Search field at the top of the screen to get the proper file.

- Confirm your selection. Choose the Buy now option. After that, choose the preferred subscription plan and provide credentials to sign up for an account.

- Process the transaction. Make use of your credit card or PayPal account to finish the registration procedure.

- Receive the form. Pick the format and download it to your system.

- Make modifications. Fill out, edit, print, and sign the acquired Long Beach California Notice of Lien.

Every single form you save in your account has no expiration date and is yours permanently. You can easily gain access to them using the My Forms menu, so if you need to have an extra duplicate for enhancing or creating a hard copy, you can come back and download it again anytime.

Take advantage of the US Legal Forms extensive library to gain access to the Long Beach California Notice of Lien you were seeking and thousands of other professional and state-specific samples in a single place!