Los Angeles, California Notice of Lien: Understanding the Basics In Los Angeles, California, a Notice of Lien is a legal document that notifies individuals or entities about a claim or encumbrance on a property due to an unpaid debt. It is an essential tool used by creditors to protect their interests and establish their right to payment. Keywords: Los Angeles, California; Notice of Lien, unpaid debt, claim, encumbrance, creditors, protect, payment. 1. Types of Los Angeles, California Notice of Liens: a) Mechanic's Lien: A Mechanic's Lien is a type of notice that contractors, subcontractors, or suppliers file to secure payment for work or materials provided in the construction or improvement of a property. It safeguards their right to compensation and creates a legal claim against the property. b) Tax Lien: A Tax Lien is filed by the government, typically the Internal Revenue Service (IRS) or state tax agencies, against a property owner who has outstanding tax liabilities. It provides the government with a legal interest in the property, allowing them to collect the unpaid taxes through the sale of the property. c) Judgment Lien: A Judgment Lien is filed by a creditor who has obtained a court judgment against a debtor. It creates a lien on the debtor's real estate property within the county, ensuring that the creditor has a claim on the property's value to satisfy the debt. d) HOA (Homeowners Association) Lien: An HOA Lien arises when a homeowner fails to pay their membership dues, assessments, or fees required by the homeowners' association (HOA). This lien secures the HOA's right to collect the unpaid amounts and potentially foreclose on the property to recover the debt. e) Property Tax Lien: A Property Tax Lien is filed by the county or municipal government when property taxes remain unpaid. It gives the government the authority to collect the outstanding property taxes by selling the property through a tax lien auction. Understanding the procedures and requirements of filing a Notice of Lien in Los Angeles, California is crucial for both creditors and property owners. Adhering to the specific regulations ensures that the lien is valid and properly recorded, and protects the rights and interests of all parties involved. Remember, each type of lien carries unique implications and varying timeframes for resolution. Seeking professional legal advice is always recommended when dealing with Notice of Liens to ensure compliance with the law and protect your rights.

Los Angeles California Notice of Lien

Category:

State:

California

County:

Los Angeles

Control #:

CA-LR022T

Format:

Word;

Rich Text

Instant download

Description

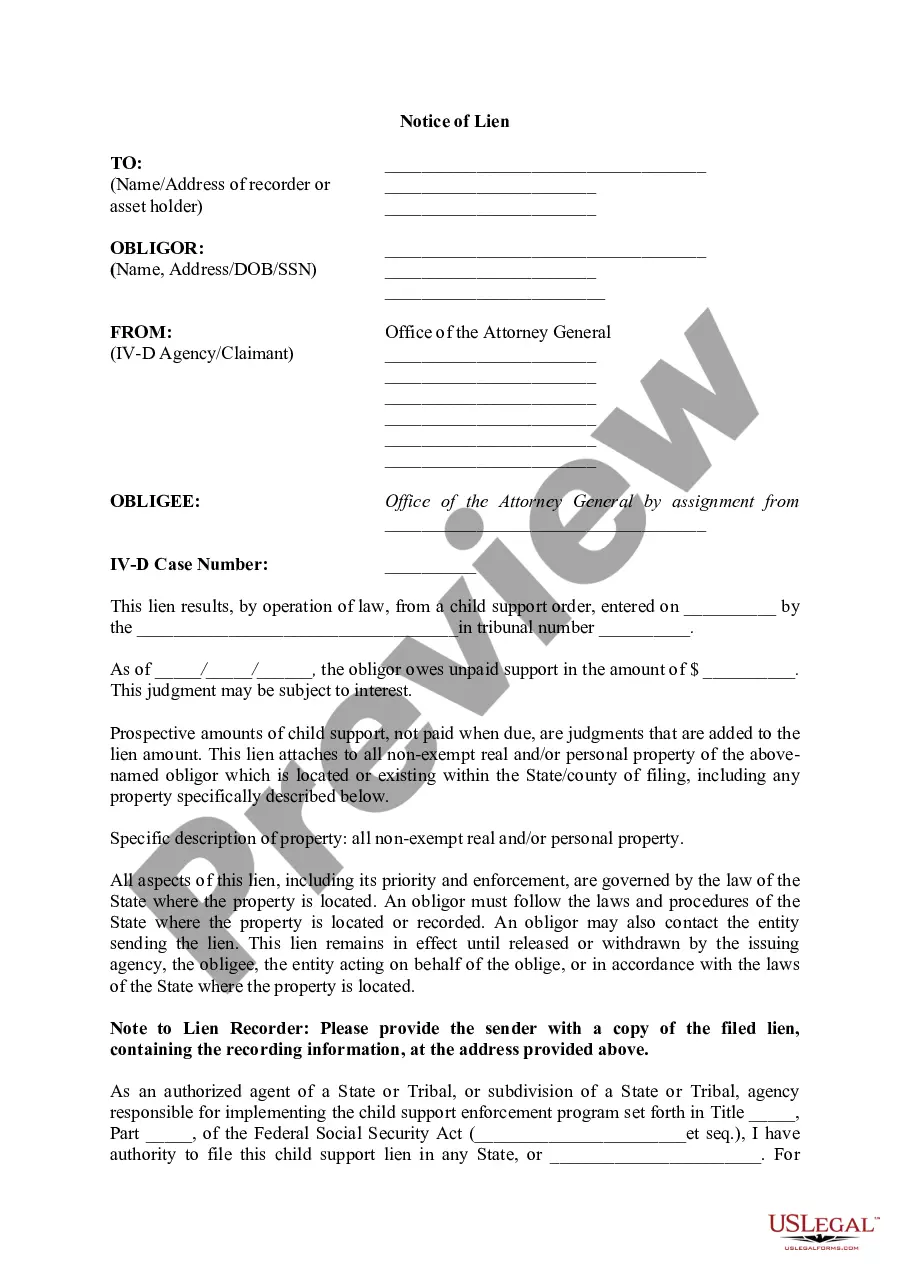

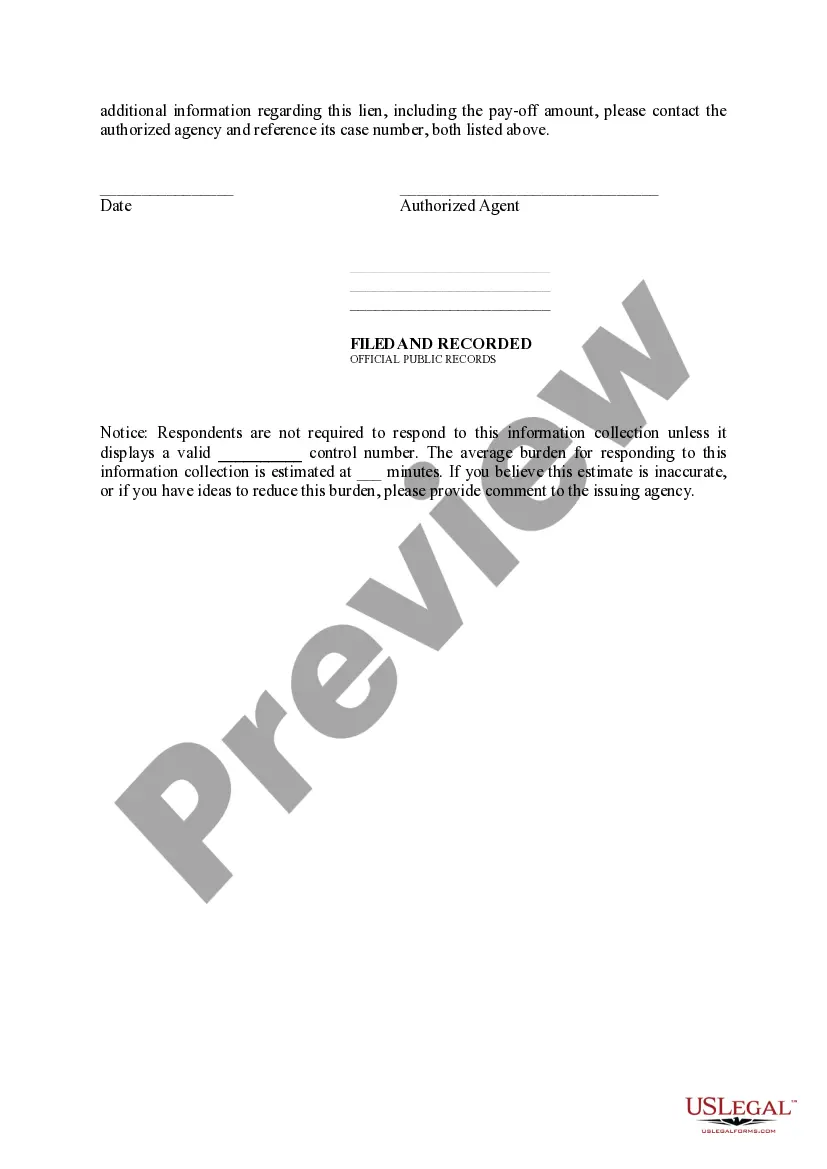

This lien is an encumbrance on property for the satisfaction of a debt of unpaid child support and is governed by the law of the State where the property is located.

Los Angeles, California Notice of Lien: Understanding the Basics In Los Angeles, California, a Notice of Lien is a legal document that notifies individuals or entities about a claim or encumbrance on a property due to an unpaid debt. It is an essential tool used by creditors to protect their interests and establish their right to payment. Keywords: Los Angeles, California; Notice of Lien, unpaid debt, claim, encumbrance, creditors, protect, payment. 1. Types of Los Angeles, California Notice of Liens: a) Mechanic's Lien: A Mechanic's Lien is a type of notice that contractors, subcontractors, or suppliers file to secure payment for work or materials provided in the construction or improvement of a property. It safeguards their right to compensation and creates a legal claim against the property. b) Tax Lien: A Tax Lien is filed by the government, typically the Internal Revenue Service (IRS) or state tax agencies, against a property owner who has outstanding tax liabilities. It provides the government with a legal interest in the property, allowing them to collect the unpaid taxes through the sale of the property. c) Judgment Lien: A Judgment Lien is filed by a creditor who has obtained a court judgment against a debtor. It creates a lien on the debtor's real estate property within the county, ensuring that the creditor has a claim on the property's value to satisfy the debt. d) HOA (Homeowners Association) Lien: An HOA Lien arises when a homeowner fails to pay their membership dues, assessments, or fees required by the homeowners' association (HOA). This lien secures the HOA's right to collect the unpaid amounts and potentially foreclose on the property to recover the debt. e) Property Tax Lien: A Property Tax Lien is filed by the county or municipal government when property taxes remain unpaid. It gives the government the authority to collect the outstanding property taxes by selling the property through a tax lien auction. Understanding the procedures and requirements of filing a Notice of Lien in Los Angeles, California is crucial for both creditors and property owners. Adhering to the specific regulations ensures that the lien is valid and properly recorded, and protects the rights and interests of all parties involved. Remember, each type of lien carries unique implications and varying timeframes for resolution. Seeking professional legal advice is always recommended when dealing with Notice of Liens to ensure compliance with the law and protect your rights.

Free preview

How to fill out Los Angeles California Notice Of Lien?

If you’ve already utilized our service before, log in to your account and save the Los Angeles California Notice of Lien on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple steps to obtain your file:

- Make sure you’ve located the right document. Look through the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t fit you, use the Search tab above to obtain the proper one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Obtain your Los Angeles California Notice of Lien. Opt for the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to each piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly find and save any template for your personal or professional needs!