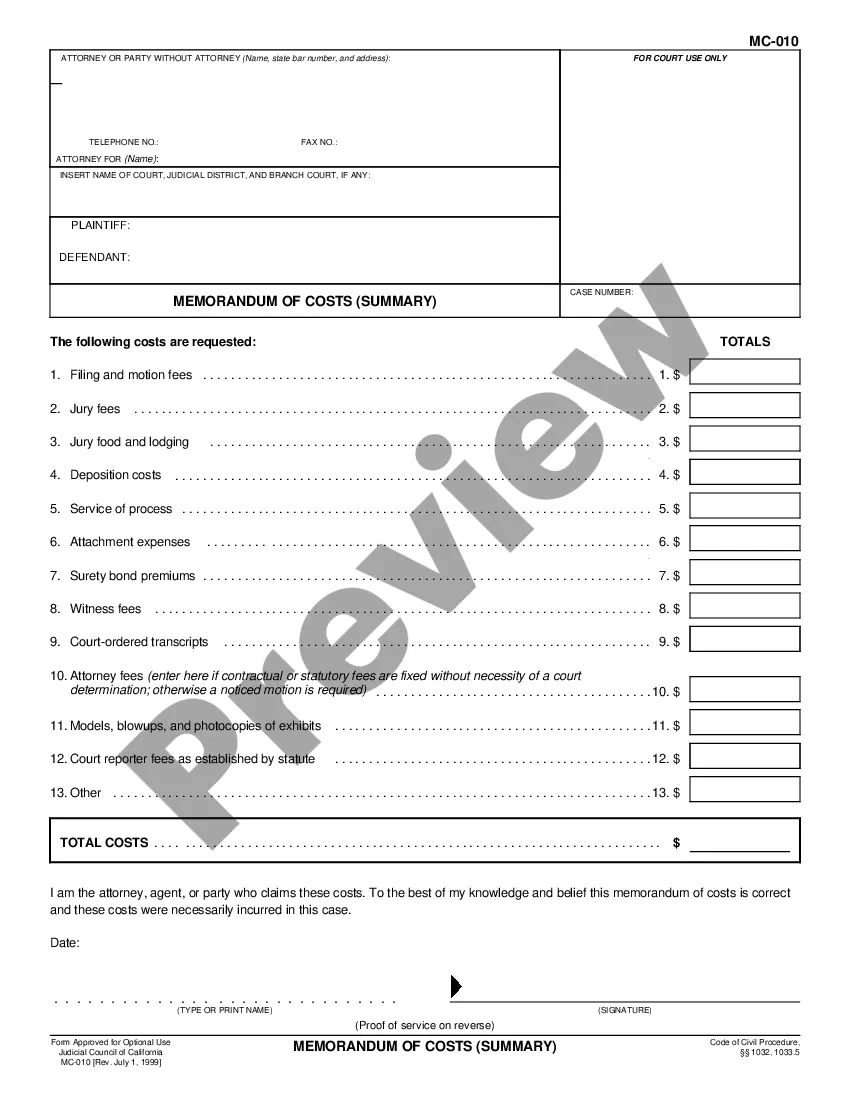

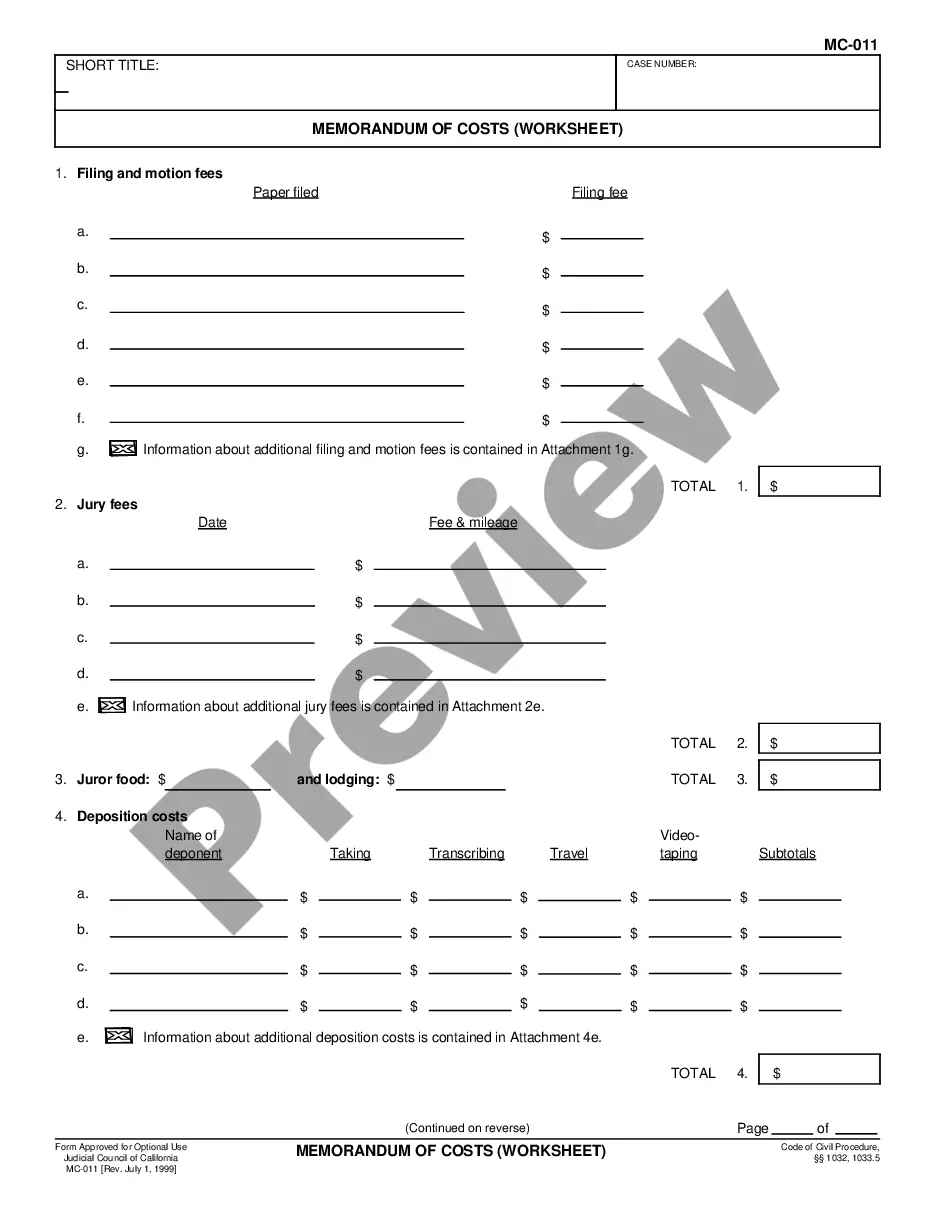

Memorandum of Costs After Judgment, Acknowledgment of Credit, and Declaration of Accrued Interest: This Memorandum is simply a list of costs associated with litigation, after the judgment has been rendered. The Declarant signs this Memorandum, stating that he/she declares these costs, including accured interest on the outstanding balance, to be accurate, under penalty of law.

Anaheim California Memorandum of Costs After Judgment, Acknowledgment of Credit, and Declaration of Accrued Interest

Description

How to fill out California Memorandum Of Costs After Judgment, Acknowledgment Of Credit, And Declaration Of Accrued Interest?

Obtaining validated templates aligned with your local regulations can be difficult unless you utilize the US Legal Forms repository.

It’s an online collection of over 85,000 legal documents catering to both personal and professional requirements as well as various real-life scenarios.

All the paperwork is systematically categorized by usage area and jurisdiction, making it simple and quick to find the Anaheim California Memorandum of Costs After Judgment, Acknowledgment of Credit, and Declaration of Accrued Interest.

Ensure that your paperwork is organized and meets legal requirements. Utilize the US Legal Forms library to have vital document templates accessible for any needs right at your fingertips!

- Examine the Preview mode and document description.

- Ensure you’ve selected the correct one that satisfies your needs and fully complies with your local jurisdiction regulations.

- Look for an alternative template if necessary.

- Once you notice any irregularity, use the Search tab above to locate the appropriate one. If it fits your requirements, proceed to the next step.

- Complete the purchase.

Form popularity

FAQ

The MC 012 is used to keep a running total of all costs, credits/payments, and interest accrued after. the final Entry of Judgment. Number 1. a) I claim the following costs after Judgment incurred within the last two years. 1) Complete if you filed an Abstract of Judgment (Form EJ-001).

Writ of Execution (EJ-130) Tells the sheriff to take action to enforce a judgment. Used with instructions to the sheriff to levy bank accounts, garnish wages, or take possession of personal property. Get form EJ-130. Revised: September 1, 2020. View EJ-130 Writ of Execution form.

Tells the court and others that a judgment has been paid in full or in part. Can be recorded with a county to release a lien against the judgment debtor's land or filed with the Secretary of State to release a lien against the debtor's personal property. Get form EJ-100.

To have costs and interest added to the amount owed, you must file and serve a Memorandum of Costs After Judgment (MC-012). On this form, you must include the exact amount of all allowable costs, the payments credited toward the principal and interest, and the amount of accrued interest.

A writ of execution is a court order granted to you that typically orders a sheriff or other similar official to take possession of property owned by the judgment debtor.

Tells the sheriff to take action to enforce a judgment. Used with instructions to the sheriff to levy bank accounts, garnish wages, or take possession of personal property.

Step 1: Obtain a Writ of Execution.Step 1a: Complete the Writ of Execution (EJ-130) form.Step 1b: Adding Costs and Interest (optional)Step 1c: Obtain a File-Endorsed Copy of Your Judgment.Step 1d: File Your Documents.Step 2: Complete the Application for Earnings Withholding Order.Step 3: Have Your Documents Served.

When you win a lawsuit, you can collect the total amount of the judgment entered by the court, plus any costs incurred after judgment and accrued interest on the total amount. To have costs and interest added to the amount owed, you must file and serve a Memorandum of Costs After Judgment (MC-012).

Writ of Execution (EJ-130) Tells the sheriff to take action to enforce a judgment. Used with instructions to the sheriff to levy bank accounts, garnish wages, or take possession of personal property. Get form EJ-130.

California Code of Civil Procedure §1032(a)(4) defines the ?prevailing party? to include ?the party with a net monetary recover? and ?a defendant in whose favor a dismissal is entered.? The statute entitles the prevailing party to the costs in the proceeding.